Ethena token label rose for three consecutive days as sentiment in the crypto industrial improved.

Ethena (ENA), easiest known for the USDe stablecoin, rose to $0.4676, its absolute most practical stage since July 24. It has jumped by over 130% from its lowest stage this year.

Its rally came about as the crypto be troubled and greed index persevered rising, transferring from final week’s be troubled zone of 38 to the neutral point of fifty.

Bitcoin (BTC) has soared to $67,000, whereas Ethereum (ETH) and Solana (SOL) rose to $2,650 and $160, respectively. In most circumstances, altcoins compose well when Bitcoin and the crypto be troubled and greed index are rising.

Ethena’s rally also coincided with the falling odds that the USDe stablecoin will de-peg this year. The odds of the stablecoin dropping its peg dropped to 4%, down from 16% a few months previously.

USDe, cherish Terra USD, is no longer pegged to the U.S. buck. As an alternative, it maintains its $1 peg by executing automatic and programmatic delta-neutral hedges on its backing assets. Records shows that USDe in circulation is valued at over $2.4 billion.

No longer like diverse favorite stablecoins cherish Tether and USD Coin, USDe offers yields to its holders. In line with its internet tell, it has an APY of 8%, better than what U.S. authorities bonds are paying.

Ethena’s rebound came about whilst records shows that the total worth locked in its ecosystem persevered to tumble. The TVL decreased from the year-to-date high of $3.6 billion to $2.4 billion.

Peaceful, the developers believe made several valuable moves in contemporary months. Closing week, they launched plans to make investments $46 million of the reserve fund in tokenized assets. Ethena also got backing from BlackRock and Securitize for its original stablecoin, UStb

Ethena label flips key resistance

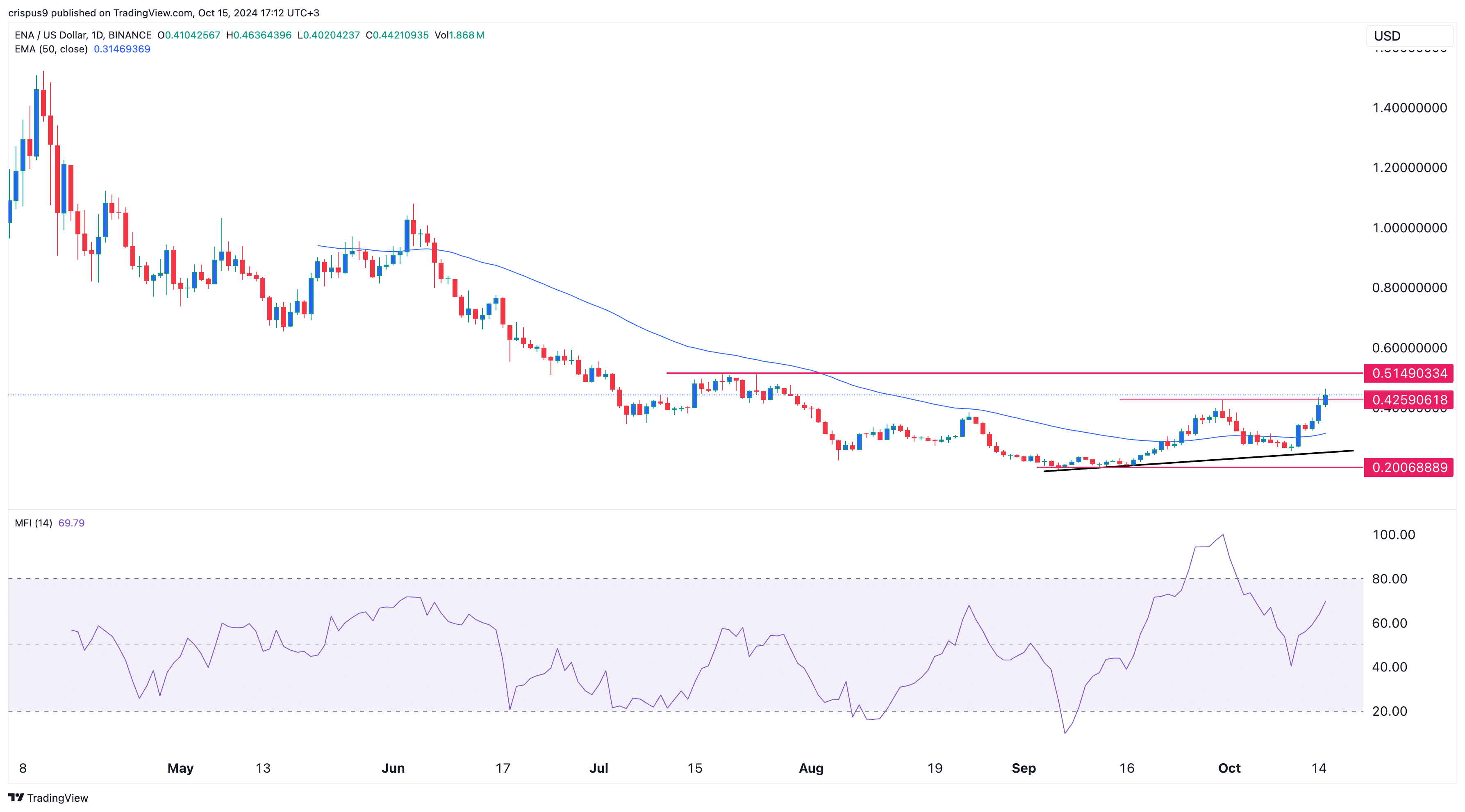

The each day chart shows that the ENA label bottomed at $0.20 in September and has rebounded by over 125% to $0.462. It flipped the valuable resistance point at $0.4260, its absolute most practical swing on Sept. 30 and the neckline of the double-backside sample.

ENA has also rallied above the 50-day transferring moderate, whereas the Money Drift Index indicator has tilted upward. Therefore, the token will seemingly continue rising as bulls target the most valuable resistance stage at $0.5150, its absolute most practical swing on July 24.