Dogecoin imprint can also kick off the week on a bullish leg amid its contemporary surge in sentiment.

Up to now more than one indicators indicating a excessive probability of a set up a question to of surge within the subsequent few days.

A mode of signals develop into Dogecoin imprint situation especially on the weekly chart.

The meme coin upright concluded one other week of shifting a key fibobacci diploma in accordance to the bottom and high of its Q4 rally.

For context, the meme coin dipped into the 0.5 and nil.618 Fibonacci zone at the tip of January.

This has restricted Dogecoin imprint throughout the $0.235 and $0.282 imprint differ. The meme coin exchanged arms at $0.241 at press time.

The truth that imprint has been bearish but peaceable managed to contain the bottom differ of the Fibonacci pattern suggests that there develop into accurate give a boost to.

In particular because Dogecoin imprint already retested the bottom of the Fibonacci differ.

Dogecoin tops list of meme coins by market sentiment

Another most indispensable motive Dogecoin shall be about to expertise one other inspiring week is the favorable social sentiment.

Per LunarCrush, Dogecoin had the supreme social sentiment within the relaxation 24 hours.

The surge in social sentiment suggests that the market is beginning to be all ears to DOGE. In particular at a time when it has been discounted by roughly 50%.

Considered one of many causes for the uptick in social task spherical Dogecoin develop into potentialities of it being integrated into X fee.

But can also these observations be adequate to situation off a appreciable set up a question to of wave?

Is Dogecoin set up a question to of making a comeback?

A Dogecoin imprint uptick this new week would require a appreciable wave of liquidity.

On-chain recordsdata printed some attention-grabbing observations relating DOGE set up a question to of profile.

So a ways as the derivatives segment develop into concerned, alternatives volume develop into down by upright over 58% within the relaxation 24 hours.

On the opposite hand, open interest develop into up 15.12% throughout the identical interval

The divergent alternatives volume and open interest typically present declining purchasing and selling task and a surge in new positions.

It may presumably presumably also simply signal a sentiment shift from bearish to bullish pondering that Dogecoin imprint has motion has been principally bearish since December.

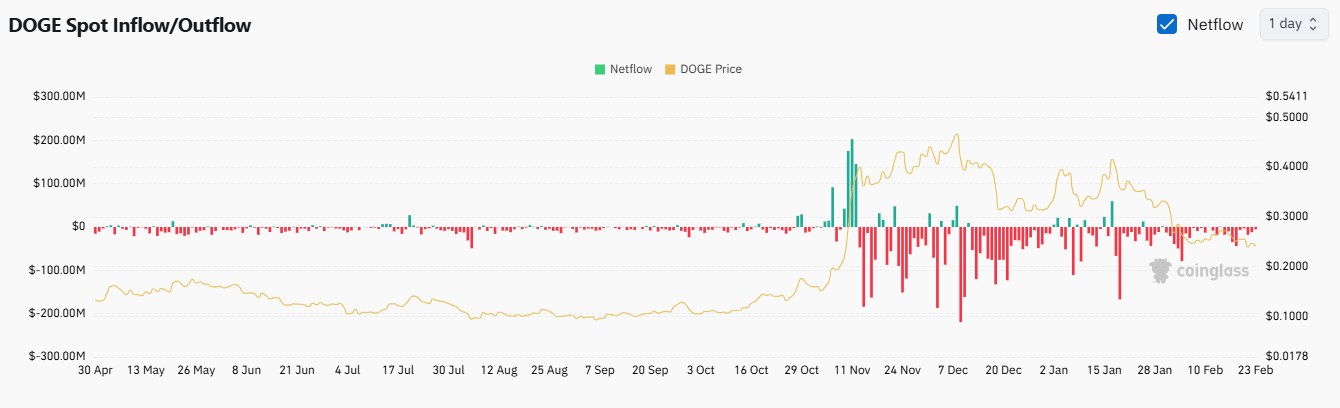

The bearish sentiment has been dominant within the convey segment too. On the opposite hand, contemporary observations highlight a appreciable decline in sell strain.

To position things into perspective, convey outflows within the relaxation 24 hours amounted to $5.05 million.

The supreme single day convey outflows observed by Coinglass in 2025 develop into $166.Ninety nine million on 19 January.

Also value noting is that there develop into no observed spike in DOGE convey inflows. This suggests traders had been peaceable in a cautious temper, coupled with outdated set up a question to of and hence its wrestle to assemble a immense recovery.

The outdated set up a question to of quandary approach DOGE bears peaceable contain a probability to procure dominance if it fails to manifest accurate set up a question to of.

Meanwhile, the Bitcoin pain and greed index these days bounced abet to 50 after previously dipping to pain territory.

This recovery to fair zone signals making improvements to market sentiment that can also pave the approach for a set up a question to of recovery.