Ethereum (ETH) is down almost 9% over the previous seven days and continues to alternate below the $3,000 ticket—a stage it hasn’t reclaimed since February 1. Most up-to-date technical indicators counsel that bearish momentum is constructing, with pattern energy weakening and selling stress intensifying.

Momentum oscillators esteem the RSI accept as true with pulled abet sharply, while key resistance stages continue to retain firm against upward makes an strive. As ETH struggles to accept ground, traders are staring at carefully to see whether or no longer make stronger stages will retain or if further scheme back is forthcoming.

Ethereum Bears Accomplish Momentum as Trend Energy Fades

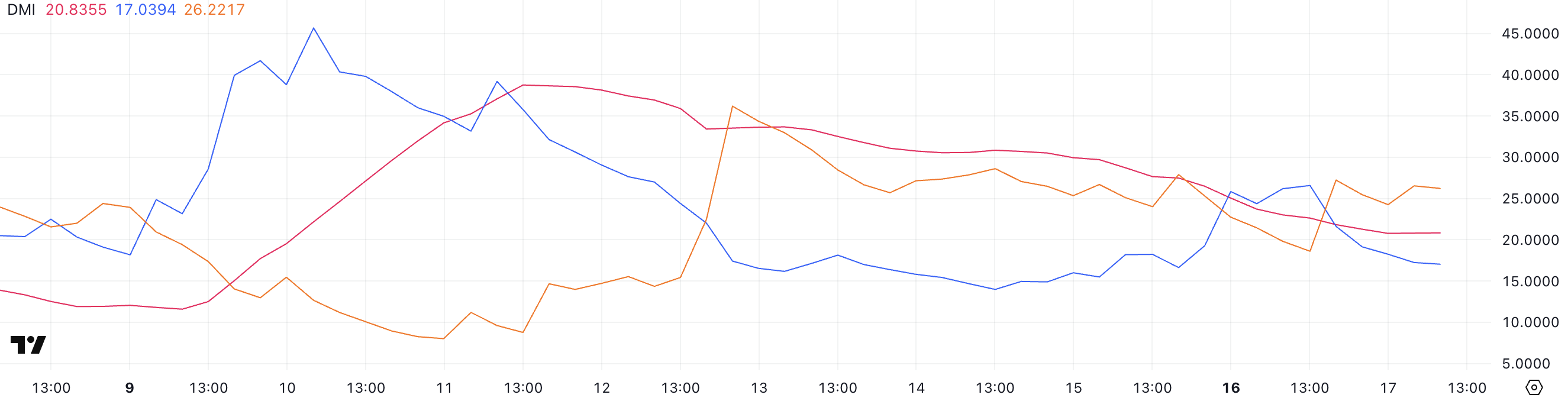

Ethereum’s Directional Inch Index (DMI) exhibits its ADX has dropped to 20.83 from 27.64 two days ago, pointing to weakening pattern energy.

The ADX, or Realistic Directional Index, measures how worthy a pattern is, despite whether or no longer it’s up or down. Values above 25 on the final indicate a audacious pattern, while values below 20 counsel a extinct or indecisive market.

With ETH’s ADX now hovering shut to the lower boundary, it suggests that contemporary directional momentum is fading, and the market shall be coming into a duration of sideways motion or indecision.

Having a stare upon the directional indicators, Ethereum’s +DI has fallen to 17 from 26.57 the day before this present day, after a short soar from 16.62 two days ago. This indicators that bullish stress has like a flash cooled off.

Meanwhile, the -DI has risen to 26.22 from 18.60, indicating increasing bearish momentum. This divergence between the declining +DI and rising -DI suggests sellers are gaining the upper hand, potentially pushing ETH correct into a short-term downtrend.

Combined with the weakening ADX, the contemporary setup aspects to increased scheme back probability unless bulls accept support an eye on presently.

