Ethereum trace has prolonged its recovery, hiking from the August 5 low shut to $3,450 to test the $3,950 zone. This rally broke above a descending constructing and retested the $3,708 give a snatch to-grew to alter into-resistance level, which now serves as a launch level for the contemporary push.

On the 4-hour chart, ETH is conserving above all predominant EMAs. The EMA20 at $3,749, EMA50 at $3,686, and EMA100 at $3,623 for the time being are stacked bullishly under trace. This alignment helps continuation as long as $3,800 holds as shut to-term give a snatch to.

Bollinger Bands dangle widened, indicating volatility growth, while trace rides the upper band, a label of sustained bullish momentum. The breakout has moreover pushed ETH abet above its broader trendline from July, re-setting up a elevated-excessive constructing.

Ethereum Label Forecast Desk: August 9, 2025

| Indicator/Zone | Stage / Signal |

| Ethereum trace at the present time | $3,918 |

| Resistance 1 | $3,950 |

| Resistance 2 | $4,100 |

| Enhance 1 | $3,800 |

| Enhance 2 | $3,749 |

| EMA20 / EMA50 / EMA100 (4H) | $3,749 / $3,686 / $3,623 (Bullish) |

| Bollinger Bands (4H) | Expanded, pattern intact |

| RSI (30-min) | 59.7, cooled from overbought |

| MACD (30-min) | Certain, gentle contraction |

| VWAP (30-min) | $3,918 pivot |

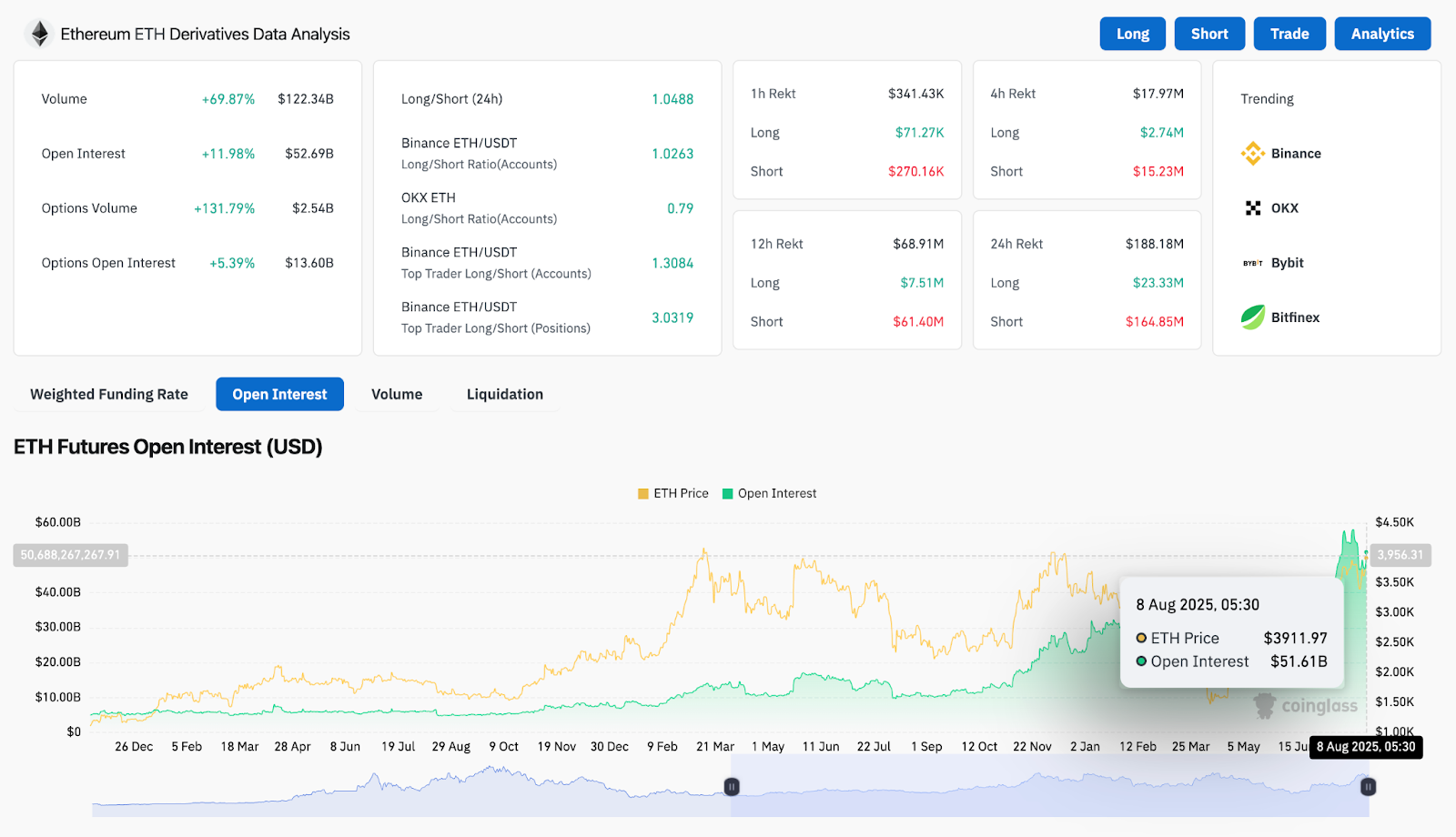

| Open Hobby | $52.69B (+11.98%), long bias |

| Supertrend (1D) | Bullish above $3,387 |

| Key Fib Stage | $4,106 resistance |

Why Is The Ethereum Label Going Up At present time?

The upward push in Ethereum trace at the present time is driven by both technical and derivatives market tailwinds. Technically, the breakout above $3,708 signaled a shift abet to purchaser alter after every week-long pullback. This caused unusual long positioning and aquire-end activation above $3,800.

Within the derivatives market, trading volume jumped almost 70 percent to $122.34 billion, with begin hobby hiking 11.98 percent to $52.69 billion. Binance’s top trader long-to-immediate ratio is at 3.03, underscoring a real long bias among excessive-volume merchants. Alternatives volume moreover surged over 131 percent, indicating aggressive bullish positioning sooner than a doable breakout toward $4,100.

