Ethereum to $10K: The Institutional Guess Is On

Ethereum is showing the total signs of being the next plentiful institutional play. Within the previous weeks, BlackRock and different foremost ETFs maintain accrued $240 million worth of ETH, even prior to the Ethereum salvage 22 situation ETF formally launches.

However they’re no longer precise positioning for the salvage 22 situation ETF.

The Exact Target: ETH Staking ETFs

Institutions are preparing for the future SEC approval of staking-based completely ETFs, which would enable them to supply yield-generating products. If current, this would be a sport-changer:

- ETH staking = passive earnings

- ETH supply is deflationary, particularly publish-merge

- Exact World Resources (RWA) worth trillions are being tokenized on Ethereum

- ETH stays the biggest tech infrastructure in crypto

- Retail is soundless staring at. Natty money is already transferring.

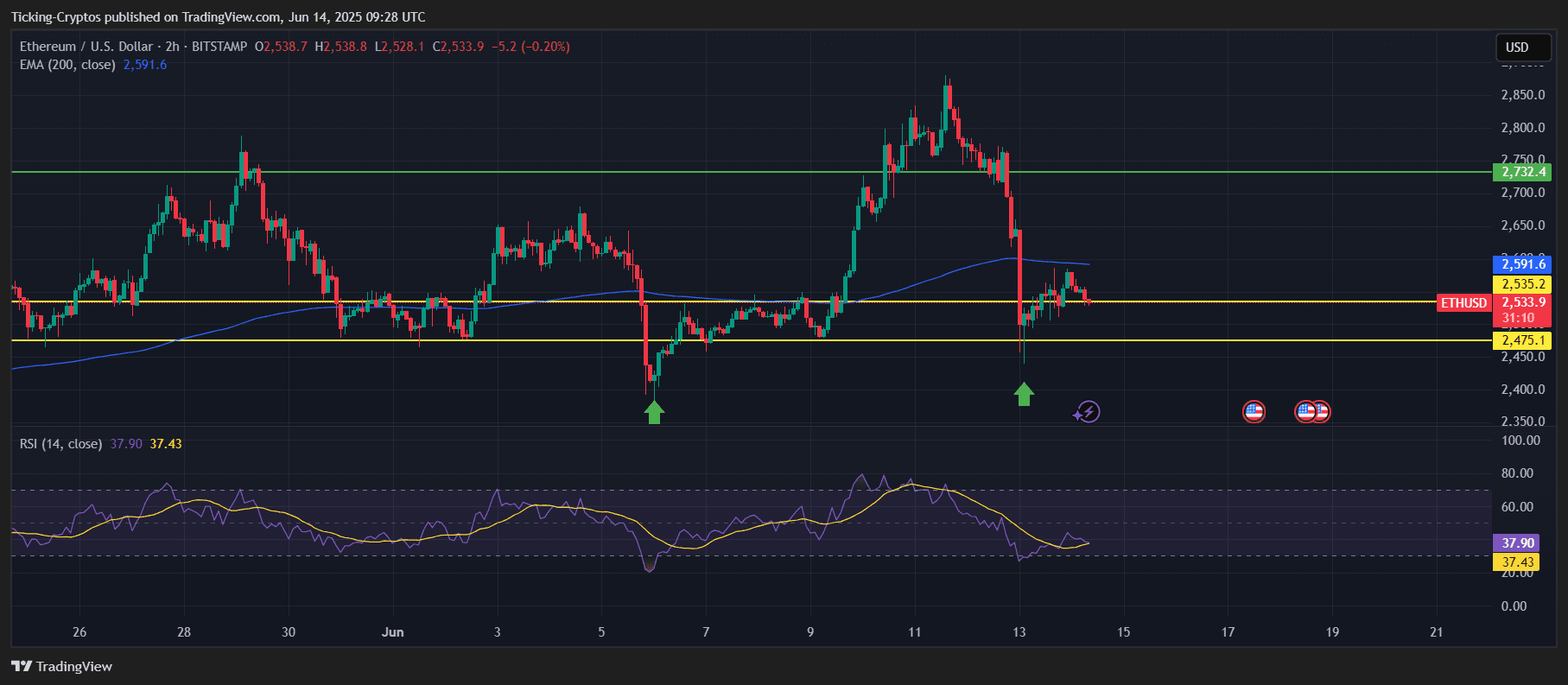

ETH Chart Evaluation: Pork up Light Maintaining

Taking a look on the chart, Ethereum is shopping and selling round $2,533, precise above the important thing enhance stage at $2,475. The worth has bounced from this stage twice, showing or no longer it is acting as a solid ask zone.

ETH/USD 2-hours chart – TradingView

On the different hand, the 200 EMA at $2,591 is acting as a ceiling. ETH must destroy above this stage to advise momentum and enter a bullish continuation.

The RSI on the 2-hour timeframe sits round 37.90, a runt bit oversold, which diagram the downside is proscribed unless enhance breaks.

Key stages:

- Pork up: $2,475

- Resistance: $2,591 and $2,732

- Breakout Zone: A bolt above $2,732 would signal acceleration against $3,000+

Ethereum Designate Prediction: Road to $10,000

The direction to $10,000 ETH received’t happen in a single day, but the foundation is already being laid:

- Institutional buying for is rising

- Space + staking ETFs are on the horizon

- Provide is horrified (burn mechanism + staking)

- Ethereum dominates clear contracts, DeFi, NFTs, and now RWAs

By the purpose retail FOMO kicks in, ETH would perhaps well already be midway there.