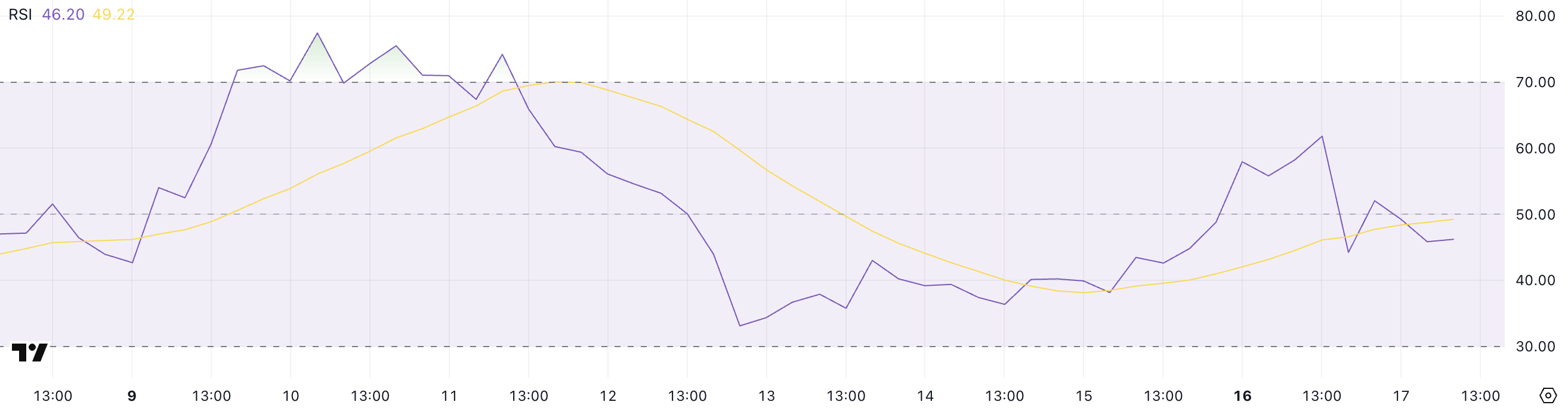

ETH Faces Stress After Animated RSI Reversal

Ethereum’s Relative Energy Index (RSI) has fallen to 46.2, down sharply from 61.82 the day before this present day, after spiking from 38.14 two days ago.

The RSI is a momentum oscillator that measures the slouch and magnitude of sleek tag changes to evaluation overbought or oversold stipulations.

Values above 70 on the final indicate an overbought asset that might maybe be due for a pullback, while readings below 30 counsel oversold stipulations that might maybe maybe also precede a rebound.

The neutral zone lies between 30 and 70, the keep tag motion is mostly in point of fact apt as balanced or consolidative.

Ethereum’s RSI is now at 46.2, dropping abet into neutral territory after like a flash forthcoming the overbought zone.

This decline indicates fading bullish momentum and can goal counsel that contemporary shopping passion has weakened. While a studying spherical 46 doesn’t imprint an instantaneous pattern reversal, it does reflect uncertainty and can goal beginning the door to further scheme back if selling stress will enhance.

If the RSI continues to lunge in direction of 30, it could maybe also confirm that ETH is coming into a extra pronounced bearish section.

