Leading altcoin Ethereum has seen a valuable label decline. At the moment trading at $2,551, ETH has dropped by over 20% in the previous month.

This downturn has led Ethereum whales to steadily nick back their positions in the previous few weeks.

Ethereum Immense Holders Excercise Caution

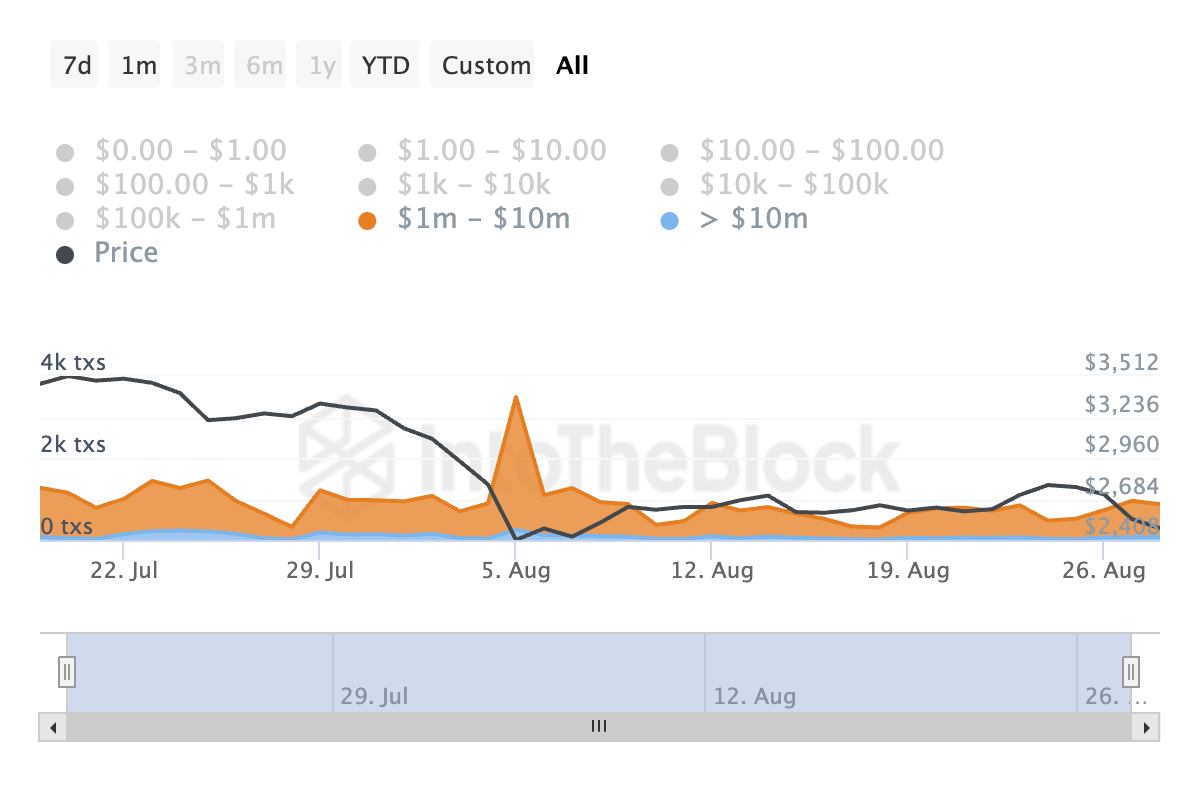

Due to ETH’s double-digit label decline, ETH whales have confidence reduced their trading exercise over the previous month. This would maybe well also be gleaned from the decline in the coin’s orderly transaction depend in the previous 30 days.

According to IntoTheBlock’s info, the day-to-day depend of ETH transactions worth between $1 million and $10 million has dropped by 5% at some level of this period. On the identical time, the day-to-day depend of elevated transactions valued above $10 million has fallen by Forty five%.

Moreover, the netflow of orderly holders for Ethereum (ETH) has plummeted by 77%. Immense holders, or whales, are those who’ve over 0.1% of the asset’s circulating provide.

The orderly holders’ netflow measures the variation between the quantity of ETH that these whales buy and the quantity they sell over a particular period.

Study more: How To Aquire Ethereum (ETH) With a Credit ranking Card: A Step-by-Step Data

When the orderly holders’ netflow metric drops, it signifies whale distribution, which is in overall a bearish signal. This in overall precedes further label declines, as reduced whale exercise can negatively affect market sentiment.

ETH Mark Prediction: Mark Eyes August 5 Lows

The bearish outlook for Ethereum (ETH) is bolstered by the setup of its Parabolic Conclude and Reverse (SAR) indicator on the one-day chart. At the moment, the indicator’s dots are positioned above the coin’s label, signaling a downtrend.

The Parabolic SAR is a software program mature to identify likely style route and reversals. When the dots seem above an asset’s label, it signifies that the market is in a decline and that the asset’s label would possibly well additionally continue to plunge.

Moreover, Ethereum’s Transferring Moderate Convergence Divergence (MACD) is displaying bearish indicators, with the MACD line (blue) nearing a depraved below the signal line (orange). This crossover generally suggests a strengthening downtrend, in overall interpreted by traders as a signal to build in mind promoting or taking earnings.

Study more: Ethereum ETF Defined: What It Is and How It Works

If promoting stress intensifies, ETH’s label would possibly well additionally drop toward its August 5 low of $2,112. Alternatively, if the market style shifts and shopping exercise picks up, the label would possibly well additionally doubtlessly rally to $2,867.