Ethereum’s recent decline has drawn attention across the crypto market because the 2nd-largest cryptocurrency struggles to recover from its 15% weekly loss. The continuing bearish prerequisites bear dragged ETH down to ranges no longer seen in months.

Nonetheless, this moving correction may most definitely also signal the beginning of a restoration, as Ethereum appears to be like to bear reached the purpose of bearish saturation.

Ethereum Enters Ancient Reversal Point

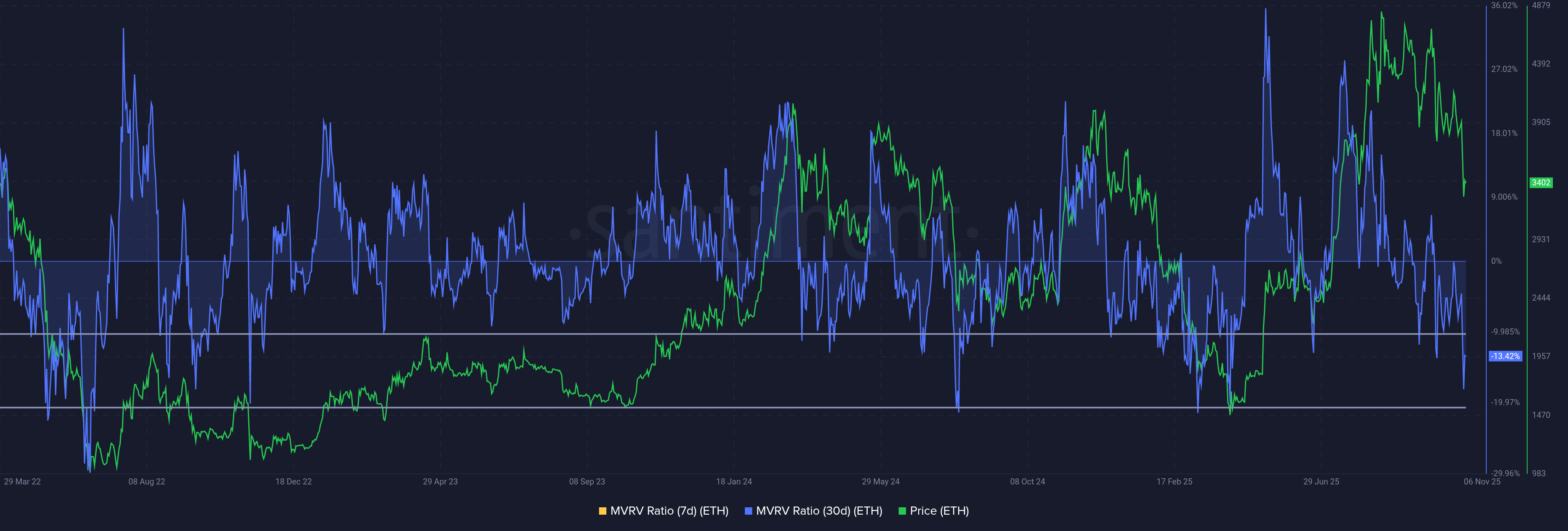

The 30-day MVRV ratio highlights that Ethereum has officially entered the “alternative zone,” a selection traditionally linked to capacity reversals for the first time in 5 months. This zone, outlined between -10% and -20%, represents sessions when investors stop promoting as losses deepen. As a substitute, they in overall gain at discounted costs, offering give a clutch to for an upcoming restoration.

Traditionally, ETH has rebounded at any time when it enters this zone, signaling a shift in investor sentiment from distress to accumulation. This pattern in overall precedes bullish rallies as traders beginning to stay wakeful for price growth once market promoting rigidity stabilizes.

Want more token insights enjoy this? Join Editor Harsh Notariya’s Daily Crypto Newsletter right here.

