Lately, Ethereum ETFs made their long-awaited debut on predominant stock exchanges. This text will analyze projected inflows for Ethereum ETFs and the scheme in which they may perhaps perchance also affect the future mark of ETH. By comparing basically the preferred success of Bitcoin ETFs, we are in a position to explore the means impact on Ethereum costs in the impending months.

Table of Contents

Working out Bitcoin ETF inflows and their implications for Ethereum

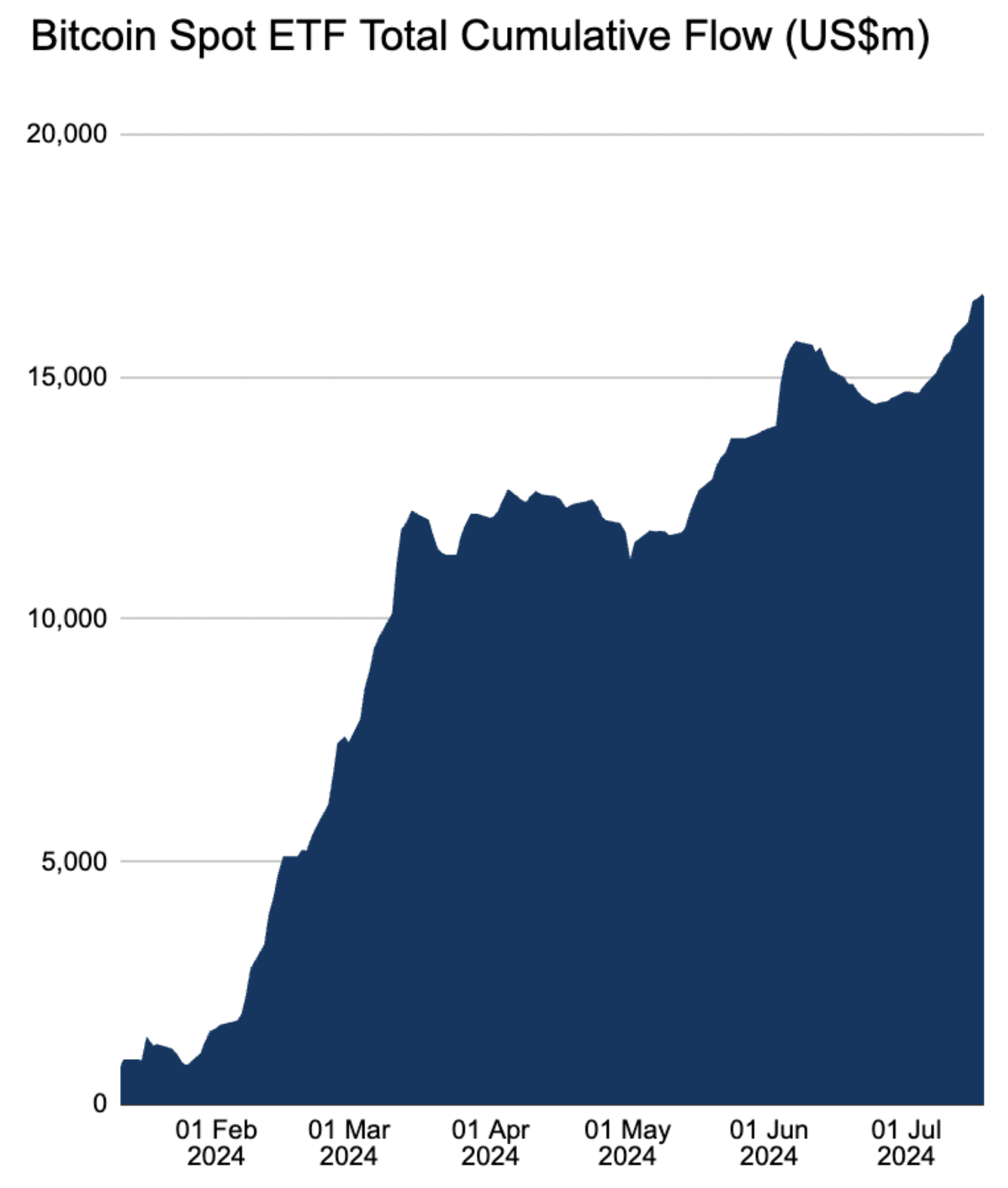

While Bitcoin ETFs own seen wide inflows, expectations for Ethereum ETFs are more modest. Since their inception, Bitcoin ETFs own attracted basic investor curiosity. As of July 18, these monetary instruments noticed a salvage influx of $16.67 billion over roughly six months. No topic being the 2nd-most attention-grabbing cryptocurrency, Ethereum is mostly perceived in every other case from Bitcoin. It is far no longer customarily seen as a retailer of mark or “digital gold.” This distinction, combined with Bitcoin’s more established market website, suggests that Ethereum may perhaps perhaps perchance also no longer entice the same level of ETF inflows as Bitcoin.

