Ethereum label is rising all yet again, up over 2% in the previous 24 hours, and is accumulated sure for the month. The rebound appears encouraging, however the structure underneath stays fragile.

A bearish pattern is accumulated active, and except key ranges are defended, this bounce dangers turning into a deeper pullback.

Ethereum Mark Rises Internal a Fragile Bearish Structure

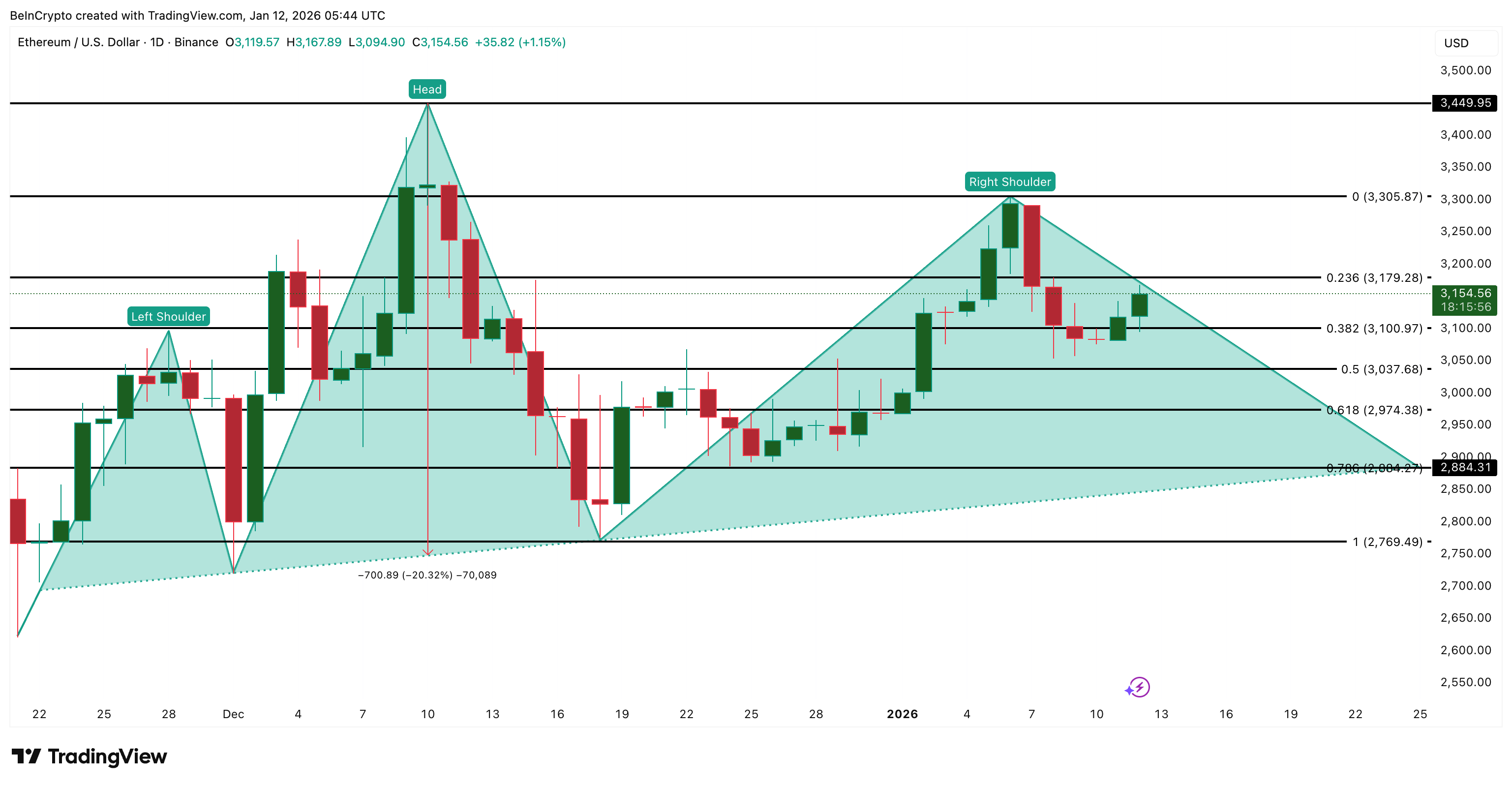

Despite the bounce, Ethereum is accumulated trading internal a head and shoulders pattern on the day-to-day chart. The January 6 height formed the true shoulder, and the cost is now attempting to stabilize with out invalidating the structure.

