After a near-vertical breakout from the $2,800 vary earlier this month, Ethereum ticket at present time is consolidating near the $3,900 ticket. This sits factual beneath a excessive multi-year resistance zone, with Successfully-organized Money Ideas exhibiting ETH pushing staunch into a excessive-liquidity constructing that had historically induced profit-taking. With derivative metrics flashing bullish and value motion hiking along an ascending channel, merchants are looking forward to affirmation of the following transfer.

What’s Took place With Ethereum’s Tag?

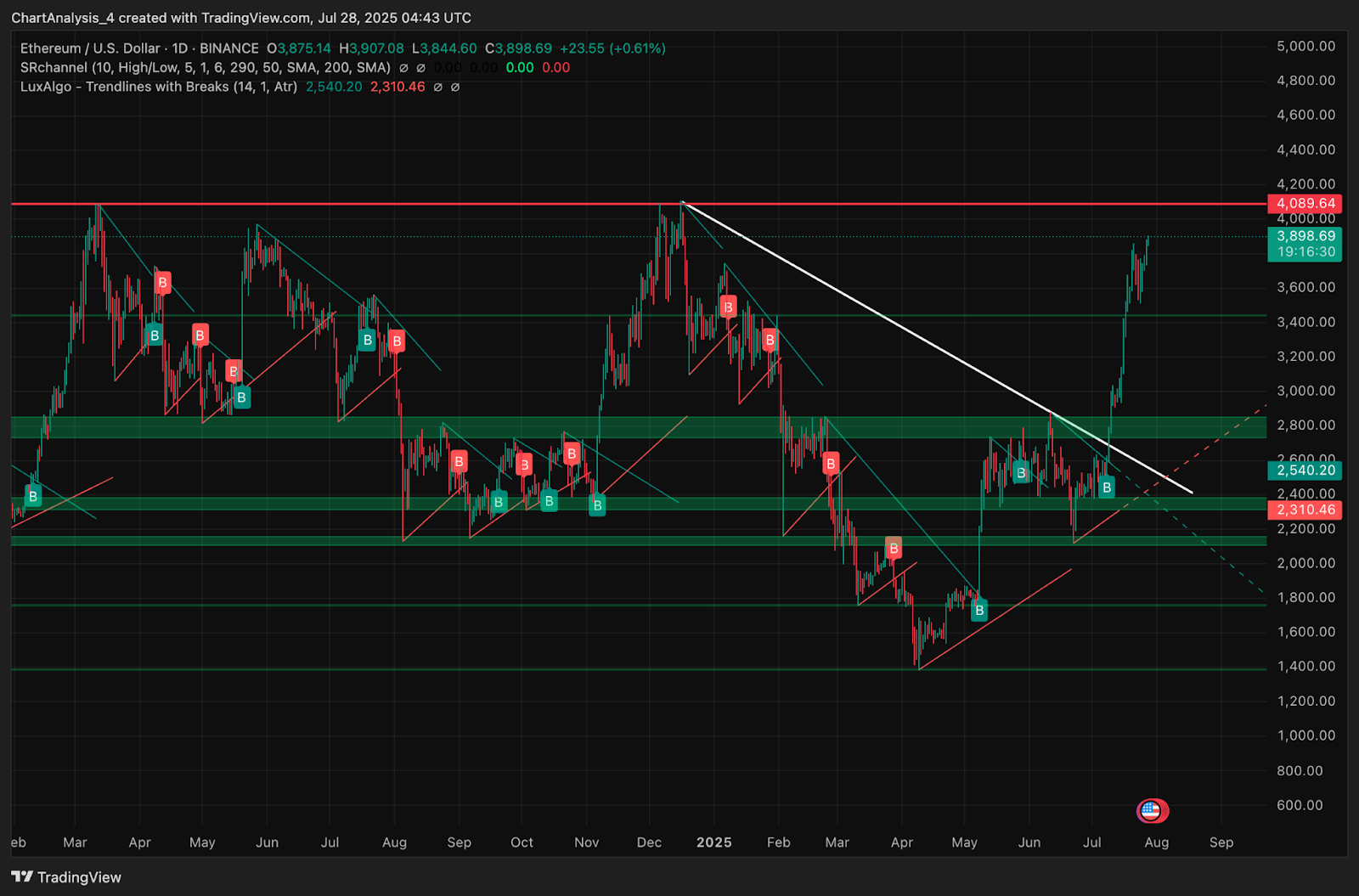

The every day chart showed Ethereum ticket piercing above its multi-month downtrend resistance in mid-July, with ticket now focusing on the 2024 swing excessive near $4,089. ETH cleared all indispensable offer zones as a lot as this level, confirming a bullish market constructing flip. A spruce breakout from the compression constructing between $2,400 and $2,800 induced this vertical rally.

