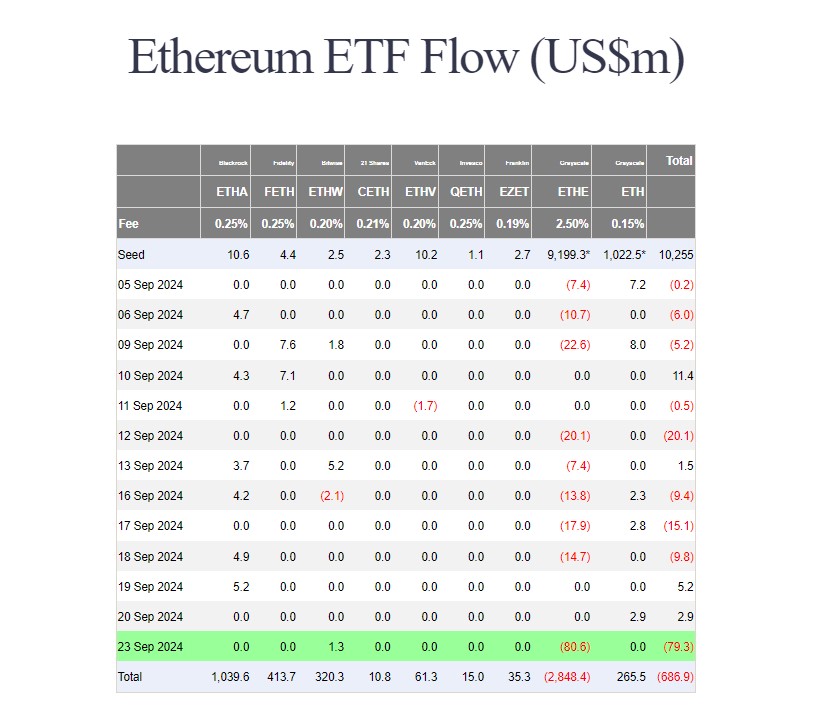

Over $Seventy nine million became withdrawn from nine US express Ethereum ETFs on Monday, the largest single-day outflow since July 29, in step with files tracked by Farside Traders. The Grayscale Ethereum Have faith, or ETHE, led redemptions, with investors pulling over $80 million from the fund.

Since its ETF conversion, the ETHE fund has seen win outflows of over $2.8 billion. Despite continued bleeding, it is far aloof the largest Ether fund in the enviornment with around $4,6 billion in property below administration.

Monday’s outflows ended a rapidly two-day assemble for these ETFs. In incompatibility to ETHE, the Bitwise Ethereum ETF (ETHW) became the sole real gainer on the day with zero flows reported from most competing funds. Traders sold over $1 million value of shares in Bitwise’s ETHW offering.

As of September 23, ETHW’s win having a watch for topped $320 million, whereas its Ether holdings exceeded 97,700, value around $261 million at contemporary costs.

The slack ask for US-listed Ethereum ETFs has continued since their market debut on July 23. BlackRock’s iShares Ethereum Have faith (ETHA) in the meanwhile leads in win inflows and became the first to reach $1 billion in win capital. It is miles followed by Fidelity’s Ethereum Fund (FETH) and Bitwise’s ETHW.

While Ethereum ETFs faced a downturn, their Bitcoin counterparts enjoyed a third consecutive day of beneficial properties, collectively along side $4.5 million, Farside’s files reveals.

Beneficial properties from Fidelity’s Bitcoin Fund (FBTC), BlackRock’s iShares Bitcoin Have faith (IBIT), and Grayscale’s Bitcoin Mini Have faith (BTC) offset gargantuan outflows from Grayscale’s Ethereum Have faith.