- Ethereum ETFs file their longest outflow dash with 5 days of consecutive detrimental flows.

- Ethereum alternate catch slither along with the circulation has increased to 31K ETH, its top most likely since the market atomize on August 5.

- Vitalik Buterin says Ethereum is increasing constant with loads of key metrics.

- Ethereum technical indicators counsel a range-sure motion amid mixed sentiments from futures merchants and fund merchants.

Ethereum (ETH) is down 1% on Thursday as its ETF and alternate catch flows counsel that sellers dominate the market. Despite the selling tension, Ethereum co-founder Vitalik Buterin shared a publish depicting its relate across loads of metrics.

Each day digest market movers: Ethereum ETF 5-day outflow dash, sure alternate catch flows, Vitalik’s metrics

Ethereum ETFs recorded its longest detrimental flows dash — 5 consecutive days — on Wednesday after posting outflows of $18 million.

The flows had been spearheaded by outflows of $31.1 million in Grayscale’s ETHE, bringing its cumulative outflows since birth to over $2.5 billion. ETHA accompanied its milestone of over $1 billion in cumulative catch inflows with zero flows on Wednesday.

With the constant detrimental flows, Ethereum ETFs might per chance per chance presumably file one other week of catch outflows as cumulative flows since Monday bask in amounted to $38 million in outflows.

