Following the market’s most modern pump, the main cryptocurrencies non-public viewed a excellent efficiency. Bitcoin is purchasing and selling above the $64,000 tag, whereas Ethereum (ETH) has surged 9% within the closing week to consolidate above a key enhance level.

No topic the bullish sentiment, some crypto traders stay cautious about ETH’s efficiency as the 2d-largest cryptocurrency faces the next crucial resistance level.

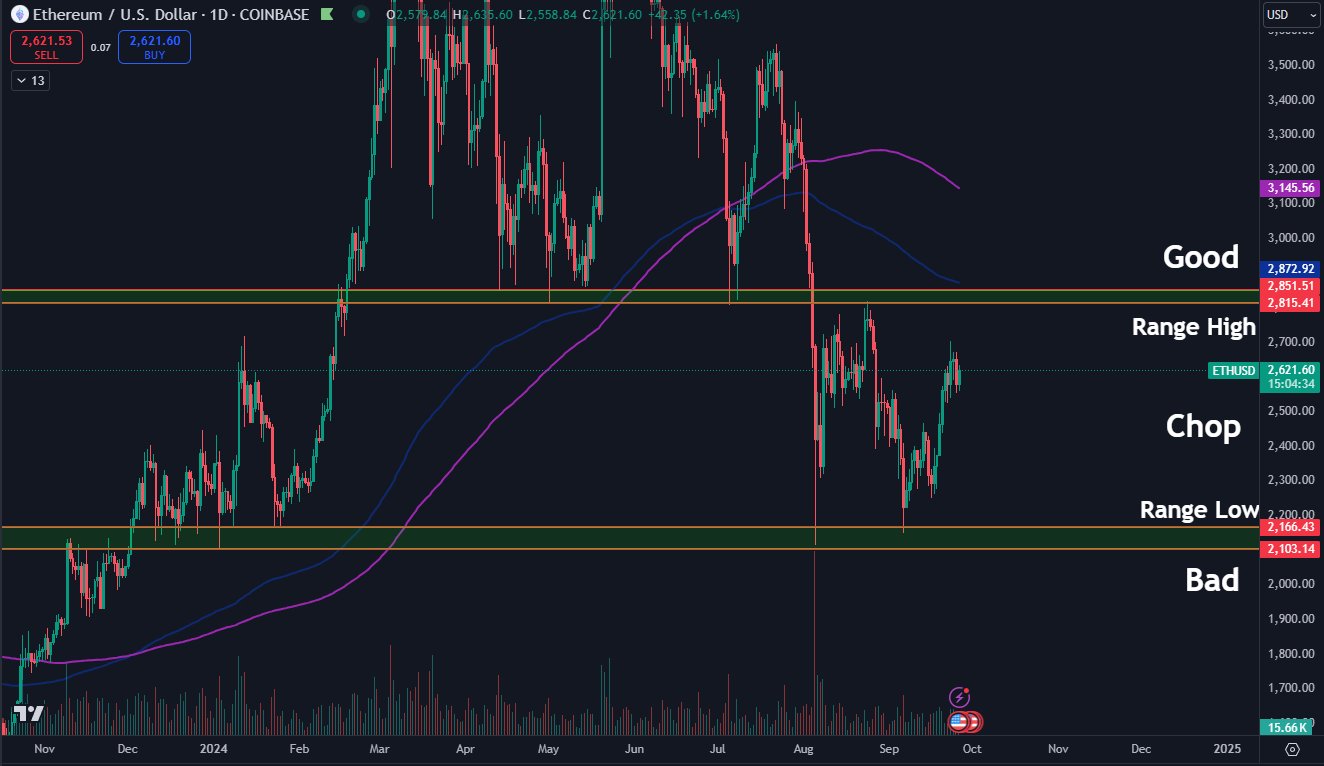

Ethereum Consolidates Above $2,600

Ethereum recorded a 13% charge bounce within the closing seven days after the US Federal Reserve (Fed) presented its resolution to minimize the hobby rate by 50 foundation functions (bps). The bullish momentum propelled the ETH’s charge to ranges now now not viewed in a month, triggering a certain sentiment amongst many traders.

Over the weekend, the “King of Altcoins” surged from the $2,300 enhance zone to the $2,500 tag earlier than reclaiming the $2,600 resistance level as the week started. Since then, the cryptocurrency has hovered between the $2,600-$2,684 funds, momentarily dropping under the critical enhance level on Wednesday afternoon.

Nonetheless, Ethereum has confronted resistance right now time after recuperating from the newest descend to $2,500. Market analyst Crypto Yapper infamous that ETH had been “working into necessary resistance on the Day after day chart,” because it had been unable to interrupt efficiently above the $2,650 tag since Tuesday.

This efficiency unnerved some traders, who thought of that now now not breaking above this level would per chance well perchance moreover hinder the cryptocurrency’s toddle and send the price toward the previous enhance zones.

On the other hand, Ethereum’s charge jumped 1% within the closing hour to change above $2,650. As of this writing, ETH exchnges fingers at $2,660, recording a 2.1% and 9.3% charge amplify within the every day and weekly timeframes.

ETH To Attain Fresh Highs In October?

Crypto Trader Daan highlighted that Ethereum’s charge made the next low (HL) nevertheless has now now not been able to originate the next excessive (HH) yet. The trader infamous that an HH would occur above the $2,820 tag, which used to be lost over a month ago, and it would per chance well perchance signify a vogue reversal for the cryptocurrency.

This level corresponds with the horizontal level that kickstarted the February-March toddle to $4,090 after the breakout. Additionally, it coincides with the Day after day 200 Exponential Provocative Average (EMA) around that role, which makes it “a crucial level to gaze.”

A breakout above this tag would per chance well perchance moreover further propel ETH’s charge toward the $3,000 resistance level. Julien Bittel, Head of Macro Compare at Global Macro Investor (GMI), infamous that Ethereum’s chart is “having a gaze a lot love a 2023 redux.”

Per the Chart, the cryptocurrency’s present market development resembles its 2023 movements very carefully. A repeat of ETH’s previous bullish trajectory means that ETH’s charge is about to rating away and hit a brand original all-time excessive (ATH) mid to gradual October.

Additionally, the chart shows that if it follows the identical bullish vogue, Ethereum’s charge has the skill to reach someplace between the $10,000 to $20,000 targets by Q1 2025, which would signify a 669% surge from its present charge and a 300% bounce from its ATH.