The novel keen value drop in Ethereum has sparked a flurry of hypothesis among traders, raising questions about whether the bearish enhance will persist.

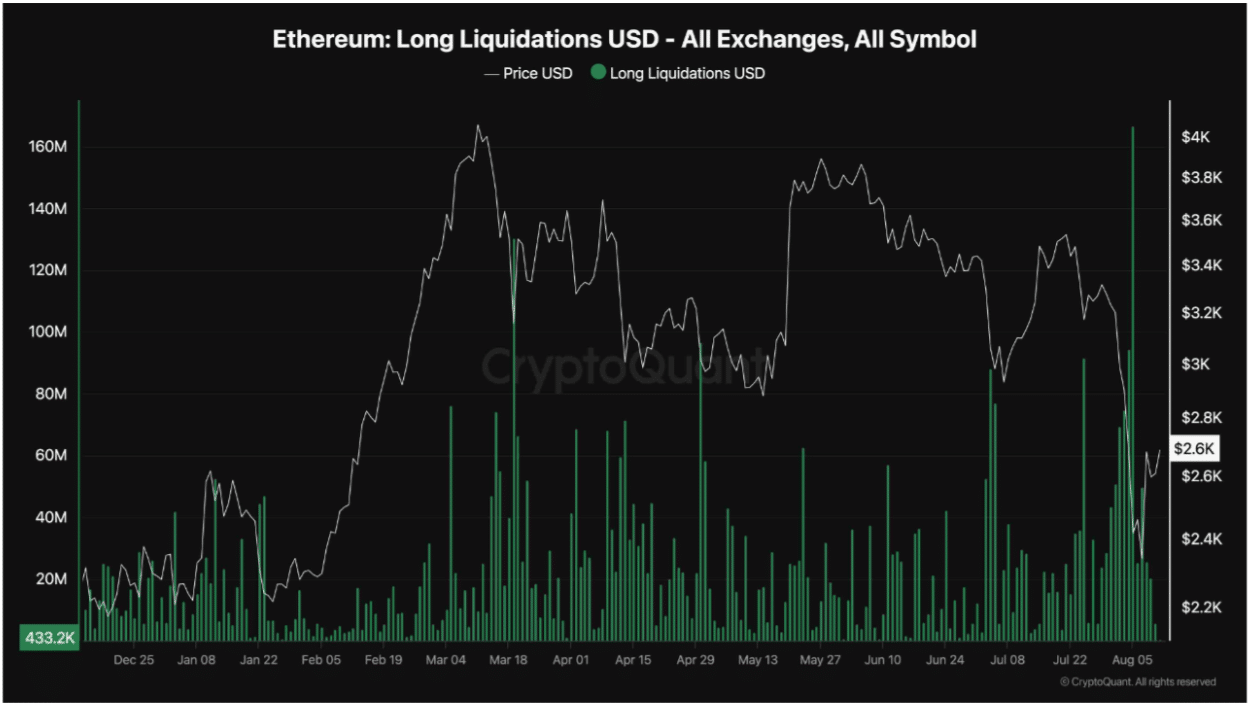

Alternatively, rising data from the futures market indicates a probable reversal pushed by vital adjustments in long liquidations all the way by exchanges. Recent data from CryptoQuant highlights a vital liquidation match in Ethereum’s futures market, reaching ranges unseen since November 2022.

These liquidations measure the compelled closure of long perpetual positions due to cost declines, which have confidence neutral lately introduced on a cascade of liquidations all the way by all exchanges. This enhance would possibly well maybe additionally simply indicate a cooling length within the futures market, as many leveraged positions had been purged.

CryptoQuant’s analyst Shayan highlighted that this form of reset would possibly well maybe additionally infrequently stabilize the market, paving the kind for renewed investor pastime. The functionality for a bullish surge will enhance if interrogate returns, as a reset futures market typically attracts novel patrons.

Historical Context

Historically, Ethereum’s value declines have confidence typically introduced on vital spikes in long liquidations. For occasion, in January, a value dip resulted in over $50 million in liquidations, adopted by a swift restoration.

Equally, as Ethereum’s value dropped to below $3,200 in March, liquidations exceeded $120 million, contributing to a critical market drop earlier than rebounding. Most neutral lately, in August, the chart presentations a dramatic liquidation spike of over $160 million as Ethereum’s value fell to $2,100.

Genuinely, with leveraged traders flushed out within the most fresh value drop, space shopping for stress is taking on, as evidenced by the reality that ETH has since rebounded to $2,700.

Emerging Shopping for Interest?

