Taking into consideration in regards to the Pi Cycle High Indicator, the ETH label evaluation suggests that Ethereum can also watch more corrections sooner than attempting to attain the $4,000 label yet again. Additionally, the Catch Unrealized Profit/Loss (NUPL) signifies it’s still far far from the euphoria zone, hinting at a doable length of consolidation in the attain future.

Moreover, the Exponential Transferring Common (EMA) Lines dispute costs converging carefully, suggesting that there would possibly be stable give a rob to on the sleek stages, that would possibly per chance fair stabilize ETH costs sooner than any indispensable upward motion.

Ethereum Pi Cycle Exhibits An Crucial Predicament

ETH trajectory on the Pi Cycle High Indicator suggests a brewing consolidation phase, as evidenced by the gap between the 111-day transferring moderate and the 350-day transferring moderate cases two.

For the time being, the indicator’s upper boundary is made up our minds attain $4,231, whereas the decrease boundary rests around $2,750, a range that lets in for a breathing room indicative of market stabilization fairly than a top. It’s inner this bandwidth that the ETH label will more than likely be carving out a foundation for its subsequent ascent.

Pi Cycle High Indicator operates on the precept that after the worth surpasses the longer-timeframe moderate (350-day multiplied by 2), a market top will more than likely be coming near, suggesting an overheated market poised for a downturn. When it’s below the short-timeframe moderate, it will also existing the asset is undervalued.

ETH label between these averages and the parallel trajectory of the traces with out a crossover match implies that whereas the heights of market euphoria are yet to be reached, the groundwork is being laid for a sturdy give a rob to level. This lack of convergence, blended with the sleek label notify, lends weight to the argument that ETH will more than likely be coming into a consolidation phase.

Be taught Extra: Ethereum ETF Explained: What It Is and How It Works

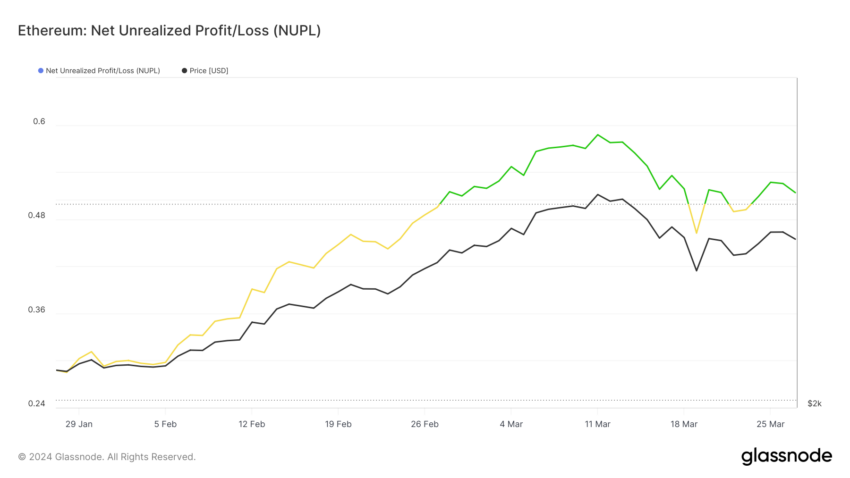

ETH Is Unruffled Some distance From Euphoria

ETH Catch Unrealized Profit/Loss (NUPL) has been persistently oscillating between “Optimism — Fear” and “Belief — Denial,” a pattern that is indicative of the market’s indecision. This sort of rhythmic shift between sentiment zones suggests that traders are alternating between cautious optimism and a stronger conviction in the asset’s doable, yet with out completely committing to an overarching pattern. This aid-and-forth motion, or ‘going and coming,’ implies a doable consolidation phase for Ethereum.

The NUPL’s transient stays in “Belief — Denial” to cease market overheating. The sentiment suggests a market stabilizing, warding off mighty promote-offs or selloffs.

This sentiment stability can also fair prep ETH’s label for customary climbs. Without stable greed or anguish, a gradual rise is more likely than volatile swings.

ETH Tag Prediction: Consolidation Sooner than Contemporary Surges

ETH Exponential Transferring Common (EMA) traces on the 4-hour label chart provide precious perception into the asset’s label motion. The EMA traces are monitoring shut to 1 any other, which signifies that there’s shrimp volatility and the worth is experiencing a consolidation phase.

EMAs are a form of transferring moderate that presents more weight to fresh costs, making them more conscious of original data. When EMA traces converge, as they seem like on the chart below, it always signifies that a stable pattern is now now not in train, and costs can also switch sideways for a whereas.

The associated price of ETH is hovering around these traces, suggesting an equilibrium between traders and sellers. If an uptrend is to initiate, a decisive break above these tangled EMA traces can also propel ETH’s label in opposition to the $4,100 resistance level. An upcoming ETH ETF can also aid this uptrend to seem.

Be taught Extra: Ethereum Restaking: What Is It And How Does It Work?

If the consolidation phase turns bearish, ETH can also drop to $3,200 give a rob to. A deeper hotfoot to $2,900 is which that you simply would possibly imagine under wider detrimental sentiment. For the time being, clustered EMA traces trace at ongoing range-slouch buying and selling for Ethereum. Any decisive switch out of this band will likely account for its subsequent major label pattern.