The Ethereum designate at present time is conserving spherical $4,735, up 0.50% on the day, following a highly efficient breakout from a symmetrical triangle on the 4-hour chart. After checking out lows shut to $4,200 final week, ETH surged to $4,800, reclaiming higher flooring and confirming renewed bullish momentum. The ask now is whether ETH can abet this breakout or if non permanent resistance will situation off a pullback.

What’s Taking place With Ethereum’s Mark?

The 4-hour chart shows that Ethereum has damaged out of a structure that has been compressing for weeks. Mark moved clearly above $4,600, confirming that the bullish pattern would continue after it regained pork up in its rising channel. The breakout candle had extra quantity, which scheme that merchants were in truth participating.

Ethereum is now procuring and selling above well-known pork up ranges between $4,600 and $4,650. Resistance ranges above that are at $4,850 and then $5,000. It is indispensable to withhold the sizzling level, attributable to if you don’t, the breakout zone shut to $4,450 will seemingly be tested all over again.

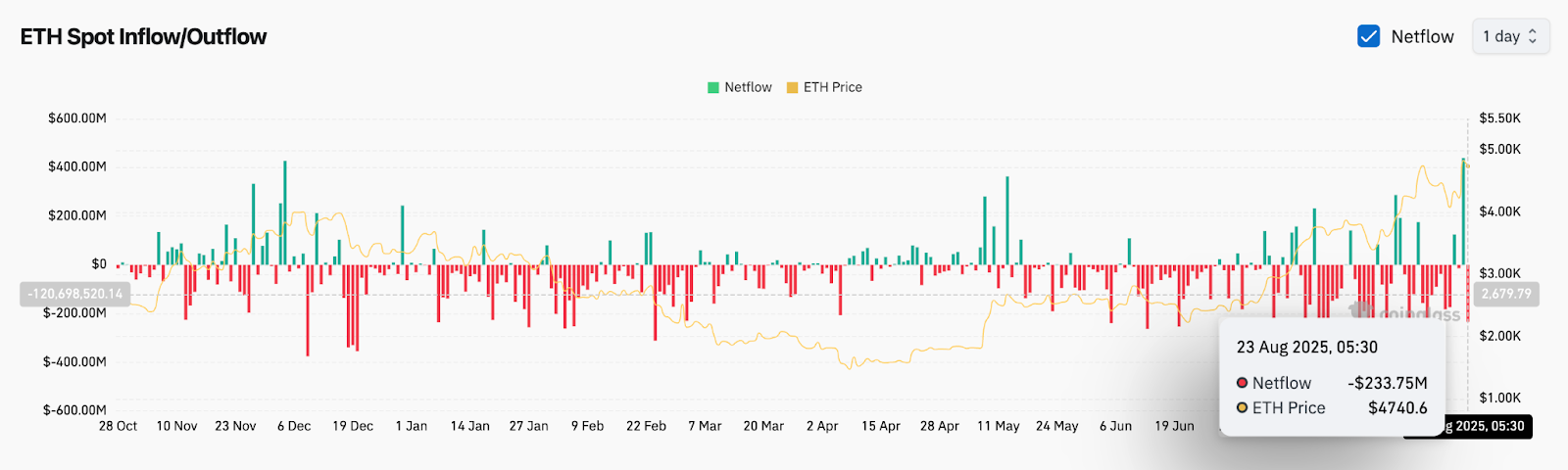

On-chain flows pork up the bullish survey. On August 23, location netflows showed a wide outflow of $233.7 million, which is a solid signal that merchants are transferring ETH off exchanges. This in overall scheme that they are taking a survey for added in location of promoting it precise away.

Why Is The Ethereum Mark Going Up This day?

The unique breakout in Ethereum designate comes after weeks of consolidation within a triangle formation. Investors defended liquidity pockets spherical $4,200 and staged a recovery, breaking structure to the upside. Natty Money Thought alerts ascertain a complete lot of Break of Structure (BOS) events in August, aligning with a bullish market structure.

Momentum indicators also favor bulls. The Supertrend indicator has flipped inexperienced on the 4-hour timeframe, sitting at $4,459, which now acts as dynamic pork up. The Directional Stream Index (DMI) shows +DI crossing above –DI with ADX rising, pointing to strengthening pattern momentum.

From a derivatives standpoint, volatility expansion is evident. Bollinger Bands on the 4-hour chart are widening, with designate now checking out the upper band shut to $4,854. Sustained closes above this level may maybe well perchance gasoline an impulsive rally in direction of $5,000.

Key Indicators Signal Strength But Direct Shut to-Length of time Overextension

The EMA cluster on the 4-hour chart is fully aligned in bullish relate. The 20 EMA ($4,487), 50 EMA ($4,398), and 100 EMA ($4,276) all sit well below the sizzling designate, confirming solid pattern pork up. As lengthy as ETH trades above these ranges, the broader structure remains bullish.

On the different hand, non permanent warning is warranted. On the 30-minute chart, RSI stands at 52 after taking flight from overbought stipulations shut to 70 all the scheme by the breakout. This suggests ETH may maybe well perchance consolidate spherical $4,700–$4,750 previous to making its next directional transfer. VWAP readings location sparkling designate shut to $4,738, with ETH hovering precise below, indicating a balanced but indecisive shut to-term posture.

Natty Money liquidity charts also highlight a frail excessive shut to $4,830. If this zone is rejected, a corrective transfer in direction of $4,600 is feasible previous to merchants strive one other leg higher.

ETH Mark Prediction: Speedy-Length of time Outlook (24h)

The non permanent outlook for Ethereum designate at present time remains cautiously bullish. If ETH sustains above $4,700, momentum may maybe well perchance lengthen in direction of $4,850 and the psychological $5,000 tag. A breakout above $5,000 would commence the door for $5,250–$5,300, where the rising channel high aligns.

On the diagram back, rapid pork up lies at $4,600, followed by $4,450, which coincides with the Supertrend and prior breakout zone. A breakdown below $4,450 would weaken the bullish case and relate ETH to a deeper correction in direction of $4,200.

Overall, ETH maintains bullish momentum after its breakout, but the war spherical $4,700–$4,850 will judge if this transfer extends or stalls.

Ethereum Mark Forecast Desk: August 24, 2025

| Indicator/Zone | Level / Signal |

| Ethereum designate at present time | $4,735 |

| Resistance 1 | $4,850 |

| Resistance 2 | $5,000 |

| Give a rob to 1 | $4,600 |

| Give a rob to 2 | $4,450 |

| EMA Cluster (20/50/100, 4H) | Bullishly aligned below designate |

| Supertrend (4H) | Bullish, pork up at $4,459 |

| RSI (30-min) | 52.4 (neutral) |

| Bollinger Bands (4H) | Expanding, upper band at $4,854 |

| DMI (14, 4H) | +DI leads, ADX rising |

| Space Netflow (Aug 23) | -$233.7M (bullish accumulation) |

Disclaimer: The sure wager presented listed here is for informational and academic functions handiest. The article would now not constitute monetary advice or advice of any form. Coin Edition is now not to blame for any losses incurred attributable to the utilization of recount, merchandise, or services mentioned. Readers are advised to exercise warning previous to taking any motion related to the corporate.