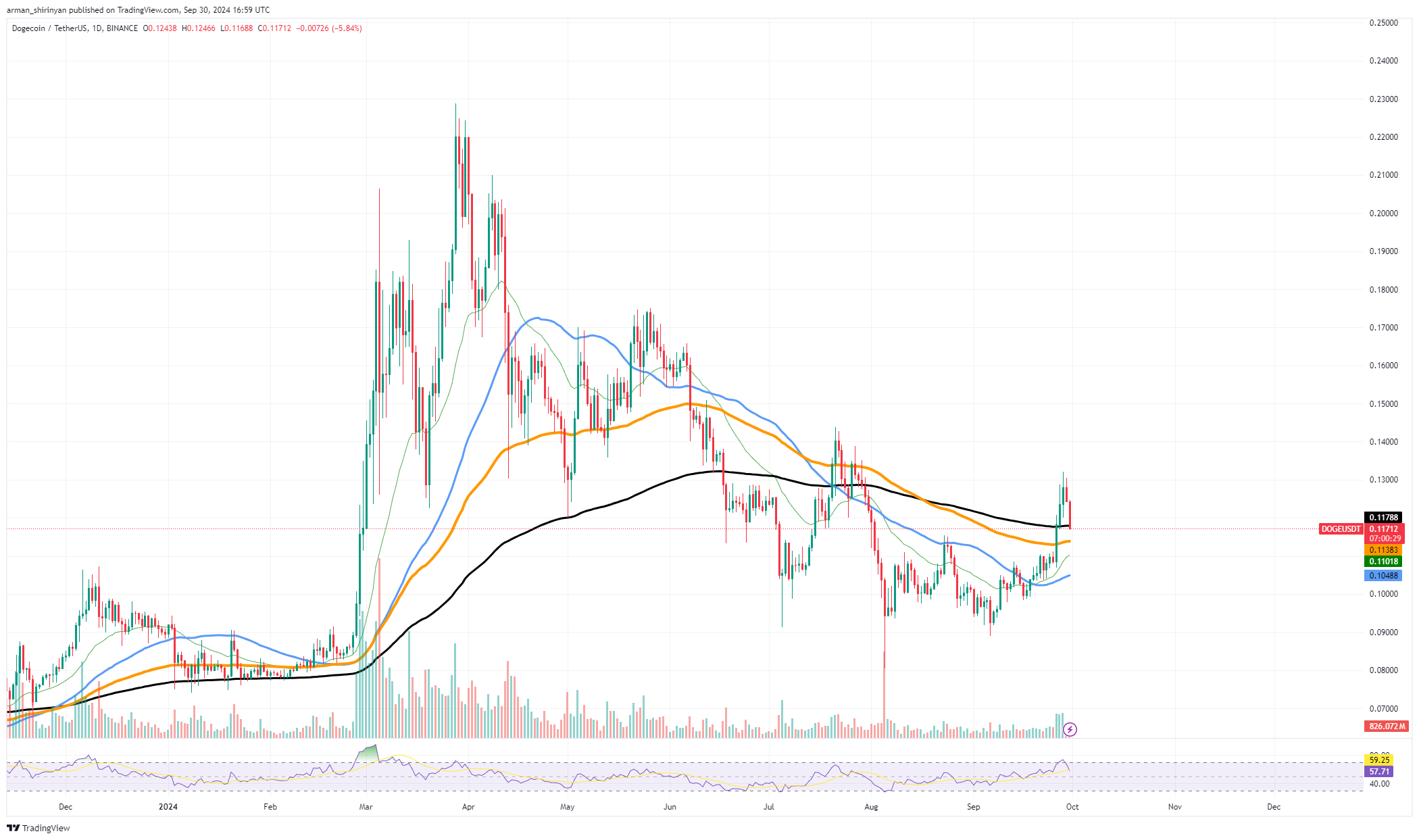

Trading volume for Dogecoin surged very a lot honest no longer too long ago, hitting an all-time high of $1.2 billion. The surprising surge in exercise ended in traders and traders to leap on DOGE, temporarily driving up its mark. The associated rate momentum does, however, appear to be slowing down as the volume starts to order no, suggesting that a decline would possibly perchance most probably well happen quickly. Throughout this surge, DOGE reached a high of $0.124; since then it has begun to lose ground and is for the time being trading at roughly $0.1205.

When the volume returns to more long-established stages, the value circulate means that procuring vitality would possibly perchance most probably well need poke out. If the procuring force doesn’t come abet, this change in market dynamics would possibly perchance most probably well cease up in a more critical retreat. Whales and speculative traders were a critical part within the abrupt volume spike, however it appears that evidently there just isn’t any continual procuring passion at these high stages.

Given the lowering volume, DOGE would possibly perchance most probably well most probably obtain it delicate to retain onto its unusual mark. Prices would possibly perchance most probably well retrace additional and take a look at about a of the fundamental assist stages if volume returns to presurge stages. The 50-day fascinating common is positioned around $0.117, which is the principle valuable assist level to retain an stare on.

For holders of DOGE, this level would possibly perchance most probably well offer some momentary respite; however, would possibly perchance most probably well peaceable it ruin, a more critical correction will be underway. One more necessary assist level that would possibly perchance most probably well relief as a buffer is $0.1139, which is below that. Lastly, forward of DOGE strikes into more bearish territory and most probably drives the value even decrease, $0.1104 is the final line of defense.

XRP looks sturdy

Unusual mark circulate for XRP has been very sturdy, pushing the asset above $0.63 and spiking by roughly 50% from its fresh lows. Talks about a skill unusual mark target of $0.94, a critical historical level for XRP, were ended in by the renewed bullish sentiment. The road forward it’s miles going to be delicate for bulls, despite the proven truth that this target appears to be inside sight.

The unusual breakout from a symmetrical triangle sample, which in overall signifies additional upside skill when paired with increasing volume and momentum, is one in every of the causes for optimism. For about a weeks, this sample has been developing, and the breakout has given XRP more momentum. Despite the proven truth that it’s miles getting closer to overbought territory, the Relative Strength Index is peaceable moderately sturdy, suggesting that traders are peaceable as a lot as the trace for the time being. This can take continual procuring force, though, to reach $0.94 – namely on story of XRP is up towards several resistance areas.

The first critical resistance is positioned at $0.70, which has served as a hurdle in earlier attempts to interrupt bigger. In direct to reach the next target, which is closer to $0.80, you would possibly perchance most probably well need gotten to first particular this level. Taking an even bigger describe peer, bulls have to fetch particular XRP stays above $0.60, which is for the time being a solid assist level. A decline below this trace can point to that the unusual rally is ready to slack down and most probably reverse.

Solana’s impactful signal

On the day to day chart, Solana is making ready for a potentially critical technical occasion as the 26-day EMA is ready to inferior the 100-day EMA. This golden inferior sample in overall denotes a bullish vogue and means that SOL’s mark would possibly perchance most probably well rise over the next several days. Charts point to that Solana is trading at roughly $157 precise now, having rebounded from a mid-September low of $142.

The asset looks to relish recovered energy following a length of consolidation and is for the time being fascinating toward bigger stages in accordance with the unusual vogue. The momentary momentum indicator, the 26-day EMA, has been rising regularly and is ready to surpass the 100-day EMA, which is a extremely critical signal of medium-timeframe mark circulate.

The 26-day fascinating common inferior above the 100-day fascinating common historically signifies a change in market sentiment from cautious to optimistic, which in overall heralds the delivery of a bullish vogue. SOL would possibly perchance most probably well fetch the momentum it needs from this not so good as overcome resistance – namely at $160 and $170.