Santiment, a market intelligence platform, reports a vital elevate in discussions surrounding memecoins love Dogecoin (DOGE) and Bonk (BONK). This surge occurred as every tokens skilled worth spikes, shooting consideration from traders. Nonetheless, market experts point out that when center of attention shifts toward speculative assets, resembling memecoins, corrections are probably to employ.

📉 There was as soon as a well-known elevate in memecoin discussions the outdated day as coins love Dogecoin and Bonk were surging. Usually, markets appropriate when center of attention shifts a ways from layer 1’s and toward extra speculative assets due to greed. Nowadays, unsurprisingly, market-huge dips are taking place. pic.twitter.com/ACzHo7TsTY

— Santiment (@santimentfeed) October 17, 2024

Dogecoin Experiences Label Dip

Dogecoin’s worth is $0.127748, with a 24-hour trading volume of $1.39 billion. DOGE has skilled a 1.07% decrease in worth over the final 24 hours, bringing its market cap to $18.7 billion. In spite of this dip, Dogecoin maintains a genuine presence within the market with a circulating provide of 146.4 billion DOGE coins.

Moreover, Dogecoin’s Relative Energy Index (RSI) stands at 69.17, nearing the overbought level of 70. This means the coin is drawing near near a severe level the attach a probably worth correction could well well occur. Nonetheless, for the reason that RSI is completely staunch below 70, there’s level-headed room for worth growth. Market participants have to preserve a shut take into memoir on any indicators of weakening momentum.

Furthermore, the Intriguing Common Convergence Divergence (MACD) prognosis reveals weakening bullish momentum. The MACD line is crossing below the trace line, suggesting a probably vogue reversal or consolidation portion. While the histogram stays in rather detrimental territory, signaling a decrease in upward momentum, traders have to proceed with warning.

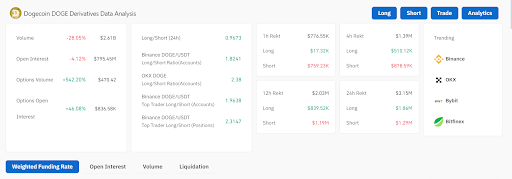

Dogecoin Derivatives Blow their private horns Blended Indicators

Dogecoin derivatives also designate a fancy describe. Quantity has dropped by 28.05% to $2.61 billion, and delivery pastime lowered by 4.12%. Nonetheless, suggestions trading surged by 542.20%, whereas delivery pastime grew by 46.08%, indicating increased speculative exercise. Prolonged positions continue to dominate on exchanges love Binance and OKX, reflecting overall bullish sentiment.

Read also: Meme Coins Rally: Dogecoin and Bonk Surge as Bitcoin Earnings Skedaddle along with the chase In

Short positions skilled vital liquidations, nonetheless long liquidations occupy also increased over the previous 12 hours. The market stays active, with traders balancing long and brief positions and attention-grabbing in suggestions trading.

Bonk Faces Market Cooling as Traders Adopt a Bearish Stance

BONK is also displaying indicators of cooling and is valued at $0.000023 on the time of writing. Bonk noticed a 9.59% decline over the previous 24 hours whereas its trading volume reached $263.41 million, and the market cap stands at $1.67 billion, with a circulating provide of 74 trillion BONK coins.

Moreover, Bonk’s RSI is at 55.12, indicating a neutral to rather bullish sentiment. Even supposing the value dropped, the momentum has no longer yet shifted toward oversold territory. This means that the most trendy downtrend could well well stabilize soon.

Equally, the MACD indicates unruffled bullish momentum, with the strains converging and the histogram displaying weakening upward chase. Traders have to remain cautious because the market could well well shift toward bearish traits if these indicators continue to soften.

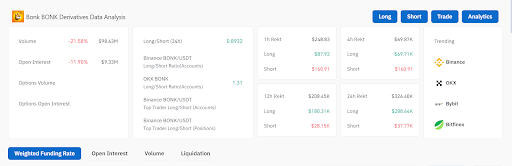

Bonk Derivatives Blow their private horns Bearish Dispositions

Bonk’s derivatives market displays a extra bearish sentiment. Quantity dropped by 21.58% to $98.63 million, whereas delivery pastime fell by 11.90% to $9.33 million. The long/brief ratio sits at 0.8932, pointing to a runt bearish tilt.

Then again, Binance’s long/brief ratio of 1.31 reveals extra optimism amongst traders on the platform. Seriously, long positions noticed vital liquidations within the previous 12 hours, reinforcing the likelihood of a market correction.

Disclaimer: The suggestions offered on this text is for informational and tutorial capabilities finest. The article does no longer constitute monetary suggestion or suggestion of any kind. Coin Version is no longer responsible for any losses incurred because the utilization of impart, merchandise, or companies talked about. Readers are suggested to exercise warning forward of taking any motion connected to the company.