For a long way of the previous twelve months, predictions had been rife that Ethereum’s (ETH) label also can attain 5-digits. Nonetheless, as Bitcoin (BTC) surged in 2024 while ETH lagged on the assist of, market analysts beget reassessed their forecasts.

With ETH struggling to defend scurry, expectations for a $6,000 label sign beget now been tempered, and indicators point to that it goes to also very properly be time to lower expectations this cycle.

Traders Prefer Bitcoin Over Ethereum

In August, the Pi Cycle Prime revealed that Ethereum’s label also can surpass $6,000 earlier than the pause of this bull market. Since then, diverse things beget shifted, making the preliminary prediction less likely.

The Pi Cycle Prime has traditionally been a legitimate indicator of the most effective label a cryptocurrency can attain within a mumble length. It uses the 111-day Easy Appealing Moderate (SMA) and the 350-day SMA to forecast this height.

Currently, Ethereum’s label is at $2,603, but the 350-day SMA (purple line), which indicators likely height label, is now at $5,699. This means that ETH also can battle to surpass this label spot in the terminate to term, making additional considerable label will enhance more no longer easy.

Read more: How one can Make investments in Ethereum ETFs

This decline in Ethereum’s likely label amplify will be linked to dwindling investor ardour in the asset, especially when when put next to Bitcoin.

As an example, Bitcoin ETFs beget considered $1 billion in inflows within perfect three days this week, signaling real institutional ardour. In inequity, Ethereum ETFs finest garnered $5 million on October 17, highlighting that institutional merchants are favoring Bitcoin over Ethereum.

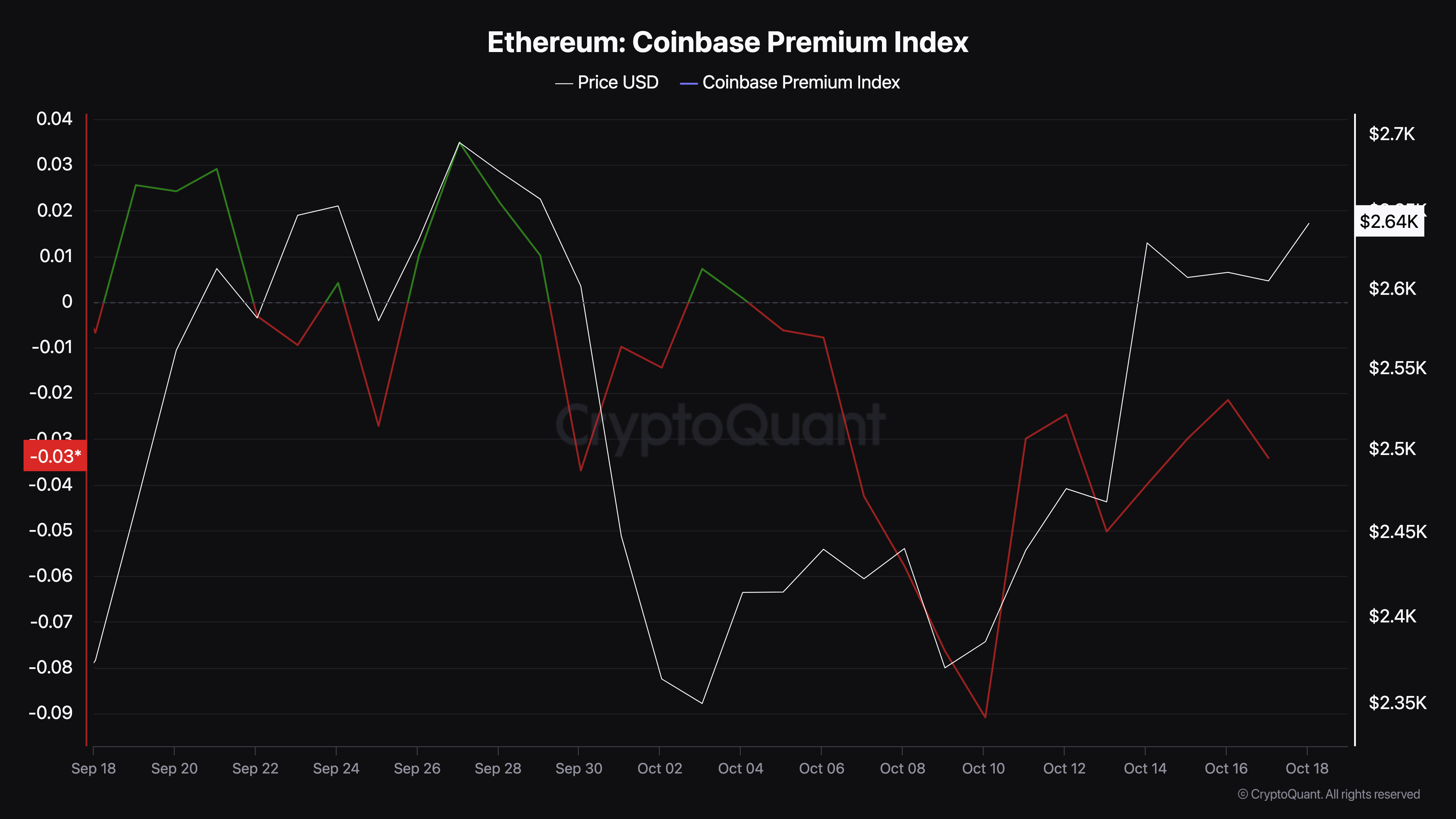

Moreover, this sentiment appears to beget prolonged to retail merchants in the US. Essentially based totally on CryptoQuant, the Coinbase Top class Index, which tracks shopping and selling stress, has impartial currently dropped into the unhealthy spot. This shift indicates that more merchants are selling ETH in space of shopping, reflecting a bearish outlook for the altcoin.

ETH Label Prediction: Retracement Aloof Looms

Ethereum on the second trades in a identical sample to the price motion in Can also and November 2021. On the weekly chart, whenever this happens, ETH’s label falls by double-digits. As an example, in Can also of the mentioned twelve months, the altcoin dropped by 52%.

With a identical technical setup, it declined by forty five% by November. Currently, ETH has been banking on the $2,455 make stronger to remain such an incidence again. Nonetheless, the low trading volume means that the cryptocurrency also can fail to defend the make stronger for prolonged.

Read more: How one can Aquire Ethereum (ETH) With a Credit Card: Complete Details

If that happens, then ETH’s label also can lower to $2,186. On the flip aspect, if merchants’ ardour in Ethereum picks up, this prediction also can no longer come fine. As an alternative, ETH also can soar to $3,814 in the mid to prolonged-term.