Ethereum’s (ETH) mark has been on a downward progress no longer too long within the past, catching the consideration of investors and traders. As the market watches intently, many are questioning what’s next for undoubtedly one of the head cryptocurrencies. Is that this upright a short-time interval dip, or could well additionally it model one thing extra? On this Ethereum Ticket Prediction article, we are going to detect the sizzling mark lope of Ethereum

How has the Ethereum Ticket Moved Today?

As of right this moment time, Ethereum (ETH) is valued at $2,616.36, with a 24-hour shopping and selling volume of $forty five.90 billion, a market cap of $314.93 billion, and a market dominance of 13.94%. Within the past 24 hours, its mark has dropped by 1.27%.

Ethereum hit its height on November 10, 2021, when it reached an all-time high of $4,867.17. In contrast, its lowest point used to be on October 21, 2015, at $0.420897. Since reaching its all-time high, the lowest mark recorded used to be $897.01 (cycle low), while the top mark since that low used to be $4,094.18 (cycle high). The recent mark prediction sentiment for Ethereum is bearish, with the Fright & Greed Index indicating a rate of 61, suggesting a hiss of “Greed.”

The circulating present of Ethereum stands at 120.37 million ETH. Over the last 365 days, the provision has grown by 0.11%, with 130,818 ETH newly created.

Why Is Ethereum Ticket Plunging?

Ethereum’s mark is for the time being experiencing a dip because exterior pressures, in particular those stemming from traits within the Jap market. These pressures contain precipitated a ripple make all the plot via main cryptocurrencies, including Bitcoin, which struggled to build its residence above $65,000.