Right here is main on account of head-and-shoulders patterns assuredly fail frequently in decision to straight. Rallies can occur internal them, but they entirely change into valid as soon as the cost decisively strikes a long way off from the neckline likelihood zone, around $2,880 in ETH’s case.

Need more token insights admire this? Register for Editor Harsh Notariya’s Day-to-day Crypto Newsletter right here.

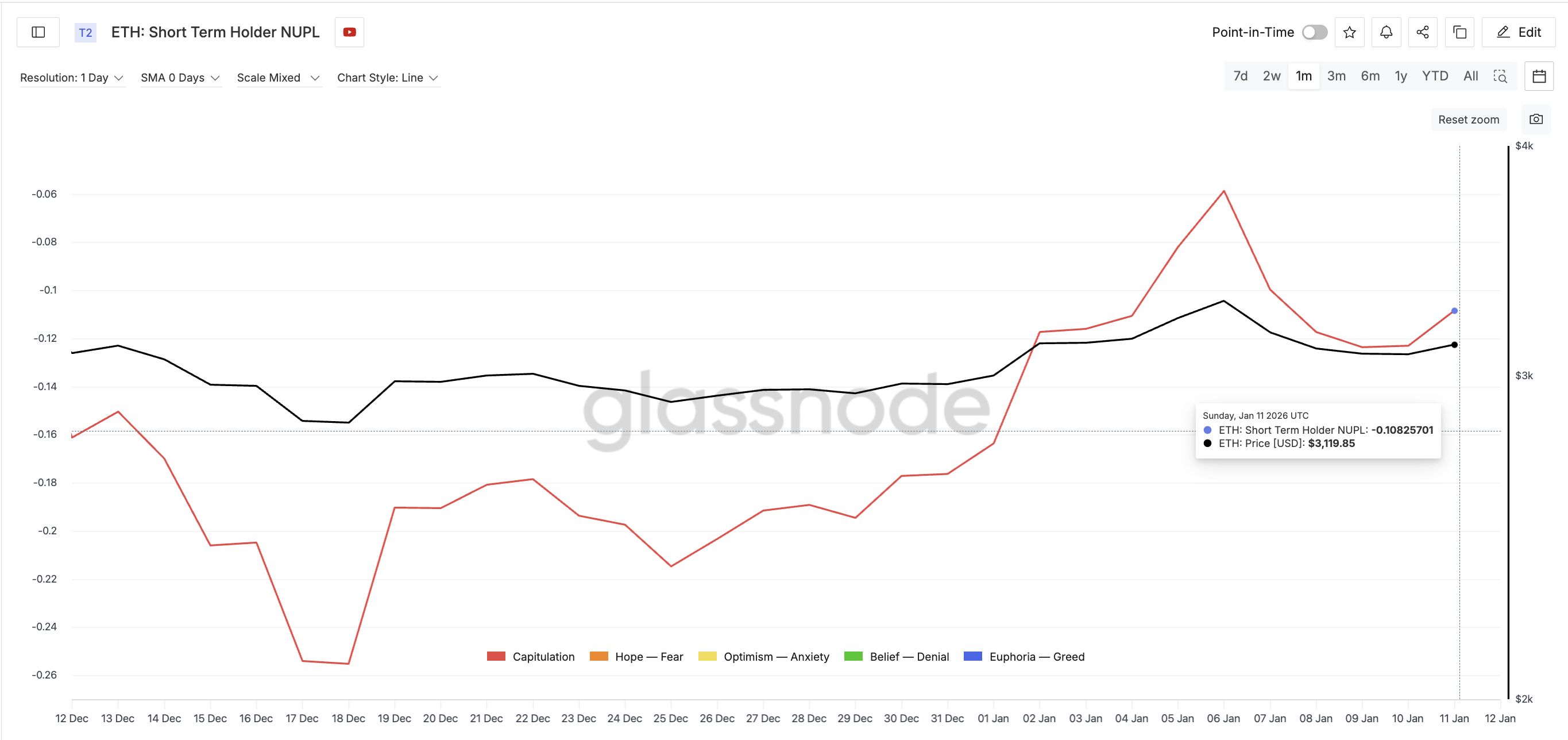

Fast-term holder habits adds caution. Fast-term holder NUPL, which tracks paper profits/losses, stays in the capitulation zone but is rising toward monthly highs. It increases the likelihood of profit-taking if the cost pushes higher.

HODL Waves metric, which tracks cohorts according to time, confirms that many short holders occupy already exited. This implies the NUPL likelihood would possibly possibly well maybe occupy already played out.