Eric Balchunas, a senior ETF analyst at Bloomberg, has provided conservative estimates for Ethereum ETF inflows and believes that these funds will entice simplest 10-15% of the inflows seen by Bitcoin ETFs.

I mediate me comparing Ether ETFs following Bitcoin ETFs to a concert the do Sister Hazel comes on after Nirvana is prob why a number of ppl coming at me on this and that’s the explanation good ample. Per chance that changed into harsh however I serene survey the ether etfs getting 10-15% of the resources of the btc ETFs (altho James is…

— Eric Balchunas (@EricBalchunas) Might well perhaps 21, 2024

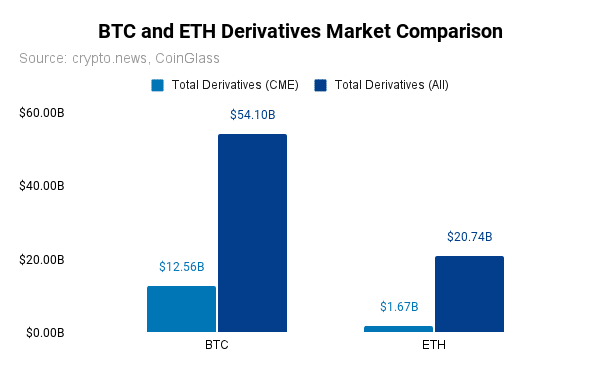

Furthermore, when taking a survey on the derivatives market, the open curiosity for Ethereum futures and alternatives on the CME is roughly $1.67 billion, while Bitcoin’s open curiosity stands at $12.56 billion. The CME, which basically serves institutional investors, reveals that Ethereum’s part is set 13.3% of Bitcoin’s. Within the broader derivatives market, Ethereum’s total open curiosity is $20.74 billion compared to Bitcoin’s $54.1 billion, which translates to a 38.34% ratio. These figures toughen the conservative projections for Ethereum ETF inflows compared to Bitcoin.

Tutorial insights into ETF effects on market costs

A ask in most cases arises: why would ETF inflows impact the price of an underlying asset, such as Ethereum? Several tutorial stories own confirmed ETFs’ basic affect on underlying asset costs. Research by Ben-David et al. (2018) demonstrates that ETFs can result in increased volatility and price deviations from well-known values in the securities they track. The scrutinize attributes these effects to the mechanical rebalancing and trading solutions employed by ETFs, that will expand mark actions and introduce non-well-known shocks into the market.

Extra supporting proof comes from Luca J. Liebi’s literature evaluation. The learn highlights ETFs’ role in bettering market liquidity and price efficiency under customary conditions. Empirical proof suggests that ETFs, specifically those with excessive leverage, can magnify mark changes in underlying resources because of their rebalancing activities. These stories collectively current that ETF inflows have a tendency to push up the costs of the resources they track, lending credence to the hypothesis that Ethereum ETFs may perhaps perhaps perchance also equally impact ETH costs.

Seemingly influx scenarios for Ethereum ETFs

According to the evaluation above, four capacity scenarios for Ethereum ETF inflows emerge:

| Share of Bitcoin ETF Inflows | Ethereum ETF Inflows |

|---|---|

| 10% | $1.67B |

| 15% | $2.50B |

| 20% | $3.33B |

| 25% | $4.17B |

These projections estimate the means inflows Ethereum ETFs may perhaps perhaps perchance experience by the discontinuance of 2024, the utilization of the $16.668 billion resolve for Bitcoin as a baseline.

Ethereum mark impact evaluation

To estimate the price impact of those capacity inflows, four multipliers are regarded as: 0.5x, 1x, 1.5x, and 2x. These multipliers replicate rather a number of levels of mark sensitivity to ETF inflows.

| 10% | 15% | 20% | 25% | |

| 0.5x | $3,570 | $3,655 | $3,740 | $3,825 |

| 1x | $3,740 | $3,910 | $4,080 | $4,250 |

| 1.5x | $3,910 | $4,165 | $4,420 | $4,675 |

| 2x | $4,080 | $4,420 | $4,760 | $5,100 |

Assuming a current Ethereum mark of $3,400, the estimated mark impact by the discontinuance of 2024, entirely from ETF inflows, would vary from $170 to $1,700. With more likely multipliers (1x to 1.5x), the price develop may perhaps perhaps perchance be between $340 and $1,275. This means a doable Ethereum mark vary of $3,740 to $4,675.

Disclosure: This text doesn’t signify funding advice. The scream material and materials featured on this page are for tutorial capabilities simplest.