In step with an X post, on-chain analysts seen that the $USDe ticker modified into bought on Hyperliquid some hours ago lately, March 18, 2025. Now, the person is speculating that the ticker aquire suggests Ethena goes to deploy on the Hyperliquid L1 chain.

“Did Ethena essentially aquire the ticker? Or modified into any individual else looking out out for to psyop other folks?” The person requested sooner than persevering with to join dots based totally on the on-chain proof they cited.

Ticker $USDe modified into bought on Hyperliquid 3 hours ago.

This implies Ethena goes to deploy on Hyperliquid however… did Ethena essentially bought the ticker? Or modified into any individual else looking out out for to psyop other folks?

Let’s take a look at onchain.

The ticker modified into bought by… pic.twitter.com/GyGqxeREo3

— Ericonomic (@ericonomic) March 18, 2025

The build the onchain proof led

After Ericonomic (@ericonomic) came across out the ticker $USDe modified into bought on Hyperliquid, he made up our minds to notice on-chain to glimpse if he would possibly perchance likely uncover if the pass modified into made by Ethena or inferior actors.

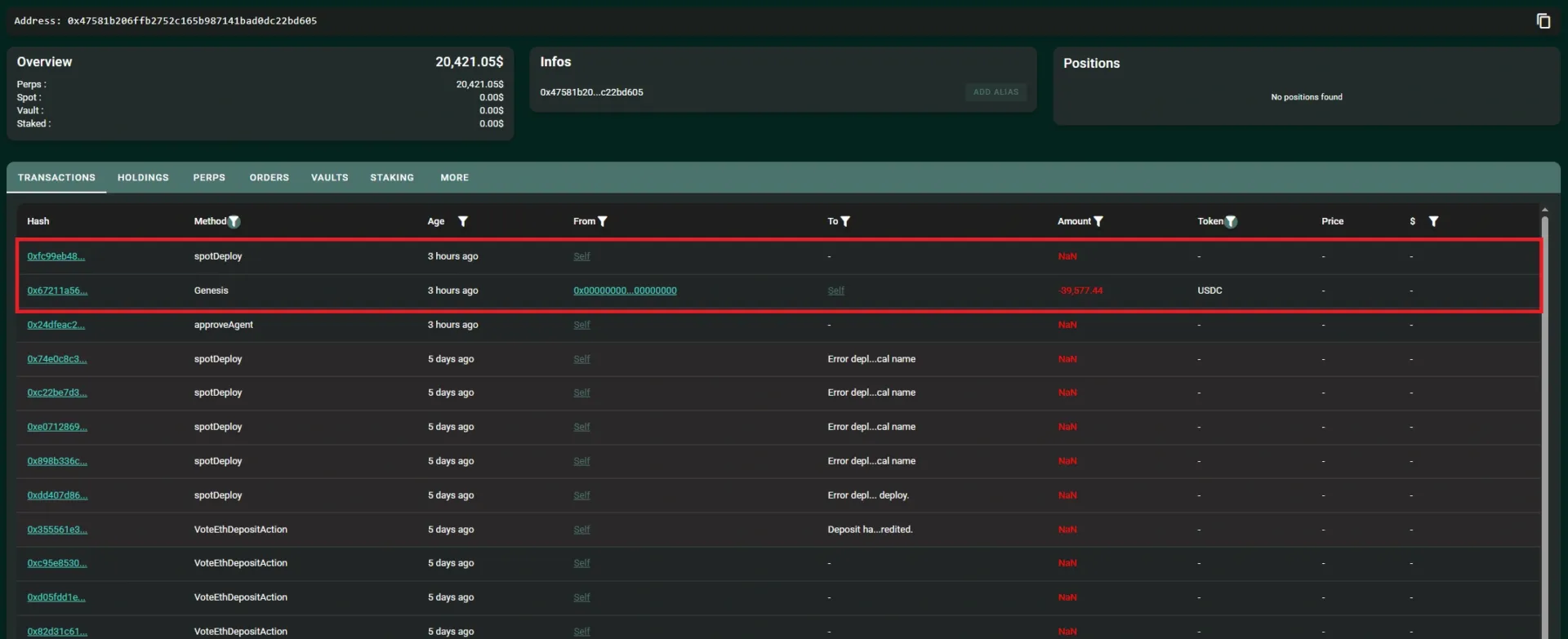

In step with on-chain prognosis that traced the wallet addresses entertaining, the ticker modified into bought by wallet contend with 0x47581b206ffb2752c165b987141bad0dc22bd605. The wallet modified into funded by 0x643Dbbc80Bb5432f646fEDFa4091a9b205E87Ae4, a wallet that appears to be like to be linked with an Ethena deployer, which is an externally owned account (EOA) long-established for deploying trim contracts or managing operations.

Extra tracing of the transactions confirmed that 0x643 modified into funded by 0x796Ee28CE42BF7bd43A09aCd43FAd0aACD7C3b29, every other contend with linked to Ethena’s pattern multisig, which has ENS names love etheinainsurancefund and ethenaops, and is referenced in Ethena’s documentation.

