A first-rate amount of Ethereum is being held by entities now not actively spending or transferring their funds.

In step with the most fresh CryptoQuant knowledge, the entire selection of Ethereum (ETH) in accumulation addresses surpassed 19 million.

As of Oct. 18, the entire amount of Ethereum in accumulation addresses nearly doubled in comparability to January 2024.

True thru the main month of 2024, this metric stood at 11.5 million. At least one analyst believes that this number will surpass 20 million by the close of the yr.

Why? Ethereum ETF approval

“In early 2024, Ethereum Region ETFs had been formally authorised, marking a novel period. Regulations boosted self belief, making Ethereum mainstream,” the analyst stated.

The CryptoQuant analyst highlighted that since the Securities and Alternate Fee authorised field Ethereum alternate-traded funds (ETFs), Ethereum expanded to institutions and folks alike.

As per the analysis, it’s additionally anticipated that by the close of 2024, when the address holdings hit 20 million ETH, the rate of the buildup addresses will seemingly be as huge as that of the enviornment’s most attention-grabbing corporations.

The analyst additionally expects the entire price of these holdings to hit $80 billion, with Ethereum priced at around $4,000.

71% of Ethereum holders in profit

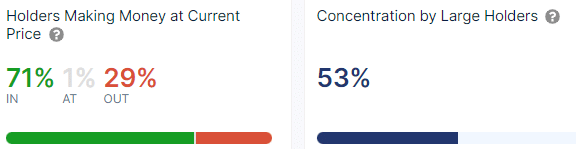

In step with the most fresh knowledge from IntoTheBlock, 71% of the Ethereum holders are for the time being in profit.

The data additionally shows that 29% of the holders are in loss, with roughly 1% in fair.

A more in-depth see at the ETH holders composition shows that over 74% of the holders win held their money for over a yr.

About 23% of the holders win held their ETH one day of 1 to 365 days. Handiest 3% of the holders win held it for lower than 1 month.

The Ethereum mark has surged by over 2% within the closing 24 hours. It’s additionally up by over 10% within the closing seven days and reclaimed the $2,700 stage at press time.