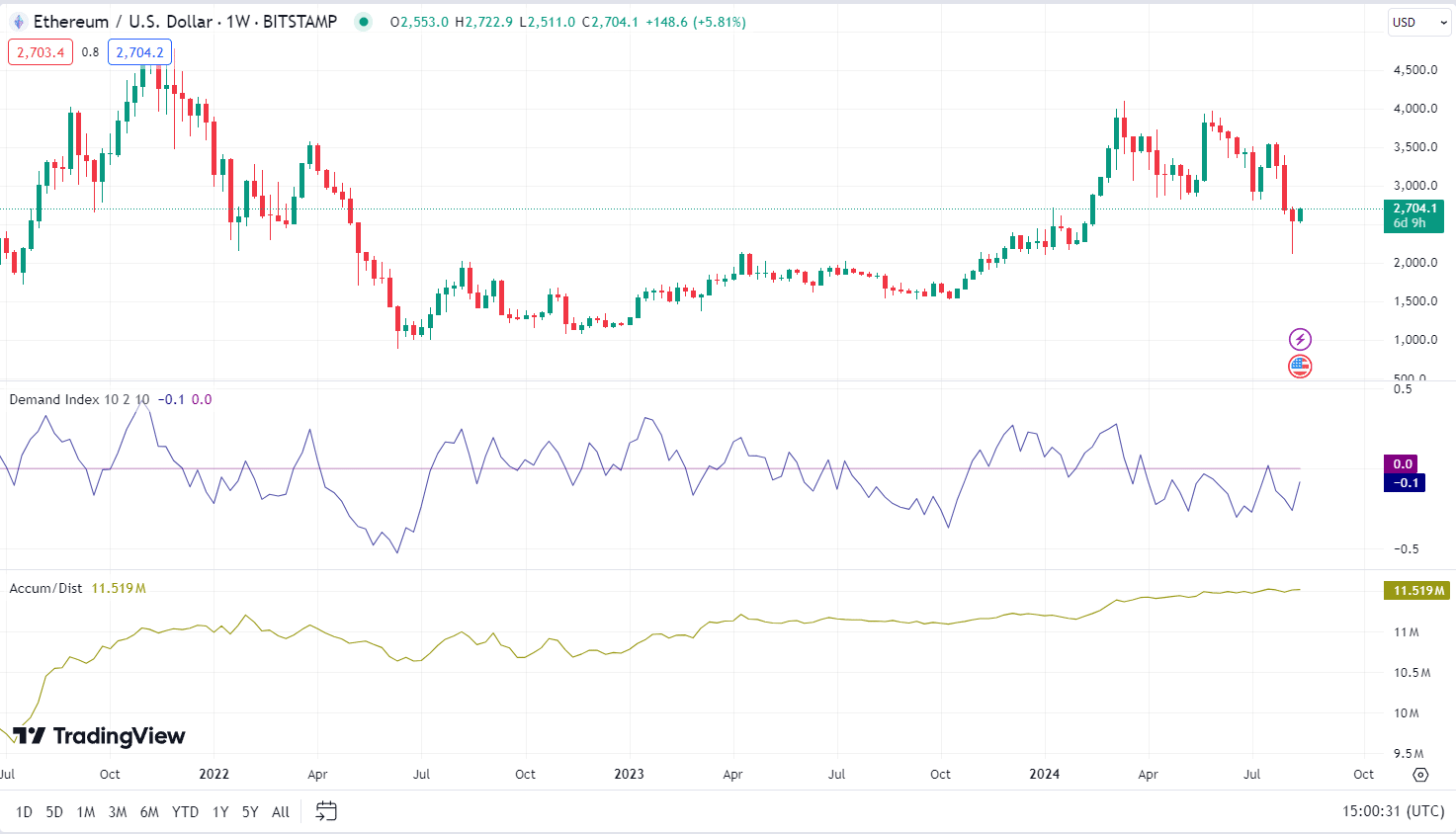

Key technical indicators counsel that Ethereum’s market would possibly well maybe additionally simply be stabilizing, with the aptitude for a bullish turnaround. Particularly, the Search data from Index, for the time being simply below zero at -0.1, presentations signs of knocking down and a puny upward walk. This ability that promoting stress would possibly well maybe additionally simply be diminishing, with shopping for pastime starting up to resurface.

Additionally, the Accumulation/Distribution indicator has been trending upward, with a fresh cost of 11.519 million. This proper accumulation suggests that traders are consistently shopping for Ethereum, a signal that will additionally precede a vital value transfer. As stable hands possess the asset, the likelihood of a future value surge will enhance.

Staking Withdrawals Inequity Bullish Sentiment

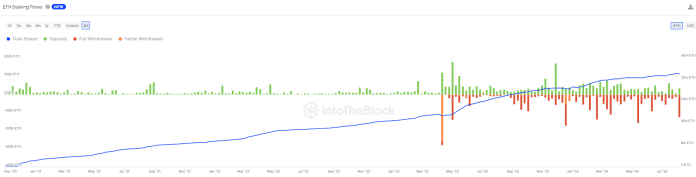

In distinction to those potentially bullish indicators, on-chain data items a more pertaining to image. Ethereum has viewed a keen elevate in staking withdrawals, with over 122,000 ETH withdrawn from staking pools this week alone.

This marks the very most real looking level of withdrawals since Might most certainly, translating to approximately $521 million. The surge in withdrawals indicators increased promoting stress as traders unstake their Ethereum, potentially liquidating their holdings. This added present available within the market would possibly well maybe additionally exert downward stress on Ethereum’s value, in particular if interrogate stays customary.