The crypto market has considered the excellent leverage flush out since April 2021 the day prior to this, December 9, as reported earlier nowadays. Amidst the market shakeout, Dogecoin (DOGE) is one among the altcoins which is exhibiting important signs of energy. In a post on X, crypto analyst CRG (@MacroCRG) argues that the DOGE designate is exhibiting “unbelievable” signs of resilience when compared to the broader altcoin market.

Right here’s Why Dogecoin Looks ‘Amazing’

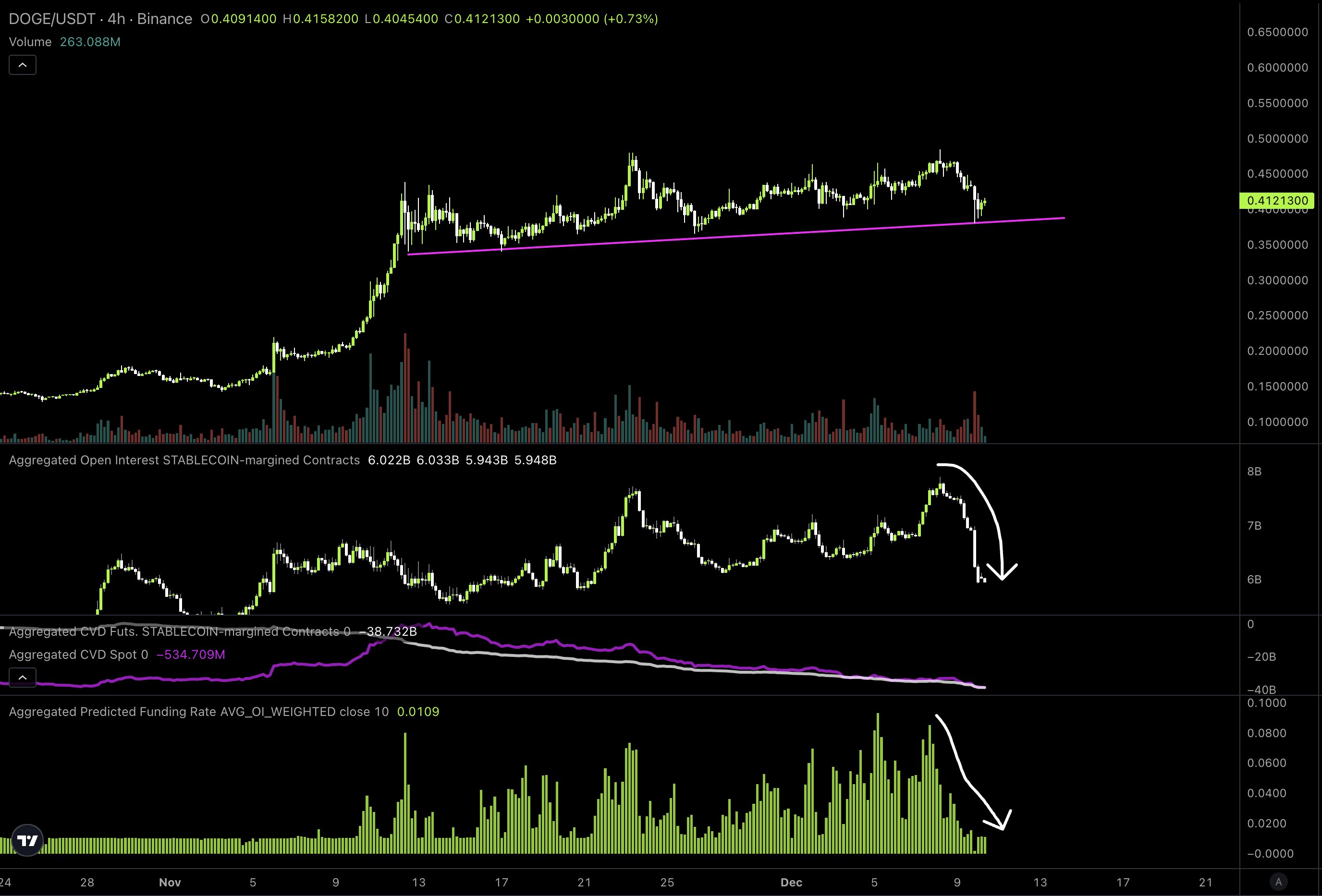

Despite the market downturn, Dogecoin managed to withhold the most important again level. CRG shared the below chart and commented, “DOGE looks unbelievable. Complete market shat itself however it barely flinched + didn’t ruin structure. Now funding has completely reset and a ton of OI has been washed out. Won’t be prolonged except here is trending anxious again IMO.”

The chart unearths loads of serious insights that again his optimistic outlook for DOGE. To delivery with, Dogecoin maintained an most crucial uptrend line in the 4-hour chart (DOGE/USDT). This pattern line has acted as a dynamic again level which the Dogecoin designate has touched however now not fallen below on three separate occasions since mid-November.

Every contact of this pattern line triggered a rebound for the Dogecoin designate, suggesting solid purchaser hobby at these phases. This alignment with the uptrend line is important consequently of it signifies now not easiest again however additionally rising self belief amongst investors whenever the price dips to this line and therefore recovers.

Resistance, on different hand, formed end to the $0.47 impress. This level has been examined a pair of occasions, and each strive to interrupt by plot of has been met with resistance. The repeated tests of this resistance level without a step forward would possibly perhaps well normally counsel a consolidation share, potentially construct up for a stronger pass upward if the market sentiment shifts positively.

Furthermore, the chart presentations a necessary reduction in delivery hobby in stablecoin-margined contracts. Primarily based entirely mostly on Coinglass info, $86.29 million in DOGE prolonged positions had been liquidated on December 9, the excellent since the bull speed of 2021.

This reduction in delivery hobby gifts a important ‘washout’ of speculative positions, normally viewed as a market reset where weaker fingers exit, and the excess leverage is reduced. Seriously, this cleaning of market participants would possibly perhaps well presumably be one other hint that a extra sustainable upwards pass is brewing.

Every other important part shown in the chart is the reset of funding charges to decrease phases, which is important as it reduces the price of maintaining prolonged positions. Decrease funding charges can aid new procuring for exercise, especially from participants who had been previously sidelined due to excessive costs related to affirming leveraged positions.

CRG’s analysis additionally entails an commentary on the Cumulative Volume Delta (CVD) for both futures and space markets. The CVD for futures has moved below that of the distance market, indicating that futures traders would possibly perhaps well be taking extra bearish positions or closing existing positions extra aggressively when compared to space traders. This divergence means that the distance market, which is on the entire much less speculative, retains bullishness, while performing as a buffer in opposition to the bearish futures markets.

At press time, DOGE traded at $0.40.