Ethereum’s procedure designate hovered at $3,087 per coin on Saturday, whereas derivatives traders quietly stacked threat during futures and alternate ideas markets. The information displays leverage constructing even as designate motion stays uneven, a setup that has a behavior of punishing crowded positions.

Ethereum Futures and Alternatives Signal Trader Power Shut to $3,100

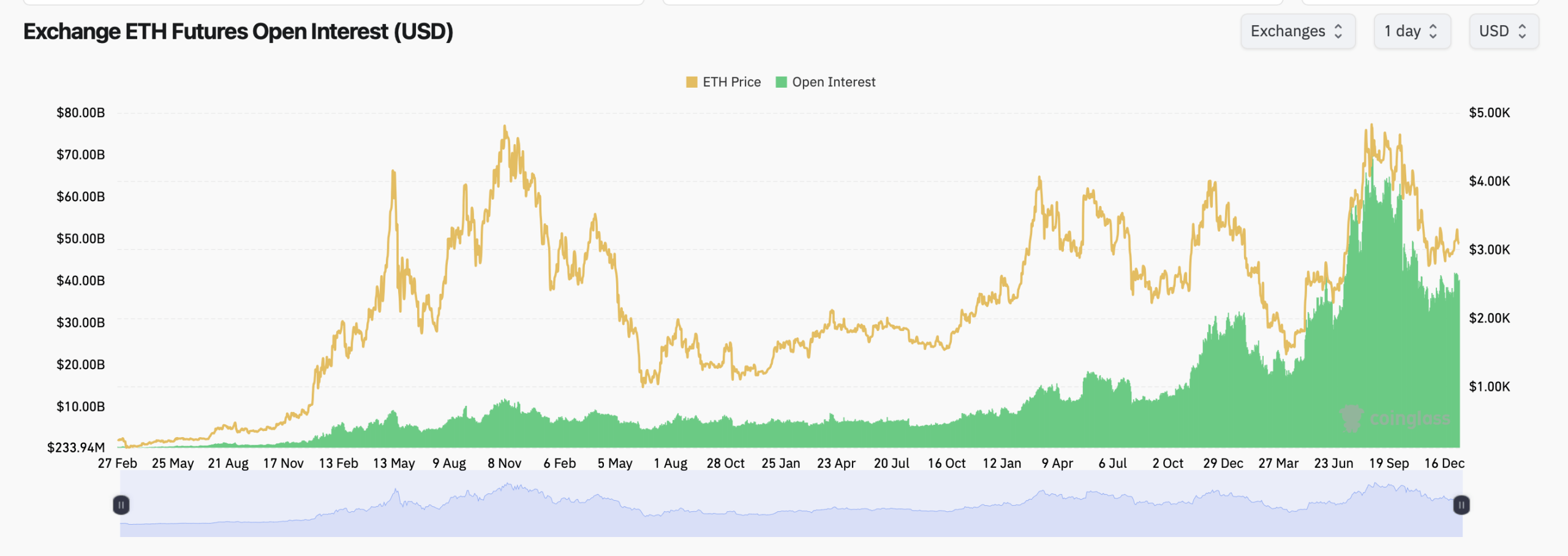

Ethereum futures open interest climbed to 13.01 million ETH, representing roughly $40.22 billion in notional price during predominant exchanges. Despite minor pullbacks in the previous hour and 4-hour windows, open interest posted a 0.69% extend over 24 hours, signaling that traders are including publicity rather then stepping away.

Binance stays the heavyweight in ethereum futures, controlling 22.62% of complete open interest, or about $9.10 billion. CME follows with $5.86 billion, a indispensable resolve that highlights continued institutional participation. Gate, Bybit, OKX, and Bitget spherical out the tip tier, each and each carrying multi-billion-greenback positions that collectively sustain leverage elevated.

Short-timeframe market motion appears to be uneven. Most exchanges recorded puny one-hour and 4-hour declines in open interest, suggesting tactical de-risking. Then all any other time, the broader 24-hour image tells a determined legend, with Gate posting a 4.34% jump and OKX rising 2.47%, indicating selective accumulation rather then alarm exits.

