Ethereum (ETH) is for the time being facing downward stress, with its designate facing a likely decline under the $3,000 designate. Other than the broader market consolidation, ETH’s present designate drop is driven by the decrease in say from its monumental merchants.

This prognosis explains why the worth decline could well fair happen and highlights the worth functions ETH holders must composed hear to.

Ethereum Faces Selloff Stress as Whale Netflow Drops

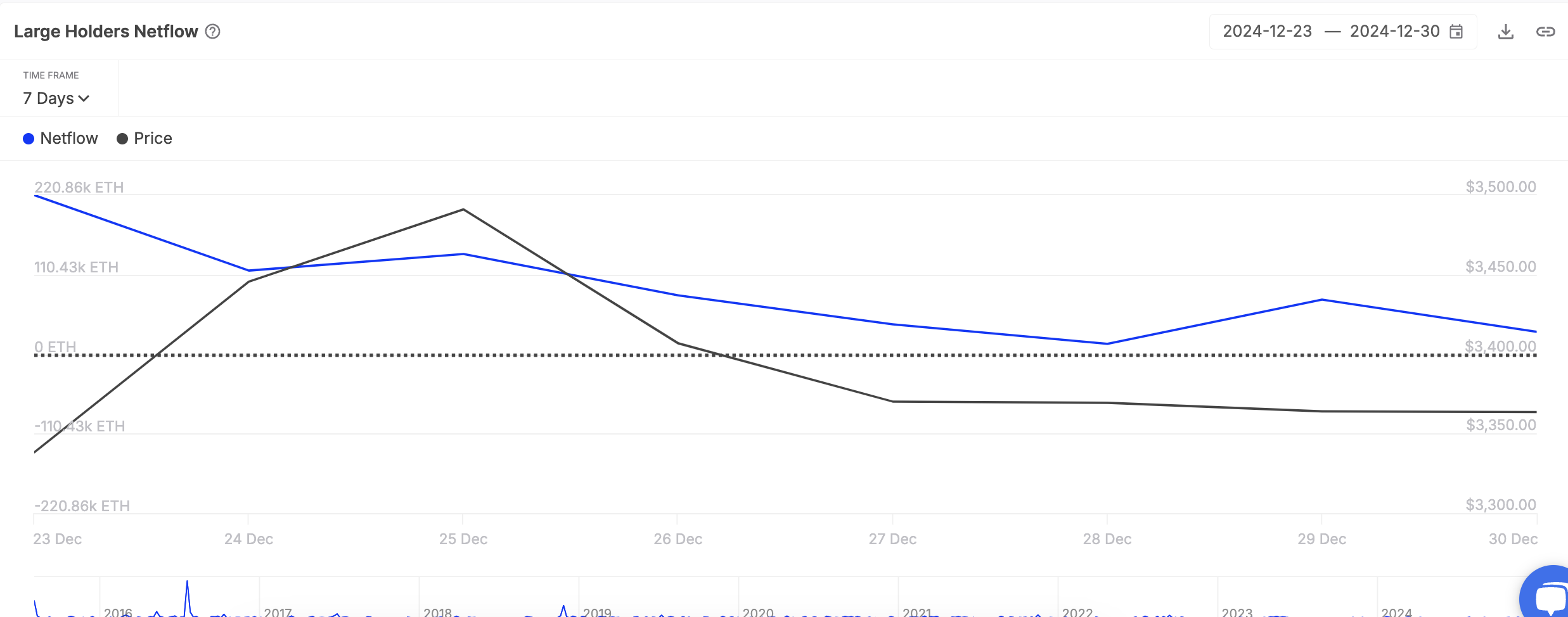

In accordance to IntoTheBlock, ETH’s monumental holders’ netflow has plummeted by 73.19% over the final seven days. Neatly-organized holders are whale addresses that sustain extra than 0.1% of an asset’s circulating provide.

When an asset witnesses a drop in whales’ netflow, it indicates that its worthy merchants are lowering their positions by promoting off or transferring sources. This generally signals an absence of confidence in the asset’s non eternal potentialities, leading to likely downward designate stress as these holders transfer their funds in completely different locations.