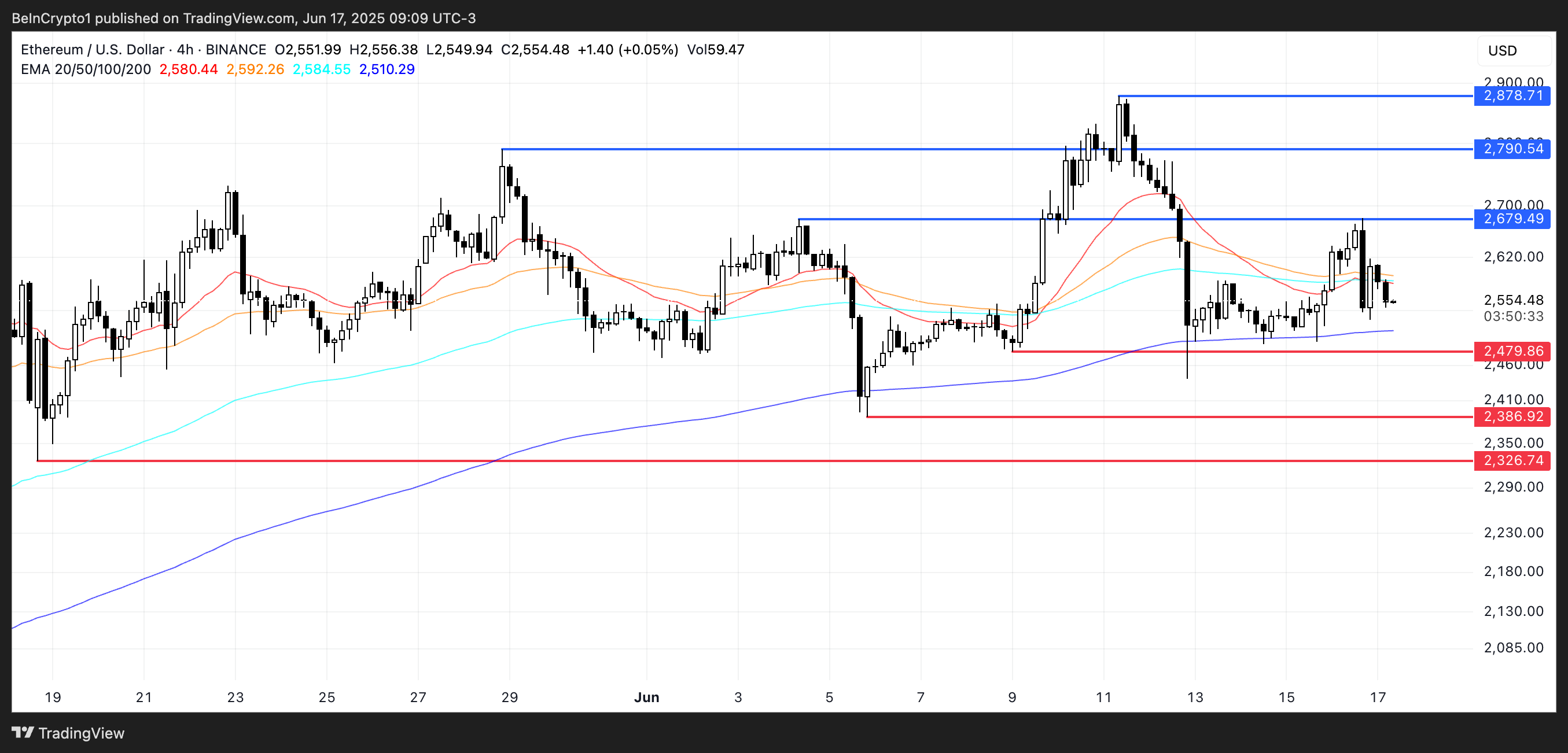

Ethereum Struggles Below Resistance as Bearish EMA Trend Holds

Ethereum’s EMA (Exponential Intelligent Realistic) lines currently bellow a bearish pattern, with tag motion struggling to accept upward momentum.

Recently, ETH tried to destroy thru the resistance stage at $2,679 however failed, reinforcing that sellers live up to the ticket. If the market tests and loses make stronger at $2,479, further scheme back might maybe maybe also lead ETH in direction of $2,386, and potentially as exiguous as $2,326 if bearish stress intensifies.

These stages ticket key zones the keep investors might maybe maybe also goal step in—however until then, the short-term constructing stays tilted to the scheme back.

Nonetheless, a shift in momentum might maybe maybe also happen if Ethereum retests and successfully breaks the $2,679 resistance.

A breakout above this stage might maybe be a audacious imprint of bullish intent, potentially triggering a pass in direction of $2,790 and even $2,878 if pattern reversal takes retain. The EMA constructing would then begin to flatten or curl upward, signaling renewed energy.

Except that occurs, despite the truth that, ETH stays inclined to further losses, with traders carefully staring at how it reacts spherical key make stronger and resistance stages.