On the weekly timeframe, ETH is urgent staunch into a crimson Successfully-organized Money liquidity zone between $3,890 and $4,200. This space acted as distribution territory for the period of the April and Can also merely 2024 peaks and represents the last resistance sooner than a attainable trip in direction of $4,500 and $4,800. A conclude above $4,089 would ticket a macro BOS and originate up a new leg elevated.

Why Is The Ethereum Tag Going Up At the present time?

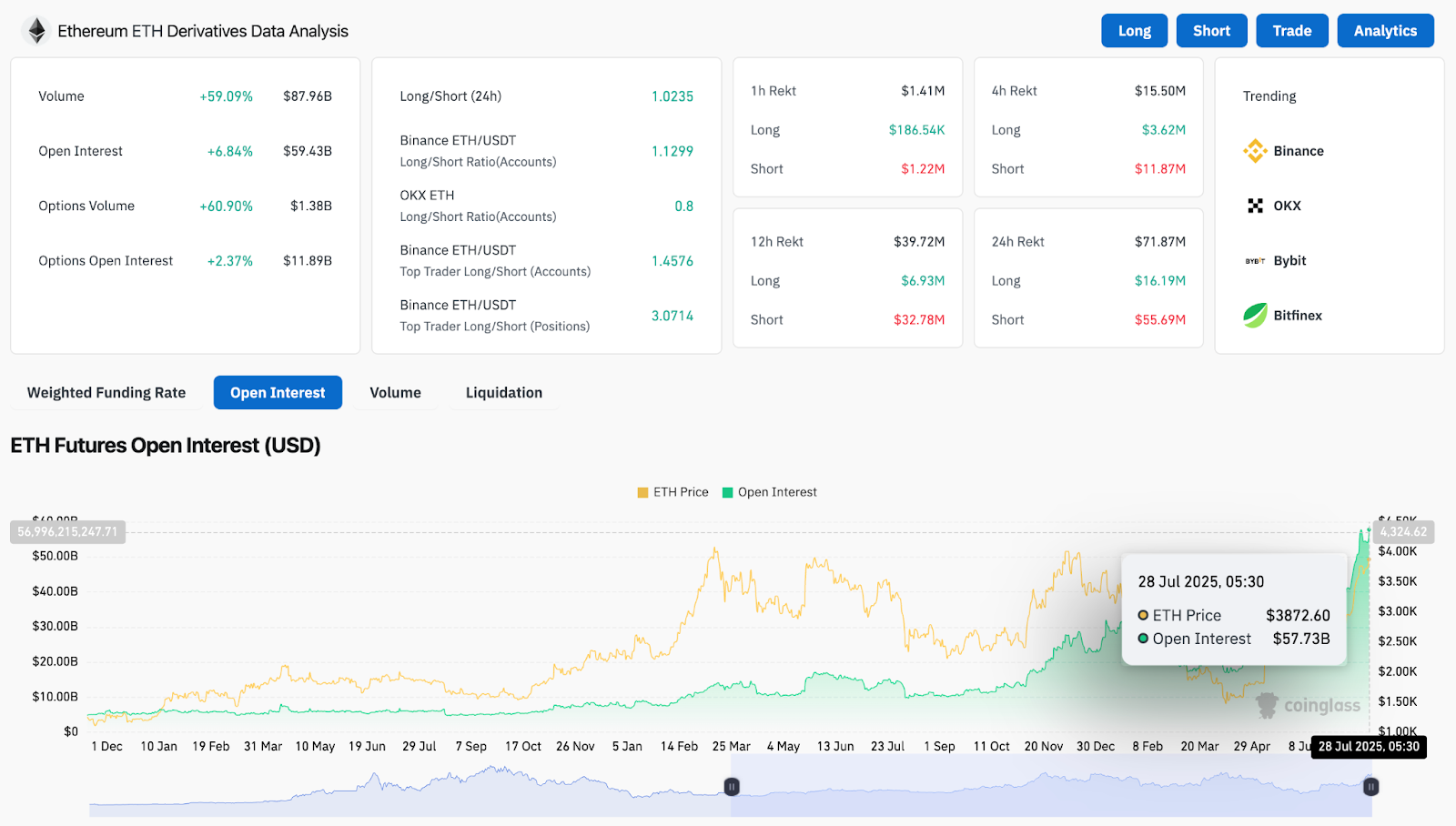

Why Ethereum ticket going up at present time is tied to a combination of technical breakout strength and heavy derivatives circulate. Coinglass data showed a 59.1 percent surge in ETH buying and selling quantity all the blueprint by the last 24 hours, with originate hobby hiking 6.84 percent to $59.43 billion. Binance’s high seller prolonged to immediate ratio reached 3.07, exhibiting necessary institutional positioning.

The 4-hour chart reflected stable constructing momentum, with candles hiking along the upper Bollinger Band near $3,920. Tag remained firmly above the EMA 20, 50, 100, and 200 cluster, which now acts as a multi-layered toughen imperfect between $3,475 and $3,781.

The Supertrend flipped bullish on July 9 and persisted to plod ticket motion tightly, for the time being sitting at $3,701. Directional Motion Index showed the +DI at 25.3 leading over -DI at 11.5, whereas ADX was rising. This confirmed the increasing constructing strength.

Channel Structure and RSI Signal Wholesome Model Extension

On the 30-minute chart, ETH revered an ascending channel that had guided ticket since July 24. Tag was using the median line, with VWAP toughen retaining spherical $3,883 and RSI cooling from 66 to 62, warding off overbought territory. This unhurried slope indicated controlled, low-volatility constructing continuation rather than euphoric exhaustion.

Bollinger Bands expanded once more on the 4-hour chart, and value was urgent towards the upper band at $3,920. If this band breaks, volatility expansion would possibly perchance more than seemingly perchance drive ETH in direction of $4,050. Nevertheless, merchants wished to dwell cautious of the prolonged-timeframe crimson zone between $4,000 and $4,200, which previously induced a cascade of promote-offs.

