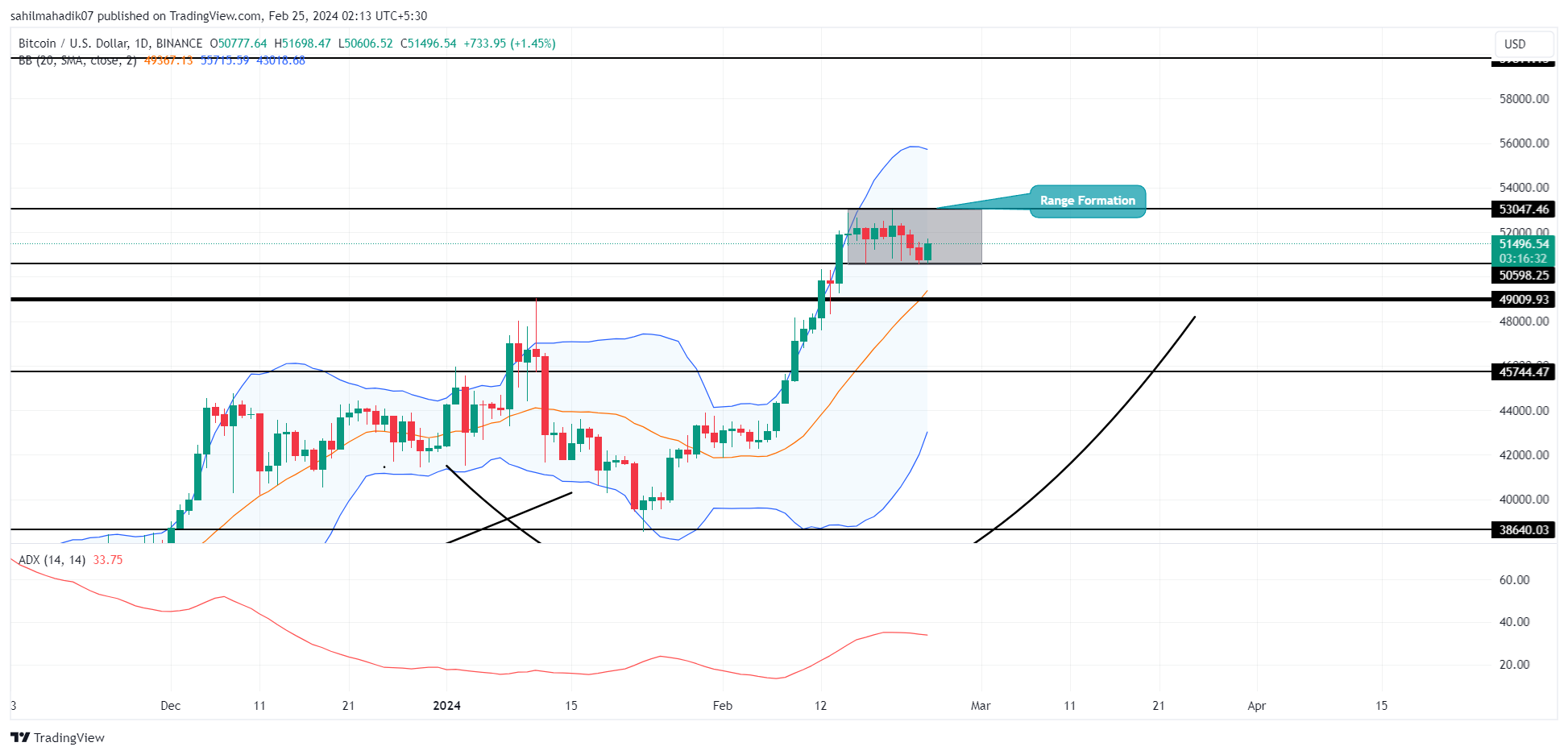

Bitcoin Technical Diagnosis: For nearly two weeks, the leading cryptocurrency Bitcoin has traded sideways resonating with two horizontal ranges of $53050 and $50600. The consolidation accompanied by immediate-physique candles and prolonged wicks reflects uncertainty amongst market contributors. No topic the lateral bound Matrixport no longer too prolonged ago released a bullish outlook for BTC with the aptitude of $63000 in March 2024.

Is Bitcoin Designate Prepared for $60000?

Matrix Port, a number one digital sources monetary services and products platform, has released an optimistic document regarding Bitcoin’s mark trajectory, projecting a goal of $63,000 by March 2024. Highlighted in a tweet by illustrious Chinese language cryptocurrency reporter Wu Blockchain, the document identifies plenty of key catalysts that will per chance well drive Bitcoin’s mark to this ambitious degree.

Predominant amongst these catalysts is the approval of a Bitcoin plight ETF, a pattern prolonged-awaited by the cryptocurrency neighborhood. On February 23, the 8 ETF added 5,781 $BTC, recording web inflows of $232.3 million. These numbers surpass the 900 Bitcoin minted each day, reflecting a increased seek files from available within the market.

One more serious problem is the upcoming Bitcoin halving tournament, historically a precursor to large mark will enhance. The halving, which reduces the reward for mining new blocks by half, successfully decreases the rate at which new bitcoins are generated, thus limiting provide and potentially riding up the worth.

Matrixport released a brand new document stating that BTC’s goal of reaching $63,000 in March 2024 is achievable. Catalysts consist of: the approval of a Bitcoin plight ETF, the Bitcoin halving, expectations of an rate of interest nick after the Fed’s FOMC meeting, and the U.S. presidential…

— Wu Blockchain (@WuBlockchain) February 23, 2024

Additionally, the document cites expectations of an rate of interest nick following the Federal Reserve’s Federal Birth Market Committee (FOMC) meeting as a probably bullish signal for Bitcoin. Decrease interest charges can diminish the attraction of yield-bearing sources, making non-interest-bearing sources like Bitcoin extra gorgeous to investors in search of increased returns.

Lastly, the U.S. presidential election is additionally mentioned as an component that will per chance well have an effect on the Bitcoin mark.

Reversal Pattern Items BTC for Most foremost Vogue Change?

An prognosis of the increased time physique chart reveals the brand new surge in BTC has breached the neckline resistance reversal sample called cup and take care of. This sample repeatedly appears to be like after a important downturn indicating pivot aspects of trend reversal.

Currently shopping and selling at $54489, the Bitcoin mark hints on the continuation of the brand new sideways trend. A likely breakdown below the vary improve tumbled the BTC mark to $49000 and retested the breach.

If the coin mark reveals sustainability above $49000, the BTC mark would possibly perchance per chance well honest scurry a probably goal of $82600.

- Bollinger Band: A downtick within the lower boundary of the Bollinger Band indicator reflects the waning bullish momentum.

- Moderate Directional Index: The ADX slope uptick at 34% reflects the investors would possibly perchance per chance well trust a minor pullback to improve energy.