On Thursday, June nineteenth, the crypto market skilled low volatility shopping and selling as investors projected FUD (difficulty, uncertainty, and doubt) surrounding the geopolitical tensions within the Center East. The Ethereum stamp proves this market sentiment with a neutral candle formation within the everyday chart, positioned above the $2,500 level. Nonetheless, the high-find-worth investor remained unfazed by this consolidation and continues to demonstrate an energetic accumulation model.

Ethereum Poised For Reversal Amid Whale Shopping Spree

Over the past week, the Ethereum stamp has plummeted from a multi-month high of $2,880 to its most up-to-the-minute shopping and selling stamp of $2,534, registering a 12% decline. This bearish model basically adopted the broader market decline amid the escalating protection power action within the Center East.

Despite the functionality for added downfall, the on-chain files highlights renewed accumulation from ETH whales. In accordance with blockchain tracker Spotonchain, a most critical institutional whale has spent over $220.82 million in USDC to create 85,465 ETH by design of OTC offers with Wintermute and Coinbase over the past week.

Early these days, the whale bought another 15,000 ETH for $37.16 million at an life like stamp of $2,477. Despite facing a floating loss of $4.97M (-2.25%), the investor composed holds $112.94M USDC on Aave and has staked your whole 85,465 ETH with Lido, signaling high long-term confidence in Ethereum’s increase.

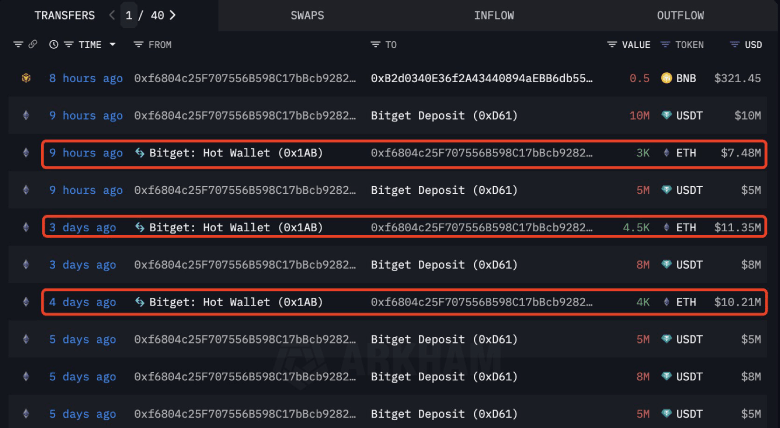

In parallel, another crypto whale running beneath the pockets address “0xf680″ bought 3,000 ETH (worth approximately $7.48 million) correct 9 hours earlier than Lookonchain’s file. This get has increased the whale’s holdings to 11,500 ETH (valued at $29M) over the final four days.

Historically, such a whale accumulation model has coincided with a most critical market bottom, rising as a ability signal of bullish reversal.

Inverted Head & Shoulder Sample Would possibly perhaps neutral Push ETH for $3,000 Breakout

Ethereum’s everyday chart diagnosis signifies that its stamp has been ranging between $2,400 and $2,850, reflecting market uncertainty.

Despite the uncertainty, this consolidation published the formation of a smartly-identified reversal pattern identified as an inverted head-and-shoulders. The chart setup is characterised by three troughs: an initiation fall that develops to the left shoulder, adopted by a most critical dip called the head, and later a renewed recovery with a momentary pullback because the exact shoulder.

Currently, the Ethereum stamp shows long-tail rejection candles on the $2,500 give a seize to level, indicating an intact aquire-the-dip sentiment among market members. If the pattern holds, the coin stamp would perhaps jump 13.5% to squawk the neckline, perhaps breaching it and signaling a trade in market direction, as indicated by the addition of $2,870.

The put up-breakout system would perhaps push the asset another 35% and hit the $3,900 stamp.

On the opposite, if sellers continue to stipulate the overhead resistance at $2,860, the patrons’ return consolidation would perhaps lengthen to July.

Also Learn: Trump Would possibly perhaps neutral Carry Movement to Pause Iranian Nuclear Enrichment: JD Vance