Ethereum’s rally toward the $5,000 rate is reframing its characteristic in world markets. The asset is transitioning from a speculative token correct into a reserve risk for establishments and big-scale merchants.

A CryptoQuant sage revealed that surging ETF inflows, aggressive whale accumulation, and file staking ranges are driving this trade.

Ethereum ETFs Anchor Institutional Query

Per the sage, Ethereum ETFs non-public emerged as a defining catalyst on this rally. The 9 US-listed funds now sustain roughly 6.7 million ETH—almost double the level considered when the market rally began in April.

This expansion followed file inflows of fair about $10 billion between July and August. The surge cemented ETFs because the most effectively most standard automobile for institutional exposure.

Ethereum is in one in all its strongest cycles but.

Institutional gain a query to, staking, and on-chain process are come file highs.

ETH is cementing its characteristic as each an investment asset and the main settlement layer. pic.twitter.com/MguVXwPsma

— CryptoQuant.com (@cryptoquant_com) 11th of September, 2025

While September has confirmed a slower creep, the funds restful attracted more than $640 million in new capital closing week, in response to SoSoValue recordsdata.

That momentum signals increasing investor reliance on ETFs no longer simplest as an entry point however moreover as a mode to sustain prolonged-time duration allocations in the crypto asset.

Moreover, huge ETH holders seem like reinforcing this pattern. CryptoQuant recordsdata presentations that wallets controlling between 10,000 and 100,000 ETH collected approximately 6 million coins throughout the similar duration.

Their combined reserves reached a file 20.6 million ETH, mirroring Bitcoin’s early trajectory after ETF approvals, when institutional gamers raced to effect positions.

Staking and Network Deliver Tighten Present

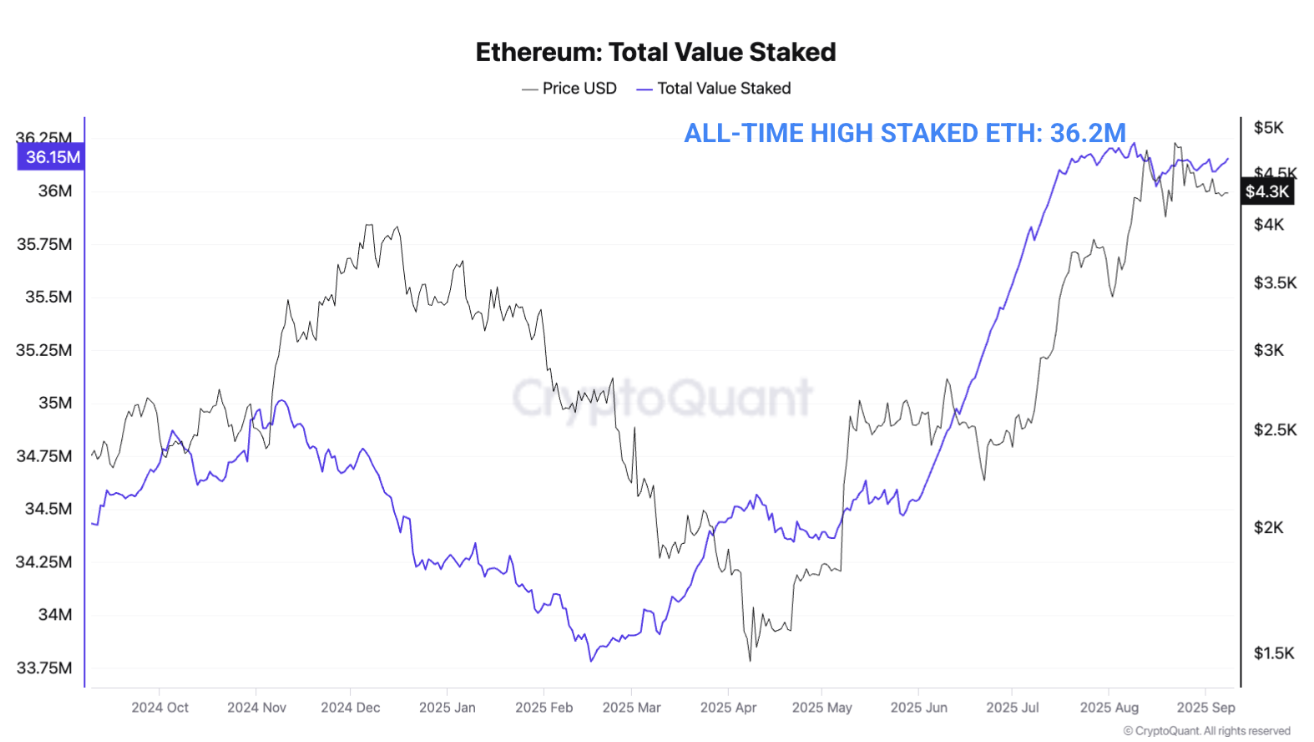

Other than for the above elements, Ethereum staking process is locking up more ETH than ever prior to.

Recordsdata from CryptoQuant showed that Ethereum merchants non-public locked up an additional 2.5 million ETH since Could presumably well maybe, pushing the total amount of staked ETH to 36.2 million. Per Dune Analytics recordsdata, this represents almost 30% of Ethereum’s entire present.

This staunch boost reduces the pinnacle crypto’s circulating present and reinforces its upward label pressure. It moreover signals that merchants are dedicated to ETH for the very prolonged time duration and no longer temporary speculative plays.

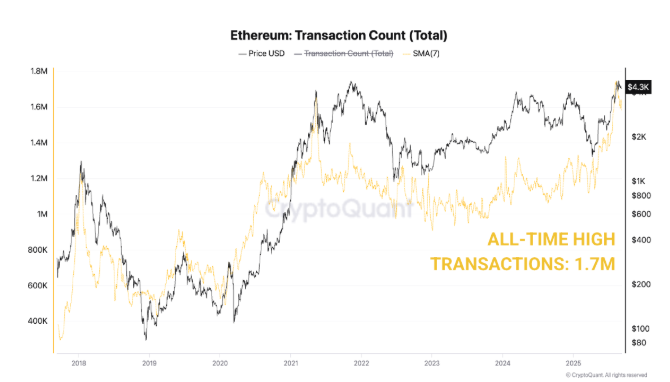

Another robust piece of proof displaying that Ethereum’s market characteristic has deal modified is the acceleration of its on-chain utility.

Per CryptoQuant, Ethereum’s each day transactions spiked to 1.7 million in mid-August, and the quantity of active addresses on the network reached a high of 800,000.

On the similar time, orderly contract calls broke past 12 million per day, which is an unheard of level in prior cycles.

This process level underscores Ethereum’s increasing characteristic because the backbone for decentralized finance, stablecoins, and tokenized resources. Particularly, the network has the very most realistic entire rate locked and adoption rate for every sector.

Taken collectively, these trends exclaim a structural realignment that presentations that Ethereum’s valuation rests on more than market sentiment.

Indeed, it is more and more positioned as a functional backbone for digital commerce. On the similar time, it has change into a strategic preserving for huge-scale merchants in search of out exposure to the rising crypto industry.

The put up Ethereum Nears $5,000 as ETFs and Staking Reshape Market Query appeared first on BeInCrypto.