Some other wallet, 0xFF0458EA5F864717B05D79BF456a8b70767A7EF5, which modified into funded by the Ethena deployer 0x643, furthermore reportedly sent funds to Hyperliquid to dwelling up a 4-8 multisig, which suggests Ethena is making ready infrastructure on the L1 blockchain.

Curiously, these develoopments are robust proof of Ethena’s involvement, which led Ericonomic to realize his post by declaring that Ethena is certainly planning to deploy on Hyperliquid.

Ericonomic ended his post by writing that Ethena will seemingly be expecting Hyperliquid to enable the HyperEVM<>HyperCore token bridge sooner than fully deploying.

Within the comment allotment, many perceived to accept as true with Ericonomic. One person, @0xnutzs, recalled a proposal from final twelve months as proof of Ethena’s hobby in Hyperliquid.

The governance proposal on Ethena’s forum modified into dated October 17, 2024, and titled “Hyperliquid Ethena Liquidity and USDe Integration.” It requested that Ethena mix Hyperliquid as an eligible venue for a share of its hedging float, field to technical and proper due diligence.

It had been an respectable recommendation inside of Ethena’s community, and it triggered speculation amongst other folks that address an witness on Ethena’s governance activities. The pleasure began to put, however then as time handed, other folks realized something extraordinary; Ethena stopped talking in regards to the matter after the proposal.

This seemingly fueled worthy extra speculation as other folks questioned why they were keeping quiet about it; would possibly perchance likely there be technical, correct, or strategic points inflicting delays, or had the mix been completely abandoned?

If the proposal had been licensed, or if it indirectly received licensed, the mix would possibly perchance likely be performed in a managed manner with Risk Committee steering as Ethena hedging float scales alongside the expansion of Hyperliquid, with maximum preliminary proposed allocations.

The proposal, which outlined synergies between Hyperliquid and Ethena furthermore requested that the Ethena Risk Committee manufacture its due diligence of Hyperliquid’s suitability as a doable hedging venue. It has been months since then, and the committee is quiet. That’s why many are now questioning if the committee is composed doing its due direction of or whether or no longer Ethena is making moves below the radar.

Hyperliquid is in overall a beautiful venue for Ethena’s USDe

Hyperliquid is a moderately new L1 that has confirmed to be extra than correct a mission that folks abandoned after receiving airdrops, as in the case of projects love Starknet.

Hyperliquid is a layer-1 blockchain that furthermore capabilities as a DEX that affords its customers perks love hasty and low-fee trading. Since it burst into the assign, it has received significant consideration and has even viewed something the same to a cult forming around it.

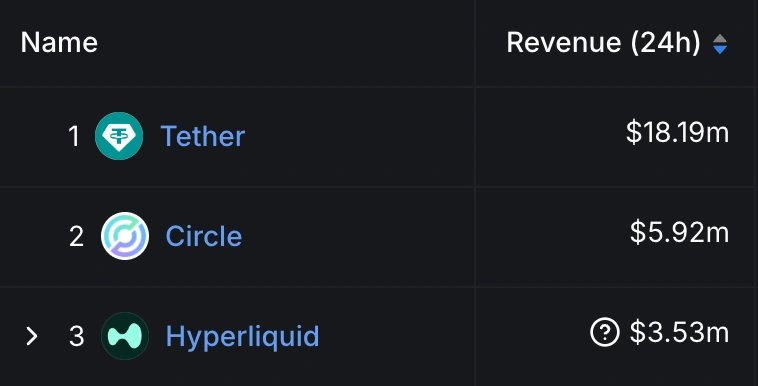

The DEX now has over 200,000 whole customers and typically records daily volumes that regulate between $1-4B. It now has over $1B in open hobby (OI), which dwarves other on-chain perpetual DEXs in doable. It’s even borderline the same to the largest CEXs.

In October, Hyperliquid modified into at long-established intervals accounting for roughly 40% of on-chain perpetual volumes, consistent with a document from Artemis. Ethena indubitably realizes that Hyperliquid, with its robust and high-performing trading infrastructure, would possibly perchance likely tremendously red meat up its operational capabilities, hence the hobby.

There’s furthermore the truth that platforms share the identical force to satisfy their customers first sooner than the rest whereas final scalable.

Following its token technology tournament final twelve months November, Hyperliquid airdropped about 31% of its 1 billion whole present and performed a $1.7B market cap on the first day, peaking at a $5.1 billion fully diluted valuation (FDV).

By early 2025, its FDV had reportedly climbed to $34B, however consistent with files from CoinGecko, it has fallen and at this time rests around $13.3M. No matter this, Hyperliquid is regarded as a top L1/ perpetual DEX that Ethena would possibly perchance likely leverage to proliferate its $USDe stablecoin in tems of volume and adoption.