Crypto company Galaxy Digital is forecasting how Ethereum (ETH) replace-traded funds (ETFs) will stack up to Bitcoin (BTC) ETFs.

Essentially based utterly on a brand recent research post from Charles Yu, the company’s vice president of research, Ethereum ETFs will gaze roughly one-third of the inflows of same Bitcoin merchandise.

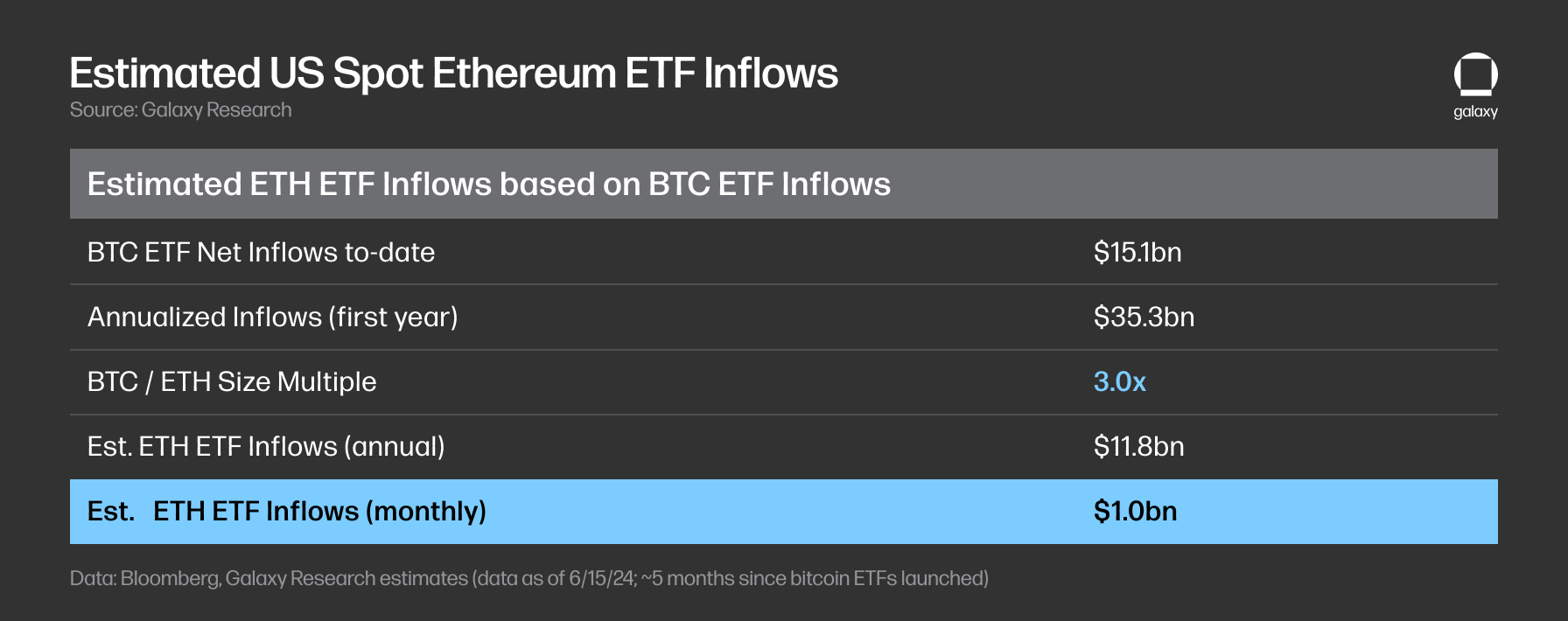

To attain their estimate, Yu says the company compared the 2 resources’ market cap, open pastime ranges and quantity in futures markets, and the total resources below management (AUM) all the diagram via existing funds.

“In step with the above, we predict that ether residing ETF inflows shall be roughly 3x less than US residing bitcoin ETF inflows (in accordance with the cap a pair of) with a range of 2x to 5x. In diversified words, we predict that ether residing ETF inflows would be 33% the scale of US residing bitcoin ETF inflows with a range of 20% to 50% of size in dollars.

Applying this a pair of to $15bn of bitcoin residing ETF inflows via June 15 would indicate monthly ETH ETF inflows of ~$1.0bn for the principal five months following ether ETF approval and begin (est. fluctuate: $600m to $1.5bn / monthly)…”

Yu additional asserts that ETH ETFs ought to like an total obvious affect on the ETH markets for 3 principal causes:

“(i) expanded accessibility all the diagram via wealth segments,

(ii) increased acceptance via formal recognition by regulators and depended on financial services and products brands. An ETF permits increased attain for both retail and institutions, offers wider distribution via more investment channels, and can red meat up the case for ether in a portfolio to be susceptible all the diagram via more investment programs.

In addition, a increased knowing of Ethereum by financial experts would ideally end result in accelerated investments and adoption of the technology.”