ETH Tag Prediction: Instant-Time-frame Outlook (24H)

Ethereum ticket remained structurally bullish, nonetheless momentum would possibly perchance more than seemingly perchance temporarily unhurried as ticket tested the $3,920 to $4,089 liquidity ceiling. A spruce breakout above $4,089 would occupy signaled continuation in direction of $4,300 and $4,500. These levels for the time being showed no on the spot offer zones.

If ETH failed to destroy above $4,000 with quantity, a healthy pullback in direction of $3,754 (lower Bollinger Band) and $3,680 (EMA50) was seemingly. These levels aligned with the prior breakout zone and provided re-entry capability for bulls.

As prolonged as ETH held above the $3,680 to $3,754 toughen band, the uptrend remained intact. Quantity and VWAP wished to be monitored carefully to evaluate whether accumulation was nonetheless in play or if profit-taking started near the $4,000 ticket.

Ethereum Tag Forecast Desk: July 28, 2025

| Indicator/Zone | Level / Signal |

| Ethereum ticket at present time | $3,903 |

| Resistance 1 | $4,089 |

| Resistance 2 | $4,300 |

| Crimson meat up 1 | $3,754 |

| Crimson meat up 2 | $3,680 |

| EMA Cluster (20/50/100/200) | $3,781 to $3,177 (Bullish stack) |

| RSI (30-min) | 62.00 (Cooling from overbought) |

| Bollinger Bands (4H) | Upper Band $3,920 (Unstable) |

| VWAP (30-min) | $3,883 (Session toughen) |

| DMI (+DI vs -DI) | +DI: 25.3, -DI: 11.5 (Bullish) |

| Supertrend (4H) | Bullish above $3,701 |

| Commence Ardour | $59.43B (+6.84 percent) |

| Quantity (24H) | +59.09 percent, $87.96B |

| Binance Top Dealer Ratio | 3.07 (Long-heavy positioning) |

Disclaimer: The understanding introduced listed right here is for informational and academic functions most intriguing. The article would no longer constitute monetary advice or advice of any sort. Coin Version is no longer accountable for any losses incurred as a results of the utilization of dispute, products, or companies and products mentioned. Readers are informed to mumble warning sooner than taking any motion linked to the corporate.