Alternate-traded funds (ETFs) gain change into increasingly extra trendy amongst retail investors in the US, with utilization surging from 31% in 2018 to 47% in 2023 and expected to surpass 50% by 2025. In line with a peek by Broadridge Financial Solutions, Millennials and Gen-Z investors are rising their market share and redefining investment traits by choosing self-directed investing.

Millennials and Gen-Z

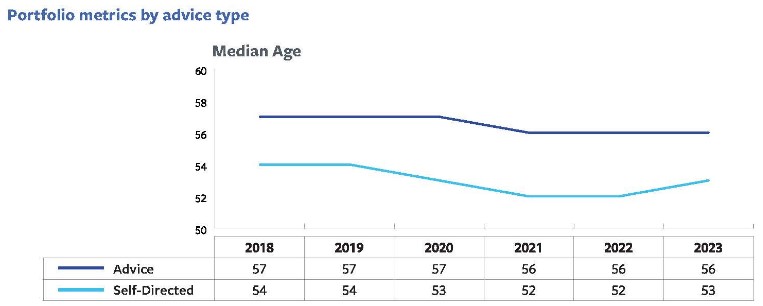

The investment landscape in the United States is undergoing principal changes, pushed primarily by younger generations who are embracing original methods and instruments. Since 2018, there become a significant upward push in self-directed investing, with 23% of all resources now managed via online reduce stamp brokerage platforms, up from 14%.

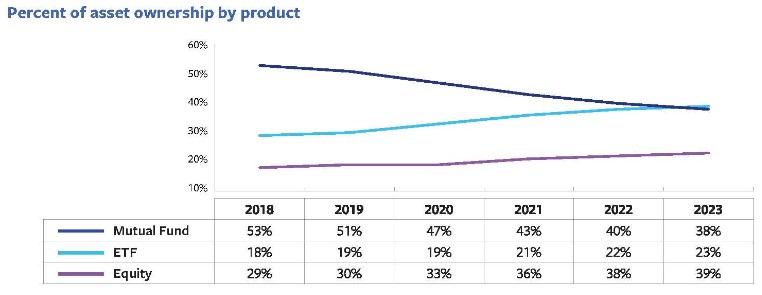

This model is now now not confined to younger investors; high-secure-worth people also prefer self-directed channels, with almost 25% of their resources in this class. This shift highlights a broader model amongst investors who are increasingly extra favoring ETFs and U.S. equities over mutual funds.

For the fundamental time, mutual fund resources dropped below equity resources in individual portfolios, with possession declining from 72% in 2018 to 62% in 2023. The depend of Millennial investors has elevated by nine share recommendations since 2018, and they also’re on the correct music to overtake Gen-X investors.

This demographic shift is accompanied by an invent bigger in the average sequence of investments held by Millennials, growing from six in 2018 to 10 in 2023. The democratization of investing is extra evidenced by the rising share of investors without a faculty stage, now exceeding 50%.

Gender Dynamics in Investing

One other spicy finding from the peek is the comparability of median resources between female and male investors. Female investors now withhold larger median resources than their male counterparts, with $52,105 in comparison with $50,271 for males. This pattern suggests a shift in the financial empowerment of females and highlights the growing participation of females in the investment landscape.

The attraction of mutual funds is waning, notably amongst younger investors. Boomers serene allocate the supreme proportion of their resources to mutual funds (39%), but younger generations are increasingly extra taking a be taught about towards replace alternate recommendations akin to ETFs and equities. Since 2018, Gen-Z’s equity asset possession has doubled, Millennials’ possession has bigger than tripled, and Gen-X has considered principal will improve as properly.

The peek also highlighted the correlation between training and asset possession. Customers with handiest a high school stage held drastically fewer resources ($28,332) in comparison with those with school ($73,044) or graduate levels ($148,399). Despite the upward push of self-directed investing, this hole underscores the continuing disparity in financial outcomes in conserving with tutorial attainment.