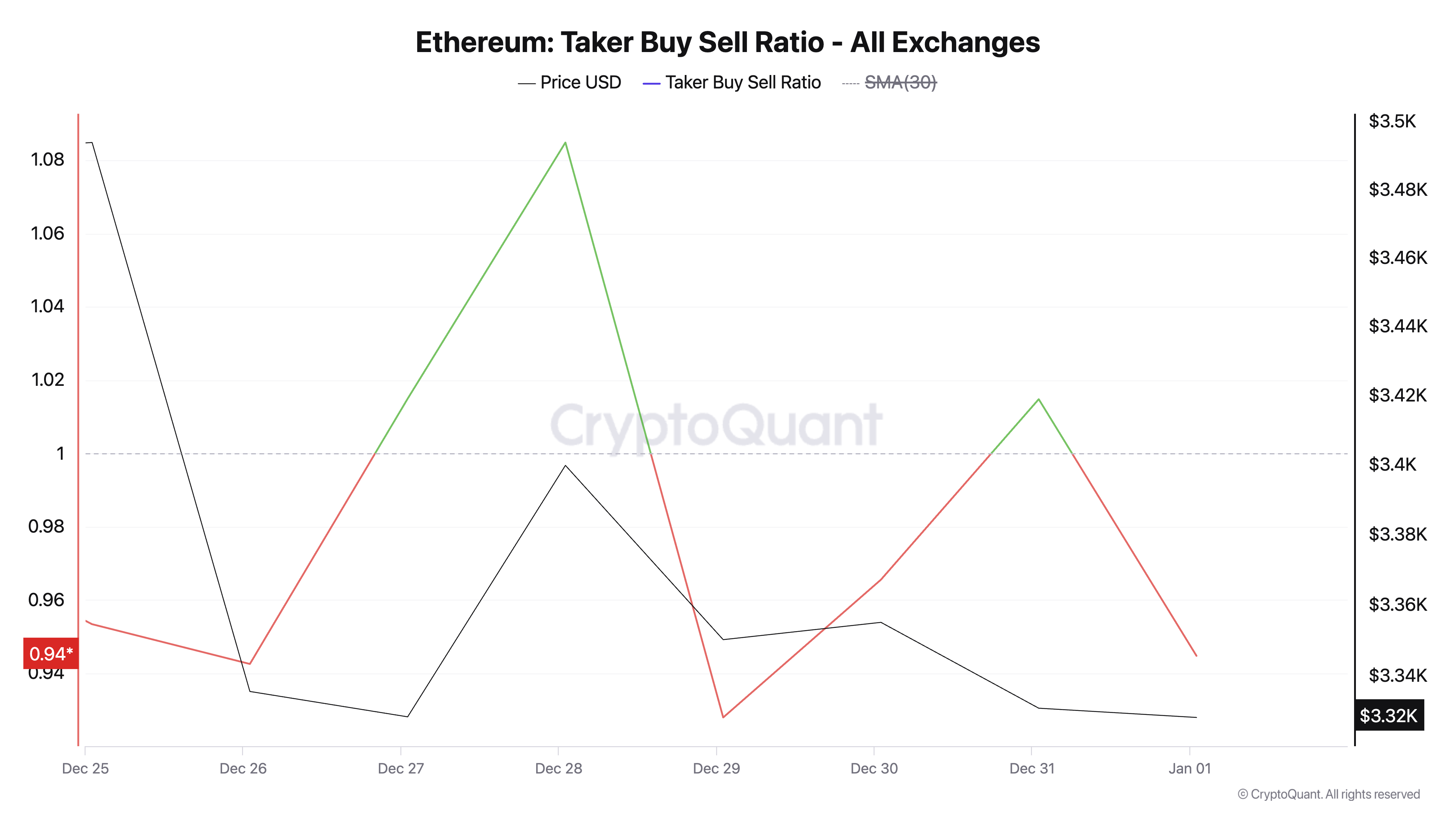

As neatly as to diminished whale accumulation, ETH’s Taker-Aquire-Sell ratio has been predominantly less than one in the past seven days, indicating selloffs amongst its derivatives merchants. In accordance to CryptoQuant, this stands at 0.94 at press time.

An asset’s Taker-Aquire-Sell ratio measures the percentage of purchase orders to sell orders done by market takers. A ratio under one indicates that sell orders outweigh purchase orders, signaling bearish sentiment. This implies promoting stress exceeds buying passion, generally hinting at likely designate declines as extra merchants exit positions than enter them.

ETH Label Prediction: All Lies With the Whales

On the day after day chart, readings from ETH’s Involving Average Convergence Divergence verify the tumble in the ask for the leading altcoin. At press time, the coin’s MACD line (blue) rests under its signal line (orange) and nil line.

This indicator helps merchants title modifications in a pattern’s energy, route, and duration. As with ETH, when the MACD line is under the signal line, it indicates a bearish pattern. If promoting stress strengthens additional, ETH’s designate could well well drop under wait on at $3,070 to interchange at $2,558.

On the completely different hand, if market sentiment improves and ETH whales resume accumulation, they could well fair force the coin’s designate toward $3,415.