Dogecoin (DOGE) has exploded with a 26% accumulate this week, taking pictures widespread consideration because it climbs to roughly $0.2025. This rally comes as DOGE’s shopping and selling volume stays mighty at $3.ninety nine billion, with a market cap of $29.71 billion, up by 3.72% in the closing 24 hours.

As the cryptocurrency edges closer to the $0.2290 resistance stage, optimism is constructing amongst merchants who speculate it would possibly perchance perchance perchance revisit the formidable $0.27 barrier closing examined in gradual 2021. But, the ask stays: would possibly perchance perchance DOGE withhold its momentum and project this barrier, or will profit-taking dampen its upward trajectory?

Dogecoin’s Each day Chart Kinds Bullish Golden Execrable

Inspecting day-to-day chart patterns, a Golden Execrable—a bullish technical indicator the put the 50-day appealing moderate crosses above the 200-day appealing moderate—has emerged, reinforcing a long-term uptrend. This formation in total signals the foundation of a sustained build upward thrust, aligning with the heightened shopping interest in DOGE.

Furthermore, the token’s build has decisively surpassed the 0.786 Fibonacci retracement stage at $0.1832, a serious stage that in total separates minor retracements from an total bullish reversal. This implies intense shopping power and suggests that the DOGE cryptocurrency will seemingly be poised for an even extra upward breakout in the days ahead.

The next targets on the chart are the $0.2290 and, sooner or later, the highly anticipated $0.27 stage. Adding to this momentum, Dogecoin’s weekly build plod shows mighty pork up above $0.14, with the 200-day SMA now around $0.1281, offering a catch security catch in opposition to imaginable dips. The latest rally has furthermore placed the DOGE token well above the 0.5 Fibonacci stage at $0.1358, extra solidifying a bullish outlook.

DOGE On-Chain Metrics Grunt Bullish Give a boost to

Adding one other layer to Dogecoin’s bullish story, the World In/Out of the Money chart unearths roughly 88.64% of all DOGE addresses are “Within the Money” at $0.2019. This implies these addresses set up Dogecoin at a build below or equal to the most modern worth.

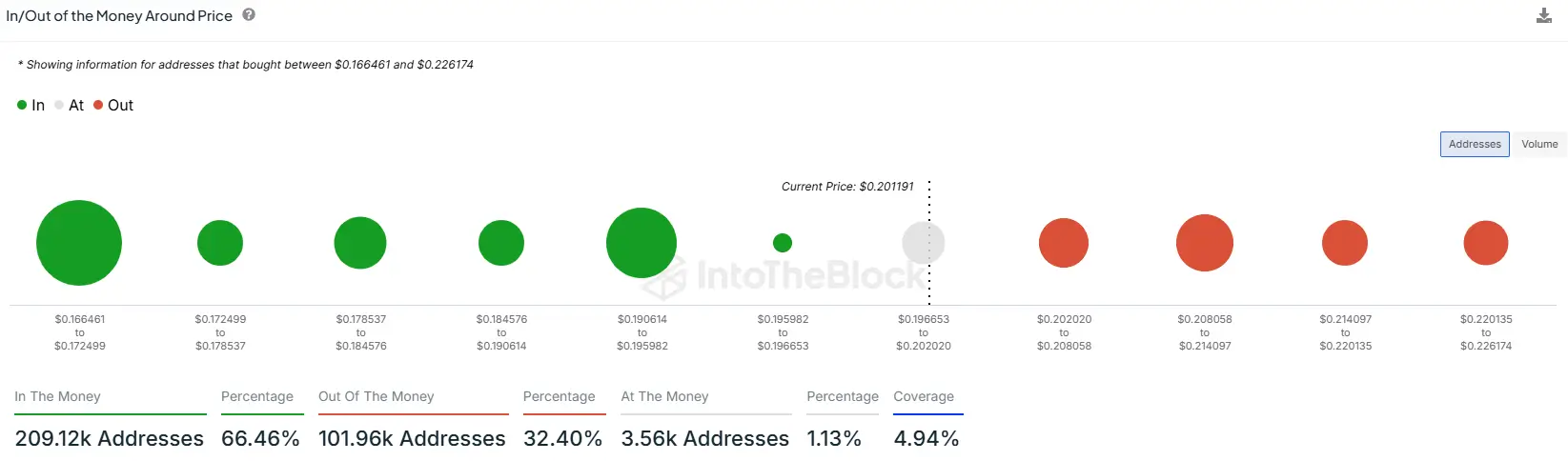

This proportion extra implies that many holders are already in profit, decreasing the chance of instantaneous promote-offs and strengthening the ability for persisted upward momentum. Meanwhile, handiest 9.seventy nine% of addresses are “Out of the Money,” with DOGE costs above their preliminary aquire stage. Furthermore, the In/Out of the Money Round Worth metric, focusing on the addresses that equipped the cryptocurrency between $0.166 and $0.226, shows that 66.46% of these addresses dwell winning.

This implies the DOGE token has constructed a mighty pork up substandard within this build fluctuate, offering catch foundations would possibly perchance perchance impartial silent the worth advance upon resistance reach $0.2290. On the replace hand, the guidelines furthermore highlights that 32.40% of these addresses are “Out of the Money” as the meme coin hovers across the $0.2019 stage, suggesting imaginable selling power if costs approach yelp resistance aspects.

Dogecoin’s Worth Prediction: Will DOGE Revisit the $0.27 Barrier?

Assuming the DOGE token manages to interrupt via the $0.2290 resistance stage, it would possibly perchance perchance perchance without complications climb to $0.27, a psychological barrier that will perchance trigger a brand contemporary wave of shopping activity. Previous $0.27, the next serious resistance would seemingly seem around $0.30, the put more merchants would possibly perchance perchance learn about to lock in earnings.

Nonetheless, the cryptocurrency would possibly perchance perchance look a transient pullback if it fails to surpass the $0.2290 stage. In this downside project, instantaneous pork up exists across the 0.786 Fibonacci stage at $0.1832. Below that, the 0.618 Fibonacci stage at $0.1537 would possibly perchance perchance support as a pork up ground, cushioning the token from a deeper correction.