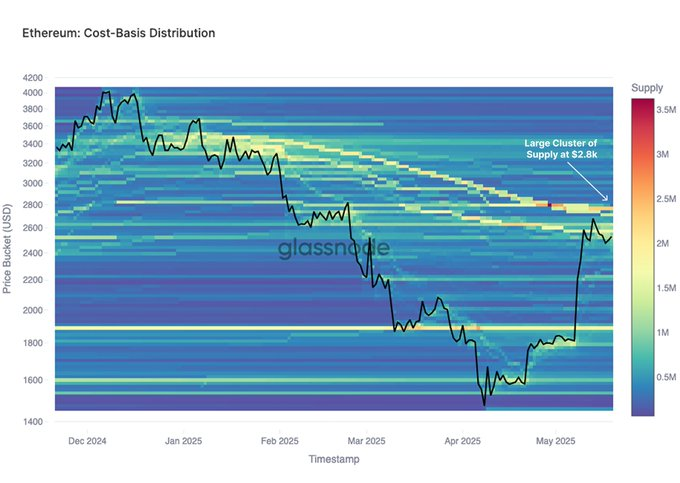

Ethereum’s fresh upward climb hit a extreme snag this week correct spherical the $2,800 heed. Fresh on-chain files from Glassnode suggests this space is a important supply zone, stuffed with lengthy-term holder positions where many investors who bought in sooner than the March and April downturns are in fact shut to breaking even or seeing earnings. That manner promoting job would possibly well derive as these traders eye to de-possibility or merely money out.

There’s a well-known cluster of investor heed basis ranges spherical $2,800 for $ETH. As heed approaches this zone, sell-side rigidity would possibly well fair boost as many beforehand underwater holders would possibly well fair eye to de-possibility shut to breakeven. pic.twitter.com/ukn2s7cOJo

— glassnode (@glassnode) May maybe 24, 2025

Taking a eye relief from December 2024 to May maybe 2025, Ethereum (ETH) took a tumble from above $3,800 to shut to $1,600. The restoration stoop since then managed to bring ETH relief up against that key $2,800 neighborhood. It’s here that the most up-to-date heed-basis distribution, in line with Glassnode’s heatmap, exhibits rather a lot of of wallet job. The finest concentrations on this heatmap clearly flag this $2,800 set as a zone of dense supply, signaling a doubtless heed ceiling unless a gradual wave of procuring punches thru the resistance.

Glassnode: $2,800 Zone Packed with ETH Prolonged-Time duration Holders Eyeing Income

Within the course of the market downturn relief in the first quarter of 2025, on-chain files exhibits Ethereum wallet job noticeably shifted into decrease heed ranges. Supply density beefed up between $1,600 and $2,000 – a unfold that later acted as steady ground for Ethereum’s rebound in May maybe. While this era of accumulation would possibly well want attach a non permanent ground under the worth, that $2,800 degree is peaceable looming because the astronomical upper boundary that ETH hasn’t managed to decisively crack but.

If Ethereum can in fact push past this $2,800 heed with some extreme, sustained quantity, it would possibly maybe well flip old resistance ranges into novel strengthen. In every other case, continued bumping up in inequity heavy supply band would possibly well fair trigger renewed earnings-taking or a spherical of defensive promoting from frightened holders.

Linked: Ethereum (ETH) Reveals “Golden Immoral”; Analysts Gape $3,000 Price Target

CryptoQuant: Ethereum Energetic Addresses Fade Price Beneficial properties, Price Caution

Including one other layer to the image, Ethereum’s fresh heed good points haven’t been matched by a proportional leap in its everyday active address job. Recordsdata from CryptoQuant exhibits that whereas ETH has climbed relief to spherical $2,500 as of May maybe 2025, the preference of active addresses is hovering shut to 340,800. That figure, whereas a dinky uptick from the sub-300,000 ranges viewed earlier in the year, peaceable trails successfully under the spikes in address job noticed at some level of slow 2023 and early 2024.

Historical traits generally present that astronomical will enhance in active addresses plug hand-in-hand with total heed rallies or heed native tops. The fresh divergence here—heed up, nonetheless novel active particular person progress a diminutive flat—means that present contributors, in desire to a novel wave of novel particular person adoption, would possibly well fair be the predominant engine in the help of Ethereum’s most up-to-date heed circulation.

Contemporary ETH Price Dip Underscores Energy of $2,800 Resistance Ceiling

Appropriate as this file change into once being attach collectively, the Ethereum heed took a 3.46% dip, procuring and selling at $2,567.78. That’s a tumble of over $100 from its excessive fair the prior day. Along with this, its market capitalization slipped to $309.ninety nine billion, though procuring and selling quantity in fact ticked up by 8.77% to $22.81 billion, in line with CoinMarketCap. This leap in quantity alongside a heed tumble generally displays elevated liquidity as sell orders hit the market, doubtlessly triggering pause-loss orders.

Ethereum’s incapacity to retain its ground above $2,600 in this fresh switch in fact highlights fair how important that $2,800 resistance set is. With out a trim, decisive breakout above that heavy supply zone, traders must peaceable doubtlessly quiz non permanent heed choppiness to stick spherical.

Disclaimer: The tips offered in this article is for informational and tutorial functions easiest. The article doesn’t represent financial advice or advice of any kind. Coin Version is rarely any longer to blame for any losses incurred on story of the utilization of bid, merchandise, or services mentioned. Readers are informed to exercise caution sooner than taking any action linked to the company.