Digital-asset investment products pulled in $3.75 billion final week, lifting property below management to $244 billion on August 13.

The complete ranks among the largest weekly inflows seen no longer too lengthy ago, CoinShares files reveals. Prices rose, but the principle driver modified into money getting into funds in region of a broad retail speed.

Concentrated Flows From A Single Product

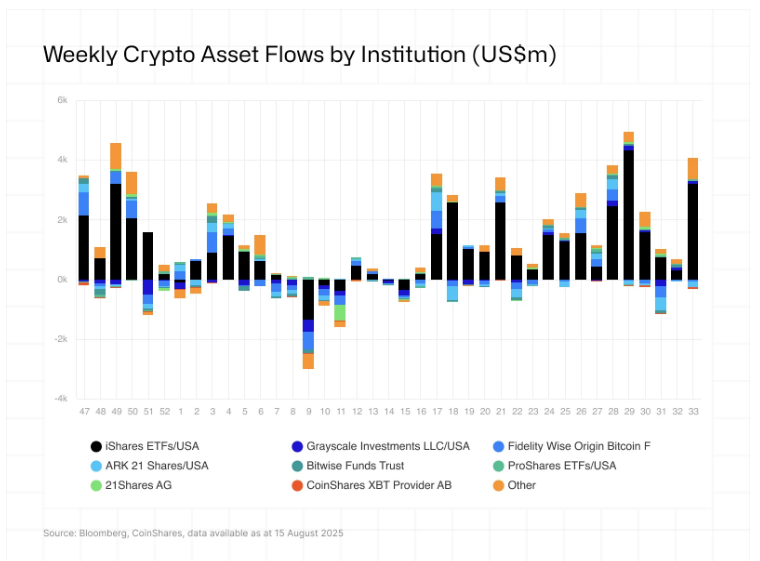

In accordance with experiences from CoinShares, almost all of the inflows came via one provider. The US accounted for $3.73 billion, almost the total week’s total.

Canada added $33.7 million, Hong Kong terminate to $21 million, and Australia $12 million. In difference, Brazil and Sweden recorded outflows of $10.6 million and $50 million.

Market contributors exclaim the large majority of the money modified into funneled into a single iShares product, which helps utter how a moderately narrow dwelling of flows moved overall AUM so sharply.

Ethereum Attracts The Most Cash

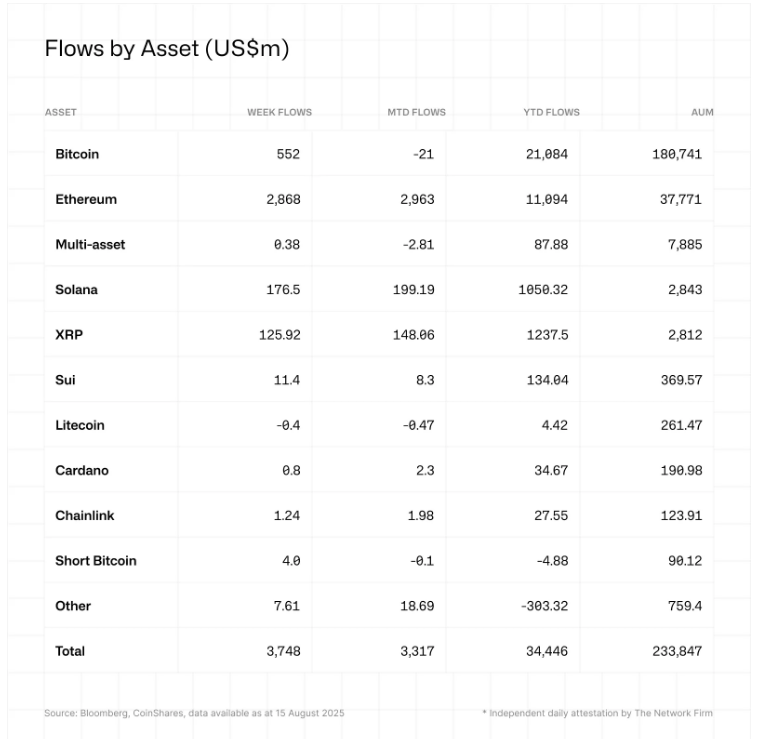

Ethereum attracted the lion’s piece of ultimate week’s inflows at $2.87 billion, or 77% of the total. That brings three hundred and sixty five days-to-date internet inflows into ETH to about $11 billion.

Ethereum now makes up nearly 30% of property below management, versus Bitcoin’s 11.6%. Bitcoin’s weekly consumption modified into $552 million.

Other strikes integrated Solana taking $176.5 million and XRP along with $126 million, whereas Litecoin and Ton confirmed microscopic outflows of $0.4 million and $1 million, respectively. These numbers existing a clear shift in where institutional money is parked this week.

Corporate Holdings And Provide Notes

Reviews catch disclosed that bigger than 16 corporations catch added Ethereum to their balance sheets, basically based on CryptoQuant.

Together they abet about 2.forty five million ETH, valued at roughly $11 billion, and those cash are effectively out of circulation whereas locked in treasuries or frigid storage.

It’s value noting that Ethereum doesn’t catch a mounted offer treasure Bitcoin; about 1,000,000 ETH modified into added to provide final three hundred and sixty five days, and offer dynamics can differ with community job.

See Futures And Huge Holders

Futures originate hobby sits terminate to $38 billion, a sizeable figure that raises the probability of swift keep strikes when positions are closed.

Huge, concentrated holders and surprising shifts in futures positions catch confirmed they will push costs sharply in both route.

For now, that is a float-driven match bigger than a broad retail surge. If the the same product retains taking in big sums, this is able to per chance well additionally just retain along with upward tension.

On the the same time, thin liquidity and broad positions can flip beneficial properties into losses quick. Traders and merchants might well maybe additionally just aloof retain an test on weekly fund flows, futures originate hobby, and on-chain movements to detect whether or no longer the model spreads beyond just a few broad buyers.

Featured portray from Meta, chart from TradingView