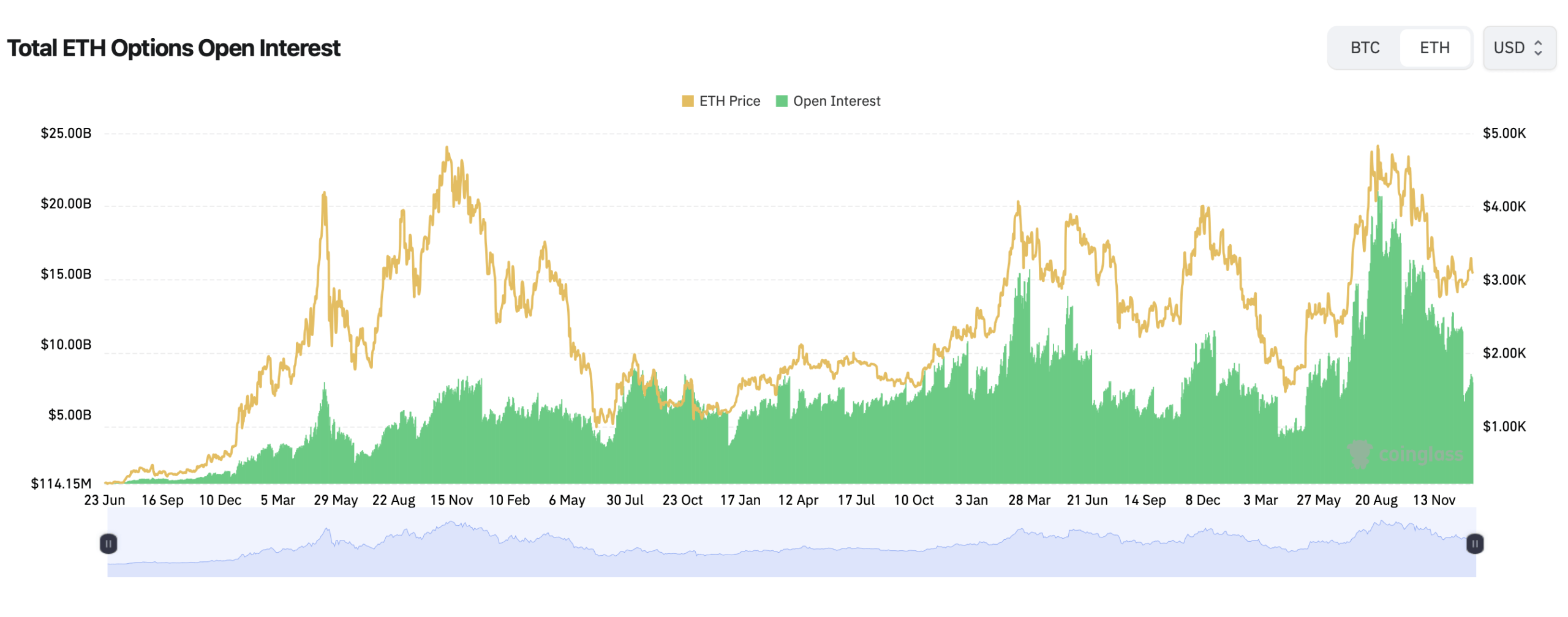

Alternatives markets lean decisively toward optimism. Total ethereum alternate ideas open interest displays calls accounting for 60.40%, in contrast with 39.60% in places, translating to roughly 1.29 million ETH in calls versus 843,794 ETH in places. Volume over the last 24 hours echoes that bias, with calls making up 52.83% of traded contracts.

Primarily the most crowded alternate ideas strikes sit some distance above procedure. On Deribit, a truly noteworthy open interest contracts consist of ETH-$6,500 calls expiring March 27 and $5,500 calls expiring March 27 and June 26, suggesting traders are making a wager on extended upside later in the year rather then immediate fireworks.

But the max anxiety recordsdata adds a twist. On Deribit, ethereum’s max anxiety level clusters terminate to $3,100, uncomfortably terminate to the present procedure designate. Binance and OKX inform identical profiles, with max anxiety curves dipping toward the $3,000–$3,100 vary, a zone that historically acts love a magnet as expiration approaches.

Furthermore read: ‘Running Bitcoin’: BTC Holds $90K on 17th Anniversary of Hal Finney’s Iconic Tweet

That tension creates an awkward standoff. Futures traders are including leverage, alternate ideas traders are loading calls, and max anxiety quietly lurks under essentially the most neatly-appreciated bullish strikes. It’s the hold of setup the put patience, no longer bravado, most ceaselessly wins.

Historically, intervals the put futures open interest rises faster than procedure designate have a tendency to precede sharper strikes. Direction is rarely assured, but crowded positioning reduces the margin for error. When everyone leans the same plan, the market has a behavior of attempting out rep to the underside of.

For now, ethereum derivatives markets mirror conviction with out affirmation. Leverage is constructing, optimism is considered, and threat stays finely balanced terminate to a psychologically charged designate level. Whether or no longer traders rep rewarded or rinsed will rely upon who blinks first.

FAQ ❓

- What’s ethereum futures open interest lawful now?

Ethereum futures open interest stands at roughly $40.22 billion during predominant exchanges. - Are ethereum alternate ideas traders more bullish or bearish?

Alternatives recordsdata displays a bullish tilt, with calls making up about 60% of open interest. - Where is ethereum’s max anxiety level?

Max anxiety clusters terminate to the $3,000–$3,100 vary on Binance, OKX, and Deribit. - Which substitute dominates ethereum futures buying and selling?

Binance leads with better than 22% of complete ethereum futures open interest.