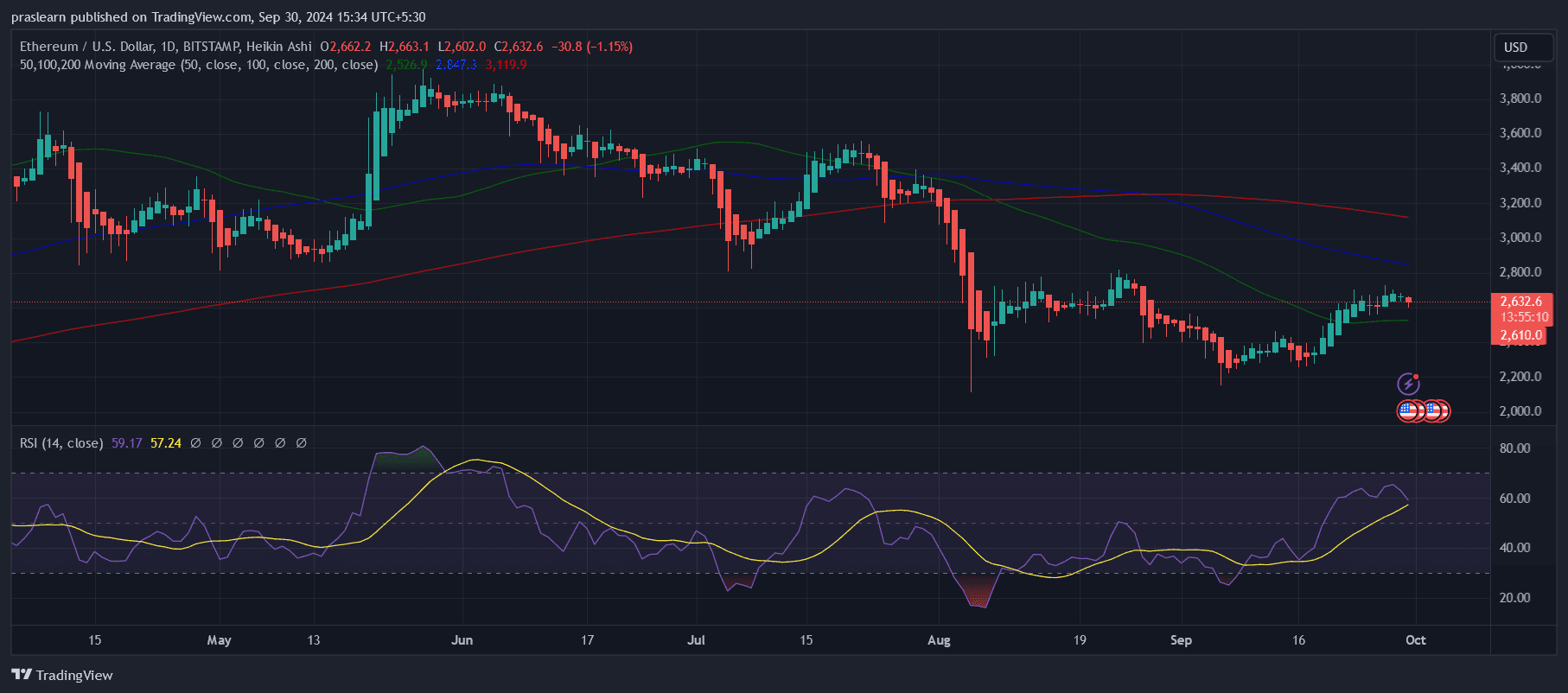

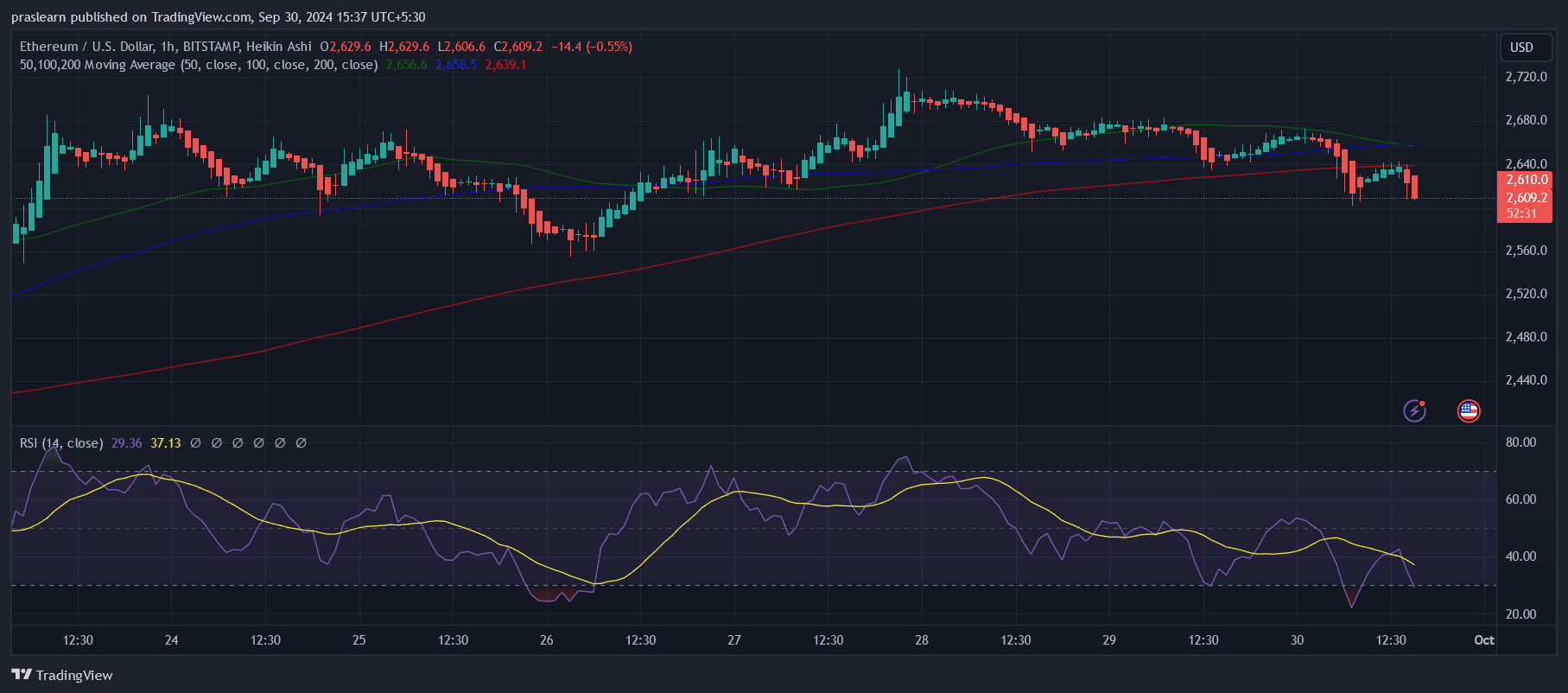

For Ethereum, the associated rate hovers round its 50-day Exponential Shifting Moderate (EMA) of $2,594, a severe make stronger level. After breaking via its descending trendline on September 19, Ethereum saw an 11% rally, nonetheless this upward momentum faces challenges.