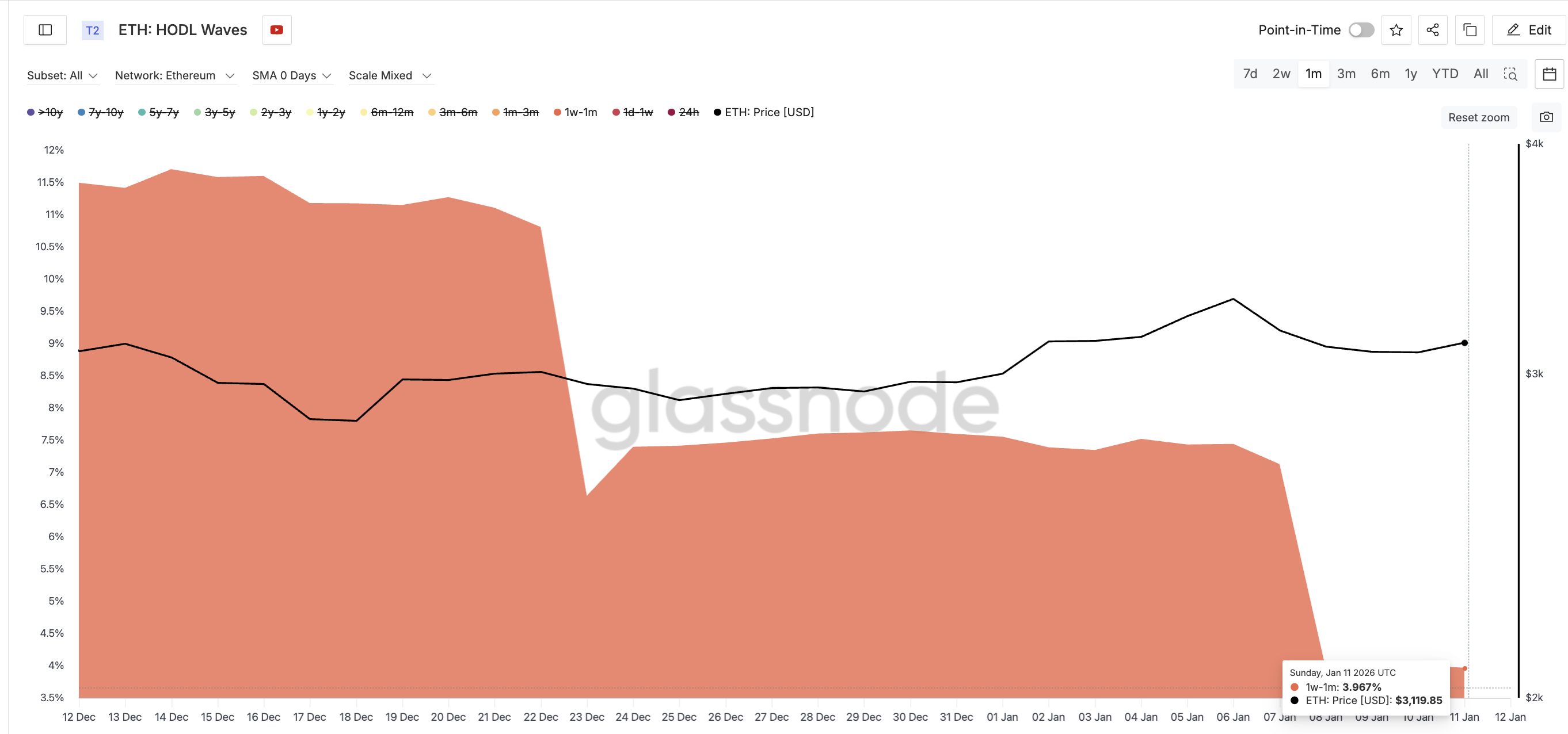

The 1-week to 1-month cohort dropped sharply from around 11.5% of provide in mid-December to about 3.9% now.

That reduces immediate promoting stress and likewise skill this bounce is no longer being driven by aggressive and speculative modern demand yet. Whereas this can also seek admire disinterest, the lack of short buyers can at last serve the ETH label switch higher if rather just a few toughen stays.

Dip Buying for and Longer-Time length Holders Are Quietly Supporting Mark

The motive Ethereum has no longer broken down comes from the underlying toughen.

The Money Waft Index (MFI), which tracks that you just would possibly possibly well maybe be ready to judge of dip procuring for, reveals a bullish divergence. Between mid-December and early January, the Ethereum label formed decrease highs, whereas MFI formed higher highs. This indicators dip procuring for. Patrons consistently stepped in all via pullbacks in decision to abandoning positions.

