Now not too prolonged ago, Ethereum (ETH) showed indicators of falling under $3,000 but held company as bulls defended the altcoin.

Now trading at $3,480, here’s what’s likely to be next for ETH.

Ethereum Soundless Has Extra Room to Develop

One metric that has repeatedly confirmed real for inspecting Ethereum is the Market Trace to Realized Trace (MVRV) ratio, a tool for assessing the profitability of holders and identifying probably market tops or bottoms. The MVRV ratio compares a cryptocurrency’s market fee to its realized fee, offering insights into whether the asset is puffed up or undervalued.

When the MVRV ratio rises, it indicates that more holders are in earnings. Nonetheless, if it climbs to an vulgar high, it suggests the asset is probably going to be puffed up, increasing the threat of a designate correction. Conversely, when the MVRV ratio declines, it aspects to reduced profitability.

If the ratio hits an vulgar low, it signals undervaluation, that will fresh a truly just correct accumulation opportunity for investors. For ETH, the 30-day MVRV ratio has risen to 11.89%. Nonetheless, this ratio is rarely any longer shut to the native top, which is always around 18% and 22%. Therefore, this vogue means that Ethereum’s designate.

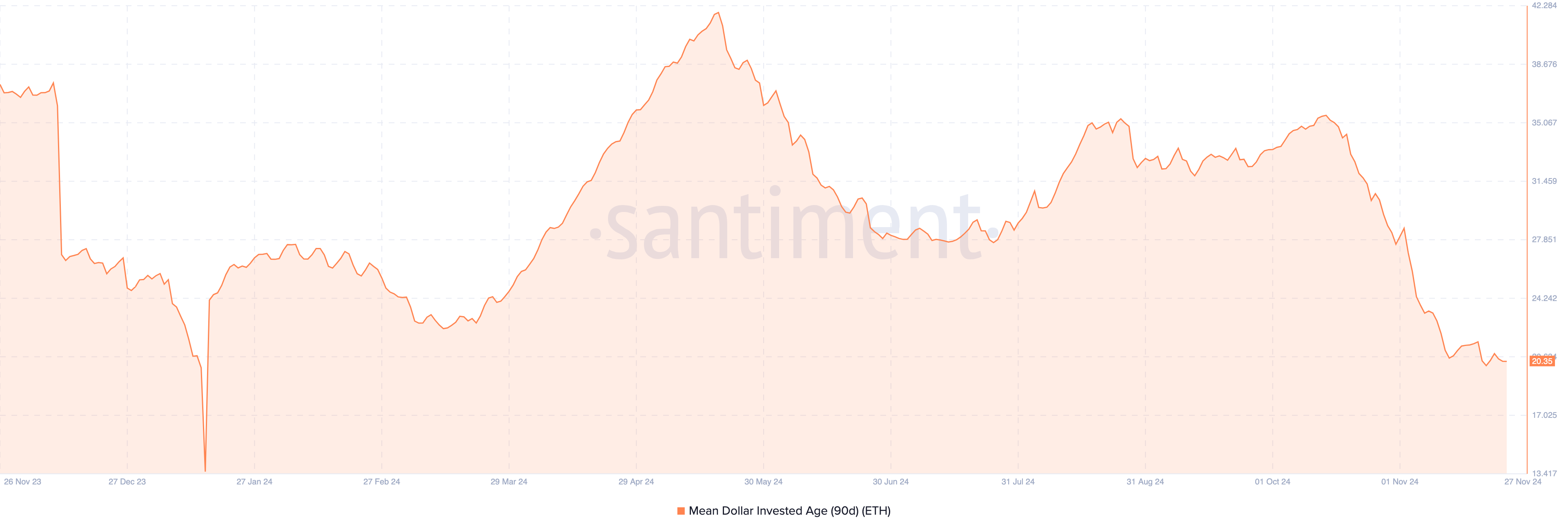

Past the MVRV ratio, the Point out Greenback Invested Age (MDIA) also means that Ethereum would possibly merely retain far flung from an additional designate drop. MDIA measures the frequent age of all cash on a blockchain, weighted by their own designate.

A rising MDIA indicates that cash are turning into more stagnant, reducing the prospect of a vital designate surge.

Conversely, a declining MDIA means that previously dormant cash are transferring, signaling increased trading job, which is the case with ETH. If this vogue persists, it can possibly per chance boost Ethereum’s potentialities of a designate rally.

ETH Trace Prediction: $4,000 Might well well Be Coming

On the day after day chart, Ethereum’s designate has formed an inverse head-and-shoulders pattern. This pattern assuredly emerges after a extended downtrend, signaling a probably sellers’ exhaustion point.

The pattern contains three key parts: the left shoulder, which marks the first uptrend; the head, signaling the reside of the downtrend; and the correct shoulder, indicating the rebound.

With ETH trending in an uptrend, the cryptocurrency is probably going to upward thrust in direction of $4,000 in the short length of time. On the opposite hand, if selling stress rises, this would possibly switch, and ETH may possibly per chance decline to $3,206.