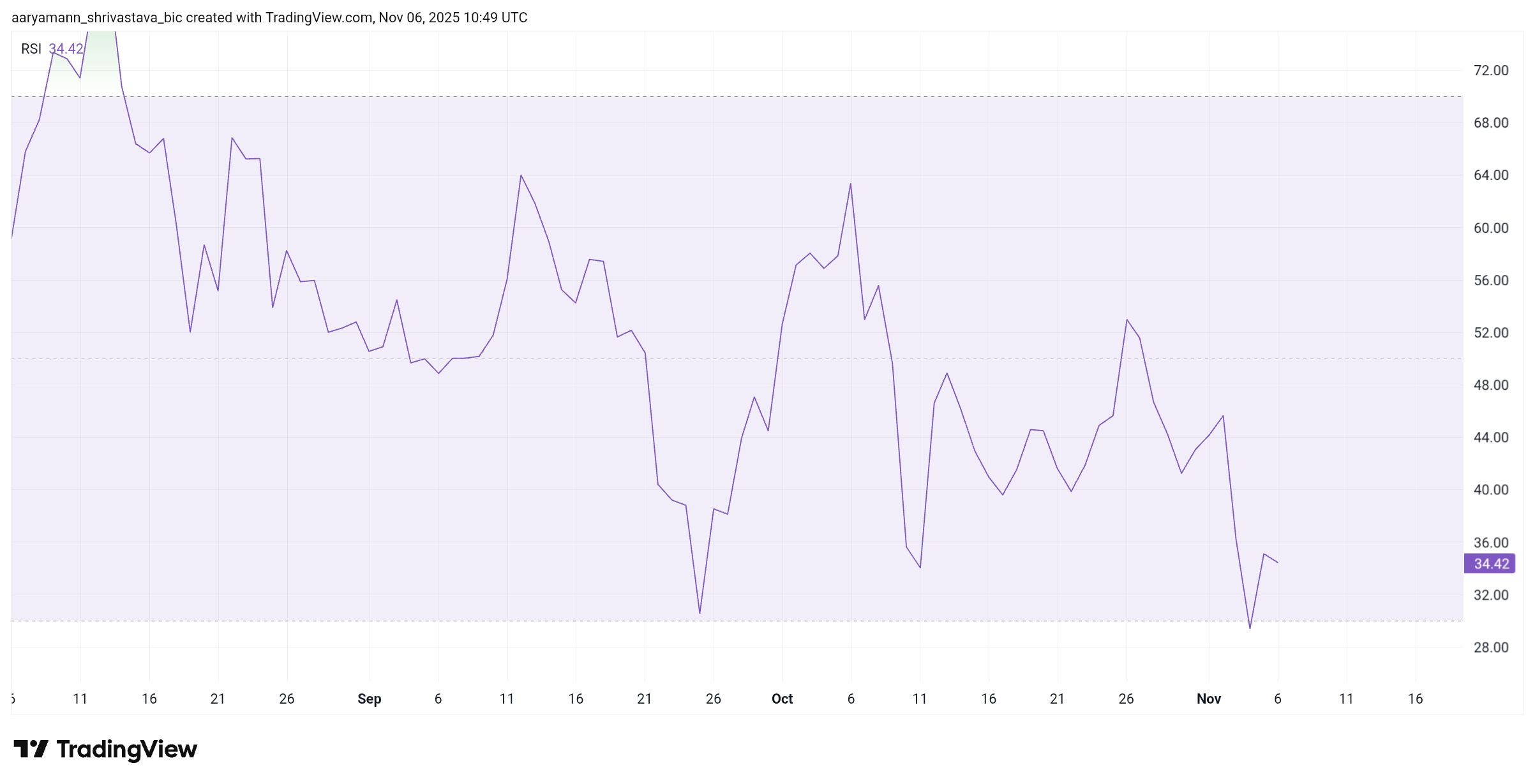

On the macro scale, Ethereum’s Relative Strength Index (RSI) supports this optimistic outlook. Currently hovering near 30.0, the RSI signifies ETH is impending oversold prerequisites. Assets near this threshold in overall ride reversals, as promoting momentum weakens and traders beginning to reenter the market.

If ETH dips any further below the 30.0 RSI level, it may well probably probably most definitely also space off a accurate technical rebound. Such indicators in most cases entice traders wanting for temporary beneficial properties whereas also enhancing the lengthy-term outlook. The mix of low MVRV and near-oversold RSI reinforces the alternative of Ethereum’s bullish reversal in the approaching days.

ETH Designate Has A Bullish Future

Ethereum’s price stands at $3,397 on the time of writing, following its steep 15% weekly decline. To recover, ETH must reclaim $3,800, a level that previously acted as a serious give a clutch to zone.

If the momentum aligns with technical indicators, Ethereum may most definitely also upward thrust previous $3,489 resistance and breach the $3,607 barrier, focusing on $3,802 subsequent. Sustained investor accumulation would further strengthen this rally.

Nonetheless, if investor sentiment weakens, Ethereum may most definitely also lunge below $3,367 give a clutch to, most definitely falling to $3,131. This fall would invalidate the bullish thesis and lengthen ETH’s consolidation share.

The put up Ethereum Enters “Opportunity Zone” After 5 Months; What Does This Mean For Designate? looked first on BeInCrypto.