If the 50-day EMA holds as a make stronger, Ethereum could well additionally just contain the aptitude to rebound and retest its earlier high of $2,820 from August 24. The success of this upward lope, then yet again, is intently tied to the market’s sentiment and shopping and selling indicators.

The Relative Energy Index (RSI), for the time being round 57 on the day-to-day chart, reveals a lower in bullish momentum. To aid any rally, the RSI would need to upward thrust above 60, signaling renewed power among investors. Must tranquil the RSI no longer discover better, the sizzling make stronger level could well additionally fail, ensuing in an extra decline in Ethereum’s mark.

Predictively, the route of Ethereum’s mark will rely on two key factors: the resilience of its 50-day EMA as a make stronger line and an enchancment in its RSI. If investors can defend this vital make stronger level and the RSI traits upwards, we could well additionally just spy Ethereum testing the $2,820 resistance and doubtlessly pushing even higher.

On the other hand, if the selling rigidity from market traits continues and the RSI stays subdued, Ethereum could well additionally spy extra downward lope within the short time interval. This uncertainty underscores the significance of monitoring both market traits and technical indicators intently.

How high can Ethereum Ticket lope?

Ethereum has demonstrated impressive progress over the past 365 days, with its mark rising by 58%, indicating mammoth passion and assignment from investors. The cryptocurrency also exhibited a mighty efficiency over the closing month, with 17 green days out of 30 (57%), suggesting short-time interval momentum.

On the other hand, despite these optimistic indicators, Ethereum’s total efficiency in all fairness combined. It has underperformed when in contrast to 51% of the head 100 crypto sources over the same interval and has lagged within the abet of Bitcoin, which usually sets the tone for the broader crypto market.

Moreover, Ethereum is for the time being shopping and selling beneath its 200-day Straightforward Shifting Moderate (SMA), a key indicator customarily used to discover the total progress. Trading beneath this long-time interval practical suggests a bearish sentiment within the broader context, which could additionally restrict the upside attainable within the short time interval.

The high liquidity of Ethereum, driven by its market cap and shopping and selling volume, affords a foundation for essential mark actions, both upward and downward. Moreover, Ethereum’s low yearly inflation rate of 0.11% makes it an handsome asset for investors in quest of long-time interval rate retention, because the puny expand in present helps defend its mark level.

If Ethereum can defend its make stronger round the 50-day EMA and derive bullish momentum reflected by an RSI above 60, there is attainable for Ethereum to test its August high of $2,820. Breaking above this level could well additionally design the stage for further positive aspects, in particular if the broader market sentiment turns extra bullish.

Within the long time interval, Ethereum’s skill to push higher will rely on a mixture of technical factors and market stipulations. If Ethereum can damage above its 200-day SMA, this will seemingly model a attainable reversal into a protracted-time interval bullish progress. On this scenario, Ethereum could well additionally impartial to revisit its earlier all-time high of round $4,867.17, provided that broader market stipulations, comparable to Bitcoin’s efficiency and global economic traits, are favorable.

Conversely, with out a shift above the 200-day SMA or a big expand in bullish momentum, Ethereum’s mark could well additionally just battle to make mammoth positive aspects beyond its recent highs, ensuing in extra consolidated or sideways lope.

Overall, Ethereum has sturdy upward attainable, nonetheless how high it could probably well well lope will largely rely on its skill to conquer recent resistance ranges and derive optimistic momentum in preserving with the total crypto market.

A sustained rally would require no longer finest technical indicators to align in its prefer nonetheless also a supportive macroeconomic backdrop and optimistic traits within the crypto sector as a total.