The Ethereum (ETH) rate has elevated all correct now all the plan thru the past five weeks, culminating with a excessive of $3,270 on the fresh time.

Ethereum emerged from long-time frame horizontal and diagonal resistance phases all the plan thru the upward trek.

Ethereum Continues Ascent Above $3,000

The weekly time body technical analysis exhibits the ETH rate has elevated all correct now within the past five weeks. This day, ETH reached a excessive of $3,270, the highest since March 2022.

Trusty thru the upward trek, the ETH rate broke out from its long-time frame ascending parallel channel and the center of its long-time frame fluctuate (green circle). This took place after two earlier unsuccessful breakout makes an are trying (crimson icons). Sooner than the breakouts, the ascending parallel channel had existed since Could moreover 2022, while the fluctuate had existed since the originate of 2021.

The weekly Relative Energy Index (RSI) helps the breakout. When evaluating market prerequisites, merchants spend the RSI as a momentum indicator to resolve whether a market is overbought or oversold and whether to glean or promote an asset.

If the RSI finding out is above 50 and the vogue is upward, bulls silent possess an attend, but when the finding out is below 50, the opposite is correct. The RSI staunch moved above 70 (green icon), something that has previously preceded swift rate rallies.

What Are Analysts Asserting?

Cryptocurrency merchants and analysts on X positively spy the long flee Ethereum vogue.

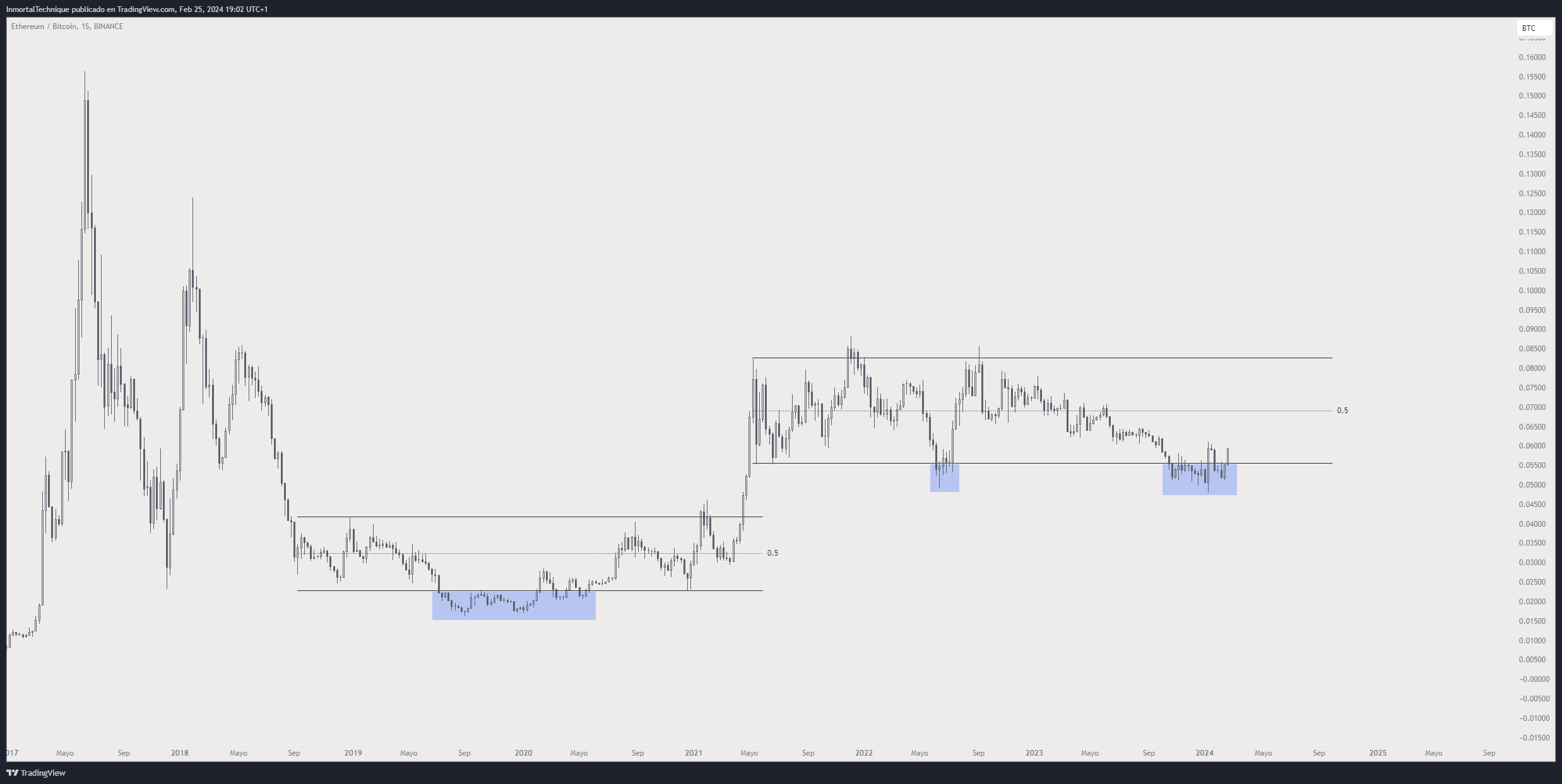

Immortalcrypto believes ETH will very a lot outperform Bitcoin quickly because it has already deviated below its fluctuate low.

Identical outlooks are given by Bob Loukas and MacnBTC, who outline a capability breakout from a descending resistance vogue line.

CryptoMichNL outlined his fundamental causes why he believes ETH will lead in opposition to BTC:

“In opposition to $BTC, it’s facing a if truth be told crucial resistance zone. Two key ingredients: – Dencun upgrade in about a weeks time. – Topic #Ethereum ETF coming up. The breakout above 0.06 BTC will trigger a resounding breakout on the total Ethereum ecosystem.” He acknowledged.

ETH Designate Prediction: The build to Subsequent?

The ETH/BTC chart exhibits bullish indicators an connected to the USD chart. The ETH/BTC rate deviated below the center of its fluctuate on the pause of 2023. Later on, the weekly RSI generated a bullish divergence, and the ETH rate elevated in 2024.

For the time being, it is a long way within the job of breaking out from a descending resistance vogue line and the center of its fluctuate. If profitable, ETH can boost by 35% and attain the discontinue of the fluctuate at ₿0.078. A an identical boost to $4,000 could well be likely within the ETH/USD pair.

Despite the bullish ETH rate prediction, a weekly shut below the vogue line and the center of the fluctuate will invalidate the breakout. Then, ETH could well tumble 33% to the fluctuate low of ₿0.038.

In the ETH/USD pair, this would possibly per chance occasionally likely trigger a drop to the center of the channel at $2,500.

For BeInCrypto‘s most contemporary crypto market analysis, click on here.

Disclaimer

The total data contained on our net area is printed in correct faith and for total data capabilities handiest. Any motion the reader takes upon the facts realized on our net area is precisely at their possess threat.