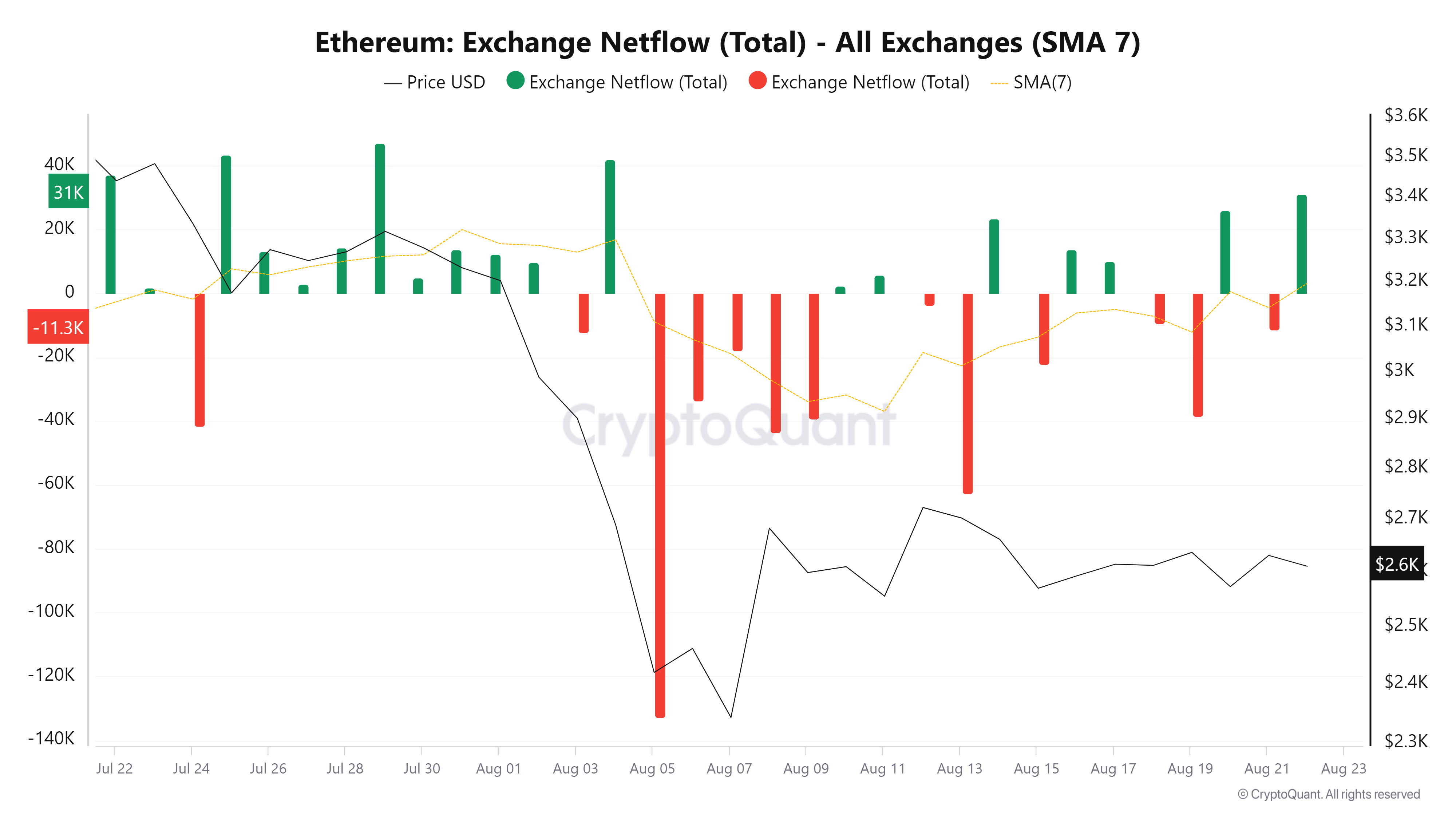

A identical pattern is occurring with ETH alternate flows. No longer like ETF flows, sure alternate catch flows existing selling tension is rising and might per chance per chance lead to cost declines.

Ethereum catch alternate influx increased to 31K ETH on Thursday, its top most likely since the market atomize on August 5. The 7-day transferring sensible alternate netflow has furthermore been rising since August 11.

ETH Change Salvage Waft

Meanwhile, Ethereum co-founder Vitalik Buterin shared an X publish with loads of metrics suggesting that ETH has persevered on its relate course. One of the foremost foremost aspects he highlighted consist of the next:

- Elevated staking decentralization.

- Enchancment in shocking-L2 wallet user ride (UX).

- Extra readability on myth abstraction roadmap.

- Faded zero-knowledge (ZK) tooling and tons of others.

“The fundamentals for Ethereum are if truth be told crazy strong factual now,” famed Buterin.

Ethereum has gotten stronger:

* Below $0.01 txfees on L2

* Two EVM L2s (@Optimism @arbitrum) now at stage 1

* Infamous-L2 wallet UX has improved loads (eg. no more manually switching networks), though silent a lengthy manner to slither

* A ways more highly efficient and outdated ZK tooling making life… pic.twitter.com/4jQGeZ3qEA— vitalik.eth (@VitalikButerin) August 22, 2024

ETH technical prognosis: Ethereum might per chance per chance presumably continue fluctuate-sure motion

Ethereum is shopping and selling round $2,610 on Thursday, down 1% on the day. In the past 24 hours, ETH has seen $31.34 million in liquidations, with lengthy and brief liquidations accounting for $24.1 million and $7.24 million, respectively.

Ethereum is consolidating on the 4-hour chart, the build the 200-day Easy Transferring Moderate (SMA) serves as reduction to stop extra note declines. Prior to prices might per chance per chance presumably rally, ETH wants to conquer the $2,775 resistance which — coupled with the 50-day SMA — has prevented any upward strive.

ETH/USDT 4-hour chart

The ETH Prolonged/Short Ratio at 0.96 reveals sellers dominate the market. Quiet, slightly strong shopping tension from Coinbase and Ethereum Funds merchants, as evidenced by their premiums of 0.024 and 0.38, respectively, has kept prices on a horizontal pattern.

ETH will likely remain fluctuate-sure with a bias in opposition to the downside, as depicted by a key trendline extending from Can also 29 to September 27.

The Relative Energy Index (RSI) has moved below its midline at 48, indicating neutrality in momentum. The Superior Oscillator (AO) furthermore aligns with the goal sentiment, posting brief bars appropriate shy above zero.

In the brief period of time, ETH might per chance per chance presumably upward thrust to $2,666 to liquidate positions price $65 million.

Ethereum FAQs

Ethereum is a decentralized birth-provide blockchain with natty contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it’s a ways the 2nd biggest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that salvage it neatly-liked among developers.

Ethereum makes exhaust of decentralized blockchain know-how, the build developers can salvage and deploy applications which might per chance per chance very successfully be goal of the central authority. To salvage this more uncomplicated, the network has a programming language in region, which helps users contain self-executing natty contracts. A natty contract is on occasion a code that will also be verified and allows inter-user transactions.

Staking is a course of the build merchants develop their portfolios by locking their resources for a specified length slightly than selling them. It’s a ways ragged by most blockchains, in particular those who use Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For many lengthy-period of time cryptocurrency holders, staking is a solution to salvage passive earnings out of your resources, striking them to work in alternate for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an tournament christened “The Merge.” The transformation got here as the network mandatory to realize more security, cut down on energy consumption by Ninety nine.95%, and effect new scaling solutions with a that you’re going to be in a way to deem threshold of 100,000 transactions per 2nd. With PoS, there are much less entry obstacles for miners brooding about the reduced energy demands.