Even supposing MFI has cooled a runt bit, it stays successfully above its prior lows. As long as this holds, promoting stress continues to get absorbed in decision to accelerating.

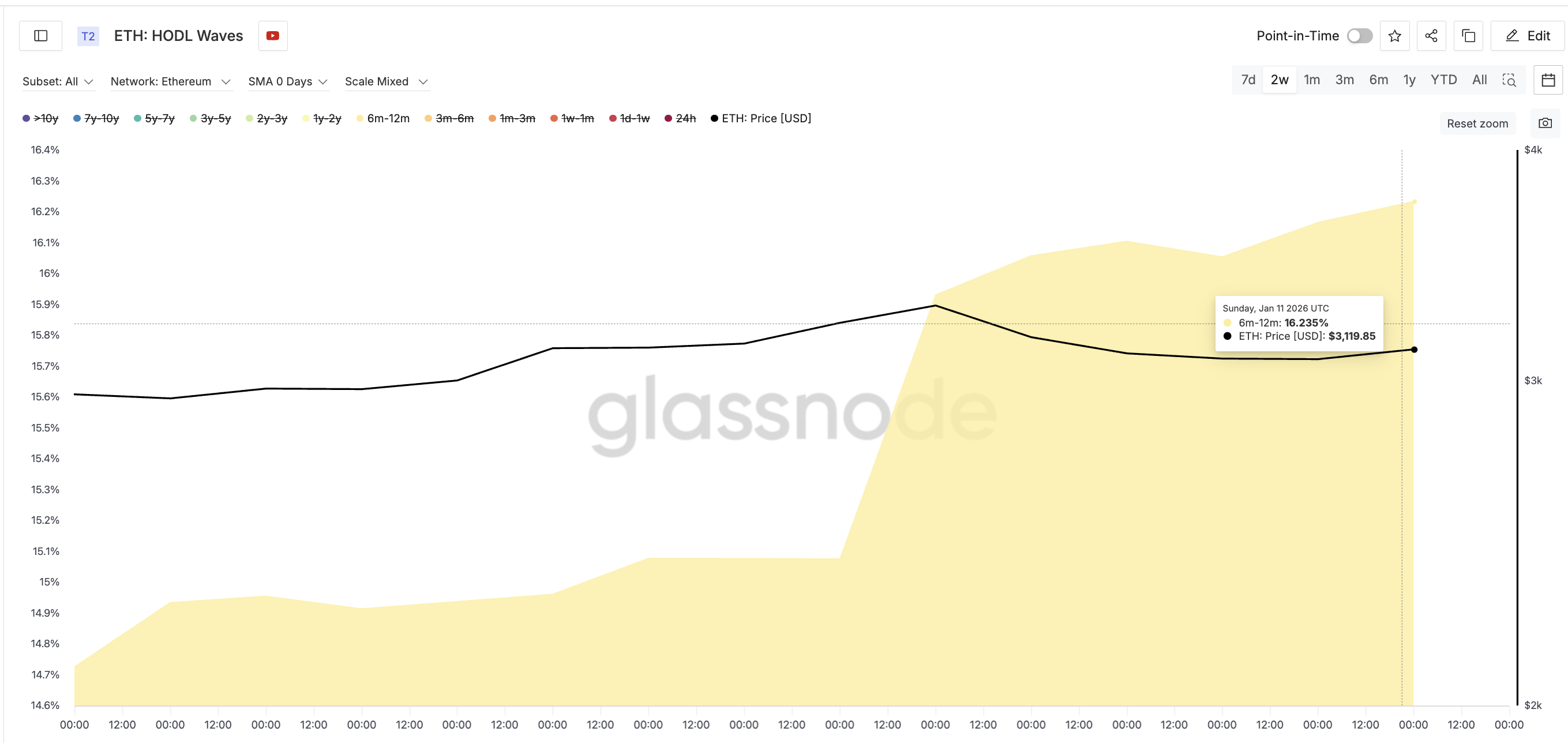

Longer-term holders enhance this toughen. The 6-month to 12-month holder neighborhood elevated its provide fragment from about 14.7% to roughly 16.2% since gradual December. Right here is valid accumulation, no longer speculative chasing.

Together, reduced short provide, ongoing dip procuring for, and mid-to-long-term holder accumulation demonstrate why Ethereum is bouncing in decision to collapsing.

However toughen by myself doesn’t remove likelihood. It entirely slows it.

Ethereum Mark Levels That Decide Whether or no longer the Jump Holds

Ethereum is now at a clear resolution level.

