Ethereum continues to suffer from extremely low market process, with its discover exhibiting minimal volatility – a regarding bearish discover.

This stagnant habits increases the probability of sellers pushing the cryptocurrency below the serious $1.5K reinforce stage within the coming weeks.

Technical Diagnosis

By Shayan

The Day after day Chart

Ethereum continues to fly above the serious $1.5K reinforce space, a long-standing psychological and structural stage that has held since January 2023. Nonetheless, the market for the time being exhibits extremely low process, with the discover consolidating in a muted, sideways system. This lack of volatility and momentum suggests a declare of uncertainty, with neither investors nor sellers exhibiting dominance.

Such prerequisites in general precede indispensable moves, because the market builds up energy awaiting recent provide or seek files from. From a technical standpoint, bearish sentiment dominates the latest discover action. Ought to unruffled renewed selling stress emerge, a decisive destroy below the $1.5K imprint might perchance perchance trigger a cascade in direction of the $1.1K stage.

Aloof, a non eternal corrective retracement in direction of the $1.8K resistance zone stays a possibility earlier than sellers mount another are attempting to breach the $1.5K reinforce. The impending days are indispensable, as discover action around this stage will seemingly dictate the course of Ethereum’s next major construction.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum’s tight-fluctuate consolidation is clearly visible. The associated rate is for the time being trapped between the $1.5K reinforce and the upper boundary of the descending channel at $1.6K, reflecting a market in equilibrium. This steadiness suggests hesitation from both investors and sellers.

A breakout from this slim fluctuate will be pivotal. If Ethereum manages to breach the $1.6K upper boundary, a non eternal rebound in direction of $1.8K might perchance perchance materialize.

Conversely, a breakdown below the $1.5K stage will seemingly spark a chief downward pass, doubtlessly using the discover in direction of $1.1K within the mid-timeframe.

Onchain Diagnosis

By Shayan

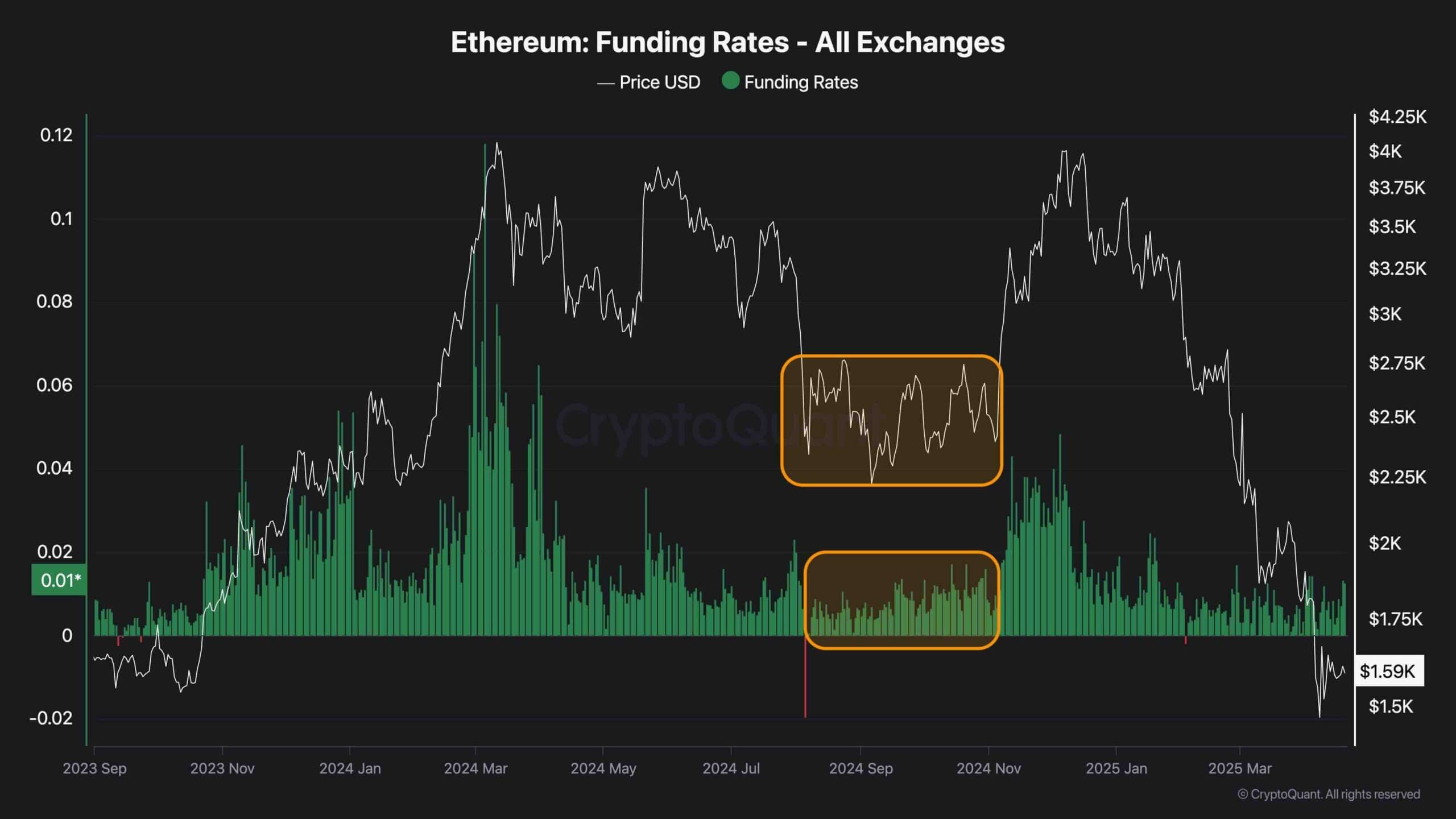

The funding rates metric serves as a indispensable indicator of sentiment within the futures markets. Analysing its recent behaviour gives key insights into Ethereum’s doable next moves. Seriously, both the discover and the funding rates were mirroring the patterns noticed throughout the September to November 2024 length, a segment marked by prolonged consolidation and deep corrections that within the rupture preceded a mighty bullish rally.

Such market prerequisites in general replicate super money accumulation, as told investors rob profit of dismay-pushed selling and fashioned distribution amongst retail participants. For the time being, funding rates gain dropped to strategy-zero values and are consolidating, suggesting that the market might perchance perchance just all over again be entering an accumulation segment.

Nonetheless, it is a necessity to camouflage that within such phases, further downside stays that you just can imagine. The associated rate might perchance perchance merely dip decrease earlier than a chief rebound occurs, offering even more elegant levels for accumulation by long-timeframe investors.