Ethena designate retreated for 3 consecutive days as commerce balances persevered rising and as whales provided their tokens.

Ethena (ENA) token dropped to $0.95, nice looking below the psychologically vital level of $1 for the first time since Dec. 20.

The continuing atomize is brought on by the danger-off sentiment in the crypto enterprise, which has brought on Bitcoin (BTC) and various costs to be lower.

It also came about as on-chain data showed that whales were selling their tokens. The largest transaction came about when a whale despatched 11.6 million ENA tokens worth $11 million to Binance, the largest crypto commerce. In but every other transaction, one trader moved ENA tokens valued at $10.7 million to the Binance.

Ethena whales dumped tokens worth $30 million on Thursday, Dec. 26. These gross sales came a few week after Arthur Hayes, Bitmex founder and earlier investor, provided a few of his ENA tokens. Based mostly on Nansen, Hayes now owns 18,616 cash valued at $17,458.

Ethena designate also fell as tokens on exchanges persevered rising, a favored bearish search for. These tokens elevated by 5.82% in the closing seven days to over 730.27 million. Total offer on exchanges moved to 4.87%, up by 0.27% a week ago.

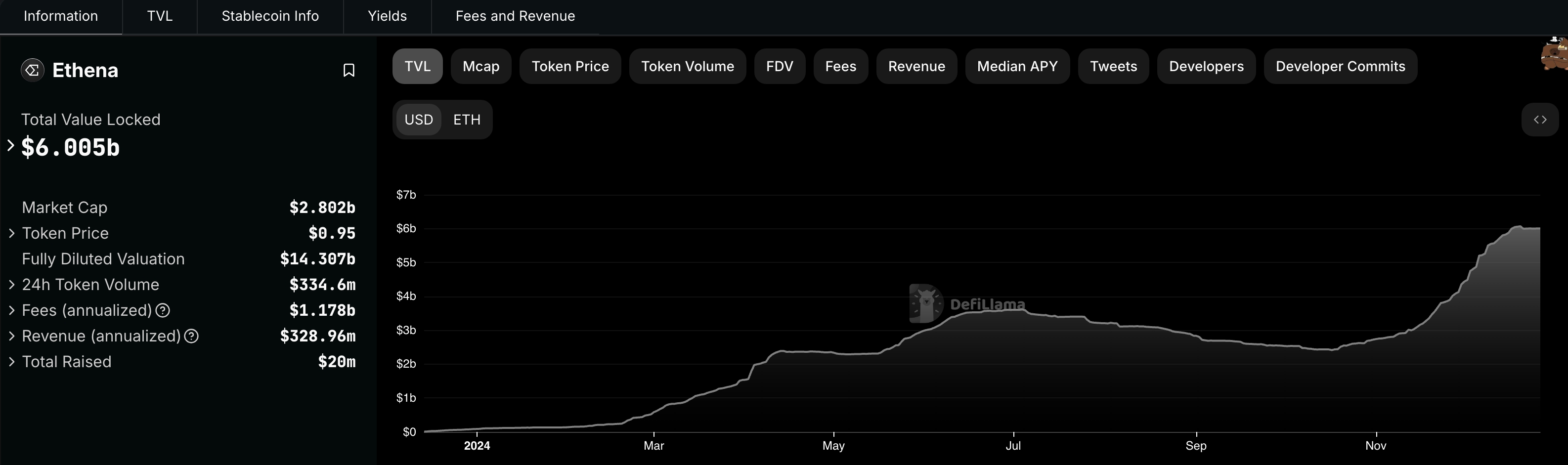

Meanwhile, inflows into Ethena’s USDe stablecoin contain stalled. The coin has a market cap of $6 billion, where it has been in the previous few days, a ticket of slack demand.

Ethena designate analysis

Technicals counsel that Ethena could maybe need extra downward to head as it has fashioned a head and shoulders pattern on the four-hour chart. This pattern comprises a neckline, which is at $0.8552, two shoulders, and a head. In most courses, the pattern outcomes in a mettlesome downward momentum when it strikes below the neckline.

Ethena has also moved to the 38.2% Fibonacci Retracement level and slipped below the 50-period nice looking reasonable. It also fell below the robust pivot reverse level of the Murrey Math Traces.

Attributable to this reality, the token will likely continue falling, with the instant target being the H&S’s neckline at $0.8552. A drop below that level will keep extra map back, potentially to the extraordinarily oversold level of $0.5860.

Disclosure: This text does no longer lisp funding advice. The allege and offers featured on this internet page are for tutorial applications most nice looking.