The largest downside degree is $2,880. This marks the neckline zone of the head and shoulders structure. A day-to-day terminate below this degree would urged the stout pattern, opening the door to a roughly 20% dip likelihood according to the measured switch from the head to the neckline.

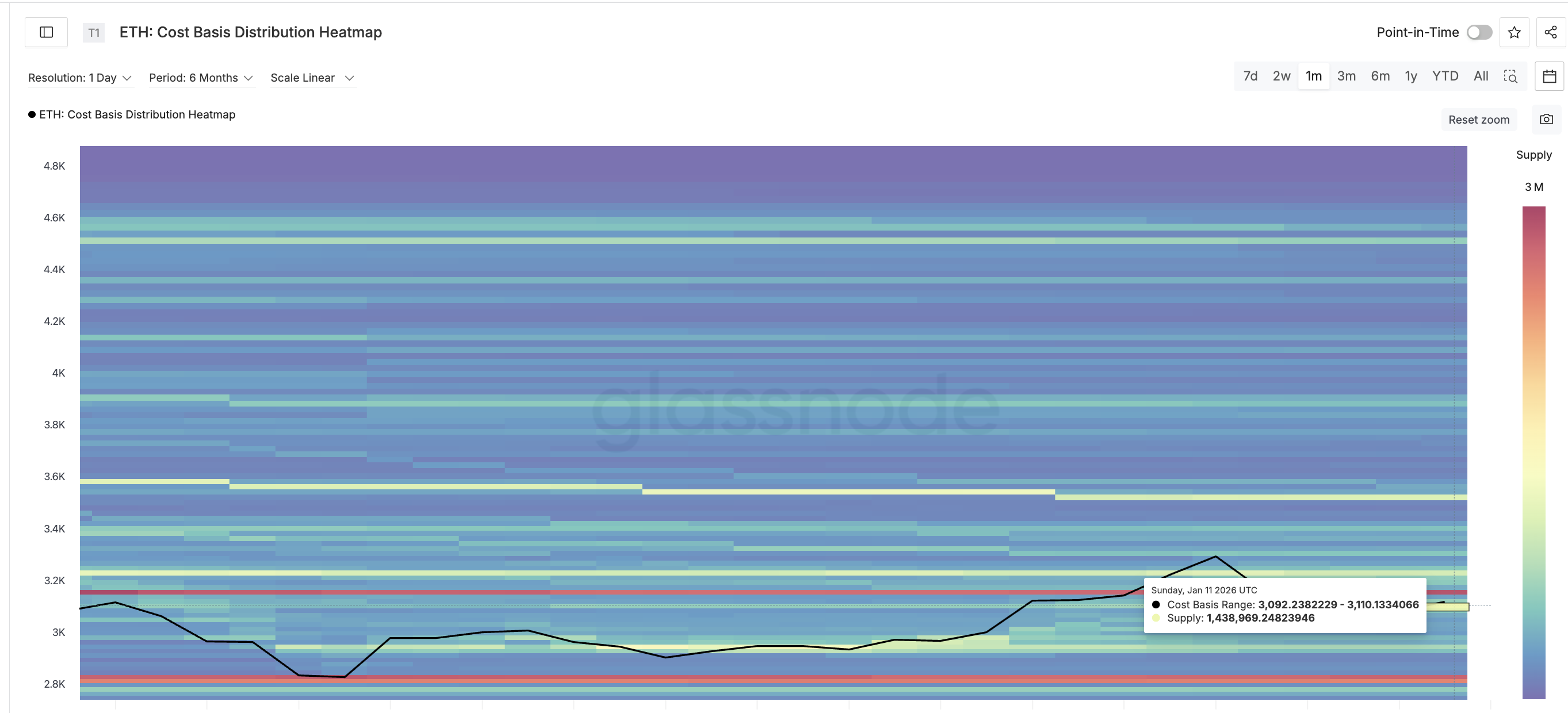

Above that label, the predominant key zone sits between $3,090 and $3,110, moderate of $3,100, a degree also viewed on the cost chart. This differ is basic on account of it incorporates a dense on-chain cost-basis cluster where roughly 1.44 million ETH last changed hands. Markets assuredly react strongly around such zones.

If Ethereum holds above this region, it strengthens the case that buyers are defending cost and though-provoking provide. Failure to effect it would possibly possibly maybe probably well possibly lengthen downside stress toward $2,970, followed by the vital $2,880 degree.

To fully invalidate the bearish structure, Ethereum wants sustained strength above $3,300. A switch above $3,440 would erase the head and shoulders likelihood entirely.

The post Ethereum Bounces — However Is a 20% Entice Forming Below One Crucial Level? looked first on BeInCrypto.