Ethereum (ETH) imprint lastly broke the $2K barrier, shopping and selling at round $2,300 after going previous major resistance. This raises hopes it could perchance perchance also climb to $3,000 and $4,000.

The appealing pass up began after the Federal Originate Market Committee’s decision to sustain passion rates right on May perchance perchance per chance additionally 7 led to an across-the-board threat-on digital resources.

With the tip altcoin imprint clearing major ranges and on-chain metrics flashing bullish alerts, the stage is residing for a chief upside pass.

ETH Designate Breaks Key $1,860 and $2,300 Resistances

In retaining with Ali Martinez, Ethereum imprint currently broke above the $1,860 resistance, a chief zone the put 4.54 million wallets sustain 5.58 million ETH. The dwell altcoin has lastly broken out of an major present wall, which had been capping its growth for the previous few weeks, marking a huge commerce in market sentiment.

Because the price has rebounded above this level and is now retaining right, Ethereum may perchance also rally for the long time period with skill goals for $3,000 and $4,000.

Moreover, crypto analyst IncomeSharks highlighted that ETH imprint has also cleared its 2d diagonal resistance, confirming a broader style reversal. The chart showed ETH bright gradually bigger after a pair of aquire alerts alongside the lower trendline.

With the subsequent main resistance zones at $3,000 and $4,000, merchants are eyeing a skill multi-month rally if the contemporary momentum holds.

Bullish Divergence and On-Chain Records Toughen ETH’s Rally

Particularly, Javon Marks well-known a chief bullish divergence in the price chart for Ethereum, a classic reversal sample signaling approaching main imprint restoration.

In retaining with his diagnosis, ETH had a double backside with momentum indicators equivalent to the Relative Energy Index (RSI) beginning to upward thrust, indicating a bullish divergence.

This technical draw changed into generally a signal of a brand contemporary style commencing with imprint targets great bigger than the contemporary ETH imprint.

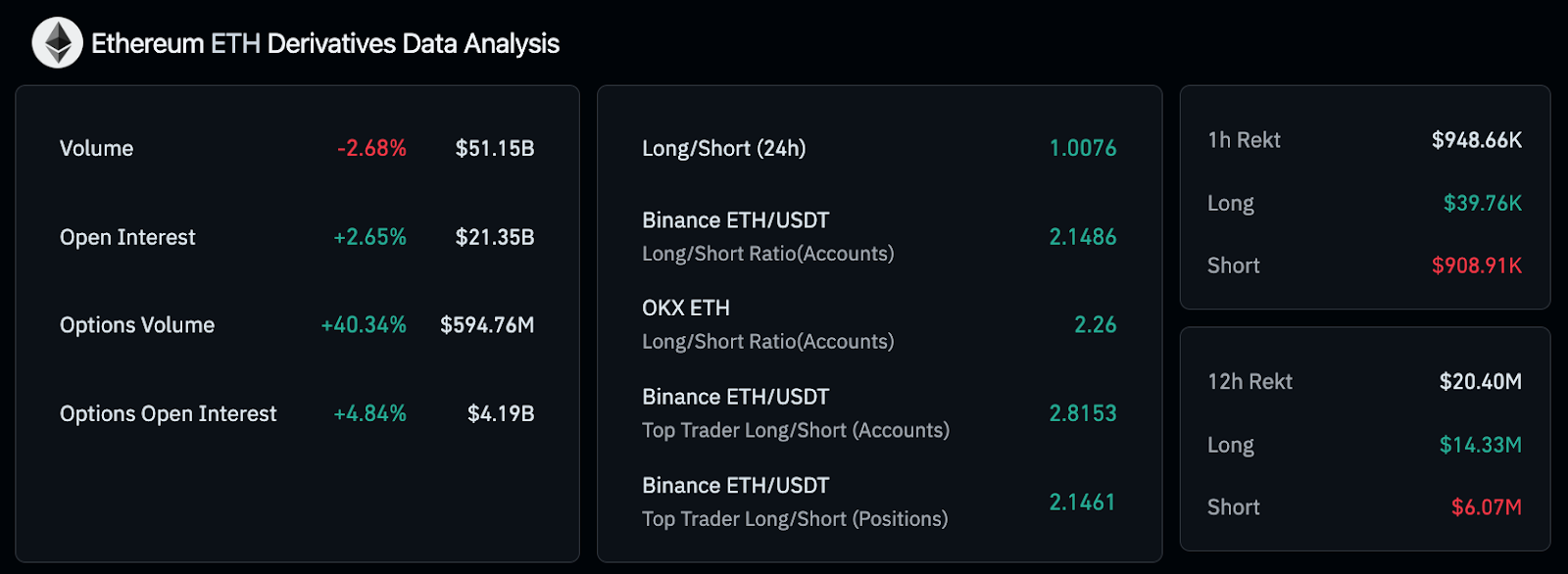

Within the meantime, on-chain knowledge also supported this bullish outlook. In retaining with contemporary figures, Ethereum’s commence passion soared by 2.65% to about $21.35 billion throughout the final 24 hours as $400 million price of contemporary capital jumped into ETH futures. The upward thrust in commence passion intended merchants are positioning for a elevated pass.

Derivatives Market Indicators Sturdy Bullish Sentiment

The derivatives market will almost definitely be reflecting a right bullish bias for Ethereum. Binance’s ETH/USDT long/short ratio stands at 2.1486, whereas OKX merchants imprint an great extra aggressive stance with a ratio of 2.26. This vogue bigger than twice as many merchants are long versus short, indicating a right perception in extra upside.

For prime merchants on Binance, ratios of long/short positions comprise risen to 2.8153, indicating elevated self assurance in Ethereum’s upward slide. Here’s in retaining with market sentiment, as merchants residing up for extra upside. The long publicity and the rise in commence passion counsel that the market is waiting for a chief ETH imprint pass in the upcoming weeks.

Moreover, liquidation knowledge also supports this bullish style. For the previous 12 hrs, ETH shorts accounted for $14.33M in long liquidations and $6.07M in ETH short liquidations. This showed that Ethereum merchants who were making a wager in opposition to a imprint restoration comprise been squeezed out.

ETH Designate Eyes $4,000 as Key Ranges to Peek

Particularly, Ethereum imprint is struggling to commerce above $1900 as the subsequent main resistance line is $1950, and subsequent up is the $2000 level.

Then again, Ethereum (ETH) imprint is anticipated to proceed its contemporary momentum to lead clear of a pullback in direction of the $1,860 abet zone, which has now flipped from resistance.

Within the advance time period, with the Fed’s fee quit as the catalyst, this could perchance perchance also real be the beginning of Ethereum’s restoration. As technical indicators enhance and market sentiment turns bullish, the outlook for the altcoin strengthens, suggesting a skill breakout in the upcoming months.