Polkadot’s native crypto DOT at final came across need with the bulls in November after months of sustained sell rigidity.

Nonetheless, the bears are abet again doing their thing this month judging by pullback that occurred from its latest peak.

DOT designate peaked at $11.64 on 4 December and has since dipped by over 35% to its latest low of $7.5 on 9 December. This pullback signaled that heavy profit-taking ensued after the November rally.

More importantly, the latest pullback dropped correct into a fundamental Fibonacci level. It came in between the 0.618 and nil.5 Fibonacci designate ranges, per its November lows to its latest top this month.

DOT sell rigidity has seriously cooled off because it entered the Fibonacci zone. Right here’s on epic of it is in this zone where the bulls have a tendency to receive their momentum. This implies that DOT re-accumulation had already resumed.

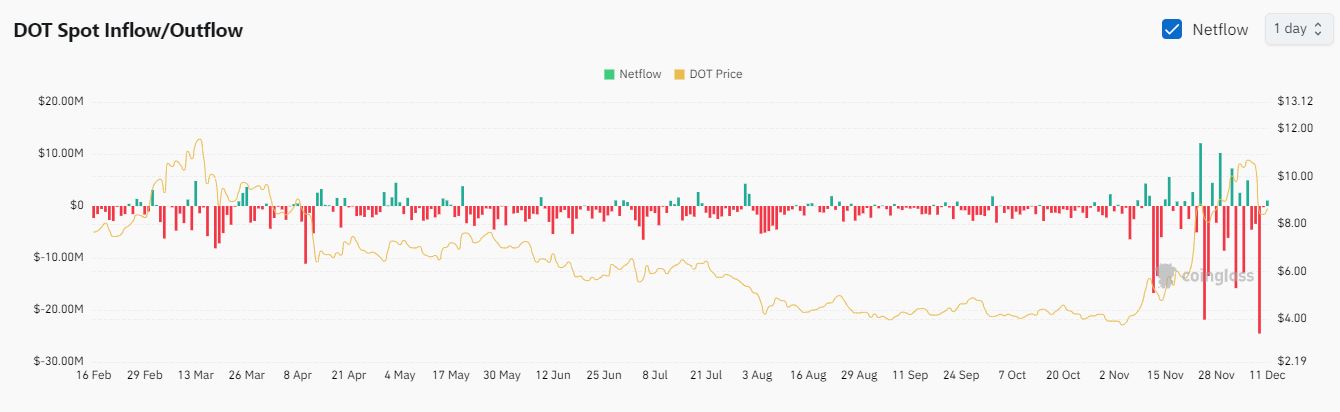

DOT Place Outflows Intensified This Week

While bullish momentum is predicted with the latest dip into the Fibonacci zone, prospects of sell rigidity remained salvage. DOT sigh outflows had been basic since the beginning of December.

Place outflows peaked at $24.52 million on 9 December. The very perfect sigh outflows observed in 2024. Nonetheless, they cooled off within the final 2 days.

This used to be per the giant spike in sell rigidity observed all over the identical day for DOT designate.

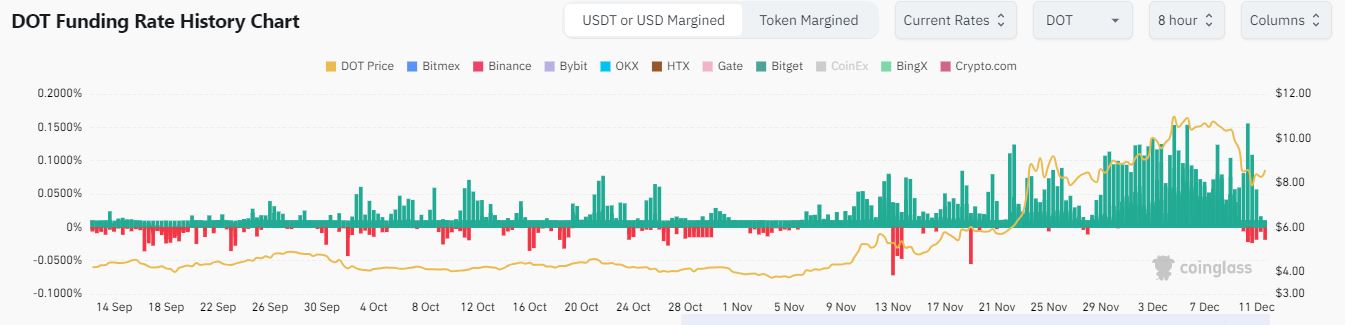

DOT sigh flows had been moreover per the location within the derivatives section. Commence curiosity dropped considerably over the final few days.

It is price noting that DOT sigh flows grew to turn into obvious again within the final 24 hours.

There used to be moreover an uptick in negative funding charges. This confirmed that derivatives had shifted particularly within the final 2 days, in need of shorts.

The shorts vs longs ratio on Coinglass could well contain signaled the altering sentiment amongst merchants. This used to be evident by the unexpected shift within the ratio within the final 2 days. Shorts had been dominant at nearly 56% on 9 September because the tip of sell rigidity.

Ever since DOT designate dipped into the Fibonacci ratio, the amount of longs surged vastly. Longs had been dominant at 51.22% on 11 December, reflecting the latest designate uptick and altering sentiment.

Merchants saw the latest dip as a chance for basic beneficial properties particularly since the market is within the season of latest highs. DOT designate, at its press time level, equipped a 30% uptick to its latest native high.

Polkadot Tag Prediction

However what are the chances that the associated rate could well rally to those highs this week? Well, it appears to be like to be that the latest wave of sell rigidity has dampened market sentiment.

For context, the crypto be troubled and greed index hovered at 74 at press time, down from 78 yesterday.

Further decline in market sentiment capacity merchants will insecure faraway from injecting liquidity abet into coin enjoy DOT, despite bullish indicators.

On the masses of hand, DOT designate could well decouple from the general market sentiment if it finds enough need with the bulls.

If such an consequence happens, then it’s going to also resume its bullish surge as used to be the case in November.