All any other time, the worth of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a extra designate broaden for the altcoin earlier than the tip of the one year.

However does this mean the cryptocurrency can surpass its old all-time excessive within this speedy duration? This on-chain prognosis reveals whether or no longer that is feasible.

Ethereum Loses Bullish Dominance in Two Significant Zones

Ethereum currently trades spherical $3,939, that components that the altcoin’s designate has elevated by 67.30% in 2024. One indicator that played a key characteristic in ETH’s rally at some stage in the one year is its Originate Interest (OI).

The OI refers again to the worth of the sum of all open contracts in the market. When it will enhance, it components that more liquidity has flowed into contracts linked to a cryptocurrency. Within the derivatives market, this capacity rising purchasing stress, which can presumably well furthermore result in elevated prices.

On the flip aspect, a lower in the OI signifies promoting stress. The decline suggests that merchants are increasingly more closing their positions and withdrawing liquidity from the market.

In accordance to Santiment, Ethereum’s OI climbed to $14.50 billion the day earlier than today, December 15. On the opposite hand, as of this writing, it has decreased to $13.94 billion, indicating that exposure to ETH has lowered. Given the stipulations above, this decline suggests that Ethereum Price risks one other decline if the OI sustains this keep.

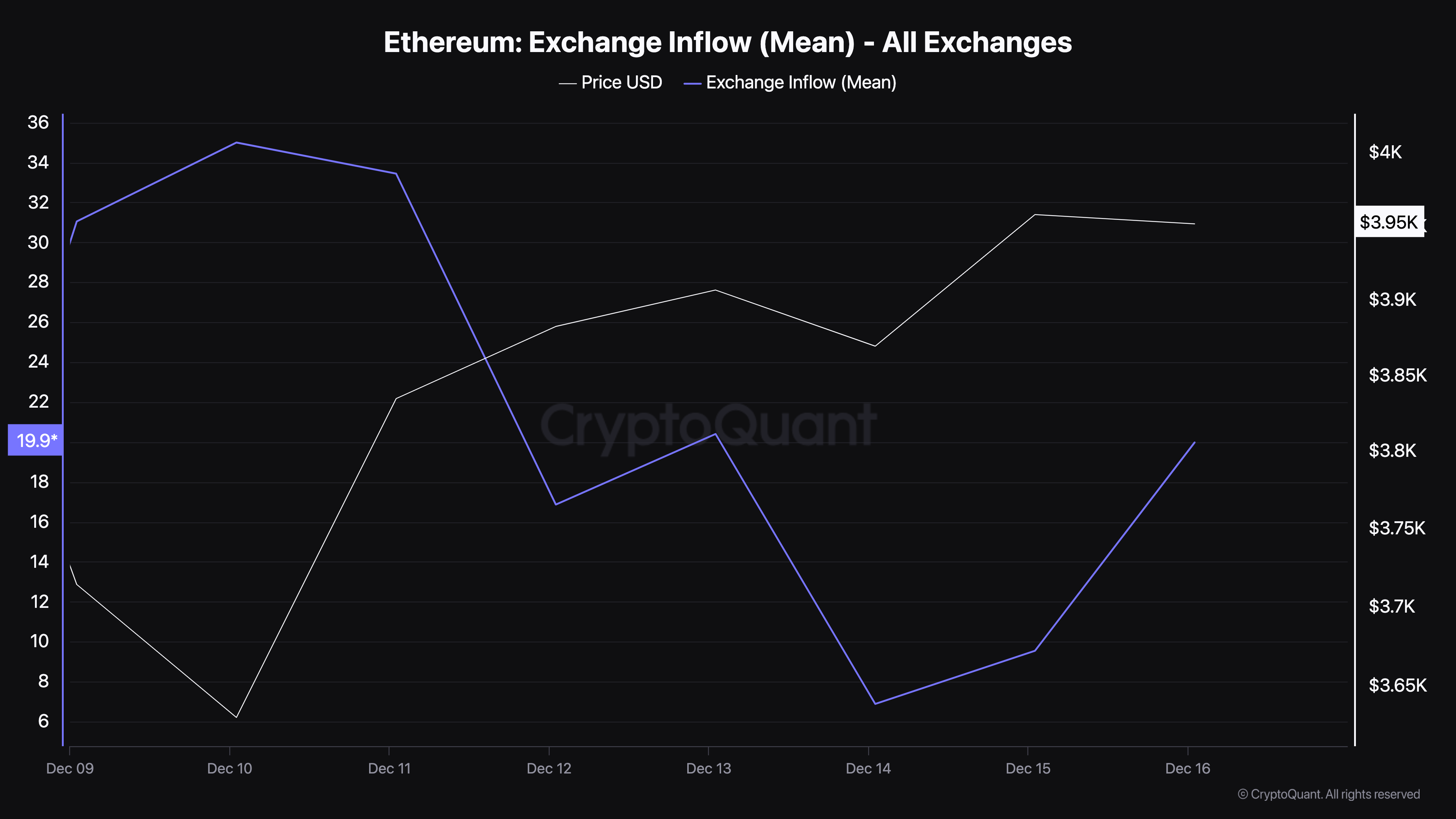

Another indicator that helps this bias is the Ethereum alternate influx. Switch influx is the mean quantity of coins per transaction despatched to exchanges. A excessive worth suggests that merchants are transferring elevated amounts, signaling elevated promoting stress, which can presumably well furthermore doubtlessly force prices lower.

A low alternate influx in the metric, nonetheless, suggests a decline in promoting stress. In accordance to CryptoQuant, the alternate influx has climbed from what it used to be on December 14, indicating that promoting stress spherical ETH has elevated.

If sustained, this is able to presumably well furthermore hinder the cryptocurrency from rising in direction of $4,500 or hitting a brand novel all-time excessive earlier than 2024 closes.

ETH Price Prediction: Now $4,500 Yet

In accordance to the each day chart, the Parabolic Conclude-and-Reverse (SAR) indicator has risen above ETH’s designate. The SAR is a technical indicator that reveals whether or no longer a cryptocurrency has encountered resistance or solid toughen.

When the dotted traces are below the worth, it signifies essential toughen that can presumably well furthermore force prices elevated. On the opposite hand, currently, the dotted traces are above Ethereum’s designate. Therefore, the cryptocurrency goes via resistance.

As long as ETH trades below the indicator, the worth is most likely to drop, with that you just’re going to evaluate of targets spherical $3,315. If that is the case, then Ethereum’s designate could presumably well furthermore no longer hit a brand novel all-time excessive earlier than the one year ends.

On the opposite hand, if Originate Interest will enhance and alternate influx drops to an extremely low level, the forecast would possibly be invalidated.