The crypto world is right now abuzz with the start of EigenLayer’s unusual token, EIGEN, which has rapid change into one in every of the 365 days’s most anticipated digital asset occasions.

In step with Bloomberg, the venture has attracted necessary consideration for its plot to decentralized finance (DeFi) and its “controversial” decision to exclude users from definite jurisdictions, including the US, China, and Canada, from taking part within the token distribution.

The start of the EIGEN token is predicament to launch with an airdrop, a route of where tokens are distributed to users based mostly mostly on definite criteria, including a points system that rewards early service adopters.

Kunal Goel, an analyst at Messari, popular that anticipating this airdrop modified into a “essential incentive” for users to predicament funds in EigenLayer’s service.

Nonetheless, the pleasure has been tempered by the truth that many participants who accrued points are if reality be told barred from claiming their tokens attributable to the usage of virtual deepest networks or residing in excluded international locations.

Robert Drost, govt director at the Eigen Foundation, outlined that the exclusions were a compulsory step to adhere to regulatory guidelines, which will be generally unclear and difficult to navigate, noting:

It’s no longer conceivable to purpose within the house with out following regulatory guidelines and being guilty, and the merciless piece is that there could be no longer rather just a few clarity.

This sentiment modified into echoed by Slash Cote, co-founding father of Secondlane, who popular:

Issuers no longer being upfront with jurisdictional restrictions leaves a sour taste in folks’s mouth when it comes time to receiving your rewards, and then you definately find out you’re disqualified for X, Y, Z reason.

Influence On The Broader DeFi Ecosystem

EigenLayer’s restaking service will not be any longer apt a brand unusual feature within the Ethereum ecosystem; it represents a shift in how functions can leverage the deep pool of transaction validators that underpin Ethereum.

This service increases the yield from staking ETH – from a baseline of spherical 3% to elevated rates, albeit with additional dangers.

As a consequence, EigenLayer has risen to change into the “2d most well-liked DeFi application,” as reported by Bloomberg, partly at the expense of liquid staking protocols like Lido and Rocket Pool, which possess considered necessary outflows in latest months.

Within the interim, based mostly mostly on a contemporary memoir from IntoTheblock, nearly 4% of all ETH is now restaked the usage of EigenLayer, showcasing the venture’s rising reputation.

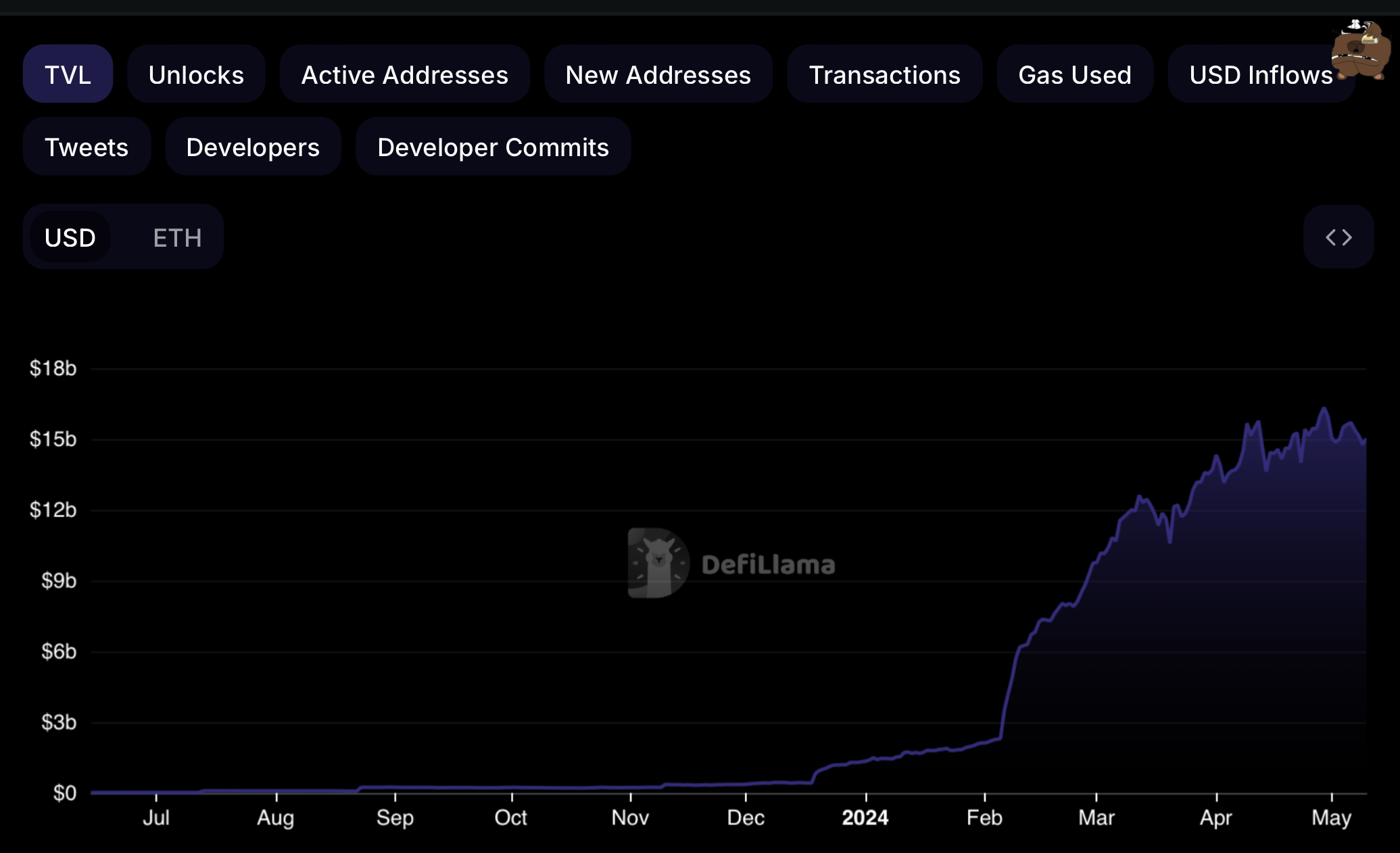

EigenLayer only within the near past surpassed $15B in TVL.

With regards to 4% of all ETH, and 40% of liquid staking tokens (LSTs) supply is right now being restaked into EigenLayer pic.twitter.com/LZ0vbp3L3z

— IntoTheBlock (@intotheblock) April 26, 2024