On the 30-minute chart, RSI sits shut to 60 after cooling from overbought territory, allowing for added upside without instant exhaustion. MACD remains in certain territory no matter a delicate histogram contraction, exhibiting bullish momentum is still contemporary.

Label Indicators and Market Structure

The weekly chart highlights a key resistance zone at $4,106, which aligns with the 1.0 Fibonacci extension from the 2021 highs. A atomize above this level may perchance well per chance begin the door toward the $5,070 and $5,788 Fibonacci targets.

Each day Supertrend phases stay firmly bullish above $3,387, and not using a reversal signals in check out. The DMI reveals +DI main -DI, supported by a rising ADX above 32, confirming a trending market.

VWAP on decrease timeframes is anchored shut to $3,918, acting as a key intraday pivot. So long as ETH holds above this zone, the slip of least resistance remains upward.

Ethereum Label Prediction: Short-Timeframe Outlook for August 9

Over the following 24 hours, Ethereum trace will must preserve above $3,800 to preserve the bullish constructing. A clear breakout above $3,950 to $3,960 may perchance well per chance immediate lead to a retest of $4,100, which is the most crucial resistance earlier than elevated targets diagram into play.

If bulls fail to maintain momentum and trace dips under $3,800, a pullback toward $3,749 (EMA20) and $3,708 give a snatch to may perchance well per chance occur. However, given the EMA alignment, expanding Bollinger Bands, and derivatives positioning favoring longs, the likelihood remains tilted toward one other breakout attempt.

Disclaimer: The guidelines supplied listed here is for informational and tutorial choices most attention-grabbing. The article does now no longer constitute financial advice or advice of any kind. Coin Edition is now no longer accountable for any losses incurred as a outcomes of the utilization of issue, merchandise, or products and services talked about. Readers are educated to exercise warning earlier than taking any hasten connected to the company.