That is a segment from the 0xResearch newsletter. To be taught plump editions, subscribe.

Obol launches its native OBOL token at this time.

Token holders could be in a attach to stake OBOL for a liquid staking token, which could be extinct for governance within the Obol Collective, as DeFi collateral, or for vote casting in retroactive funding rounds (RAF).

“After years of constructing respectable, allotted validator technology that eliminates single aspects of failure, we’re now hanging governance within the fingers of the neighborhood,” stated Obol Affiliation CEO Thomas Heremans.

“The OBOL Token represents more than simply governance — it’s the coordination mechanism for a total ecosystem of operators who are revolutionizing how Ethereum secures its infrastructure.”

What’s Obol?

Obol is a middleware tech provider for Ethereum network staking. The firm permits “allotted validators” (DV), which enable multiple independent nodes to collectively characteristic one validator by sharing its duties and inner most keys.

This solves a longstanding discipline confronted by all proof-of-stake networks.

Ethereum validators stake about a collective ~34 million ETH ($64.7 billion) at this time. Tall establishments especially would possibly per chance well well goal withhold a watch on hundreds of thousands and thousands of greenbacks as one operator entity. These operators could be files superhighway web hosting validators across the similar hardware servers or in concentrated geographic jurisdictions, exposing them to technological disruption or regulatory risks.

Thanks to allotted validator technology enabled by firms admire Obol and SSV, multiple nodes (two of three, four of seven, seven of ten) globally can now collectively bustle one Ethereum validator.

Due to the this truth, one node going on causes no disruption to the validator, reducing its exposure to those concentrated risks.

This helps validators protect a ways from slashing and reduces risks of single aspects of failure, thereby improving validator uptime and total network resilience.

At the moment time, 800+ queer node operators, from foremost staking products and providers to solo dwelling stakers, bustle Obol-powered validators. $975 million value of ETH from Lido, EtherFi, StakeWise, Swell, Bitcoin Suisse and more are secured by Obol’s allotted validator clusters across Ethereum at this time.

Thanks to Obol, Lido has elevated its operators from 36 to over 200, in accordance to its press originate.

EtherFi, the largest restaking protocol with $5.4 billion TVL, modified into once in a attach to elongate its operators from ~10 to practically 100 at this time. About 258,784 ETH ($499 million) from EtherFi is staked on Obol DVs at this time. An additional 40 on testnet are location to transfer to mainnet soon.

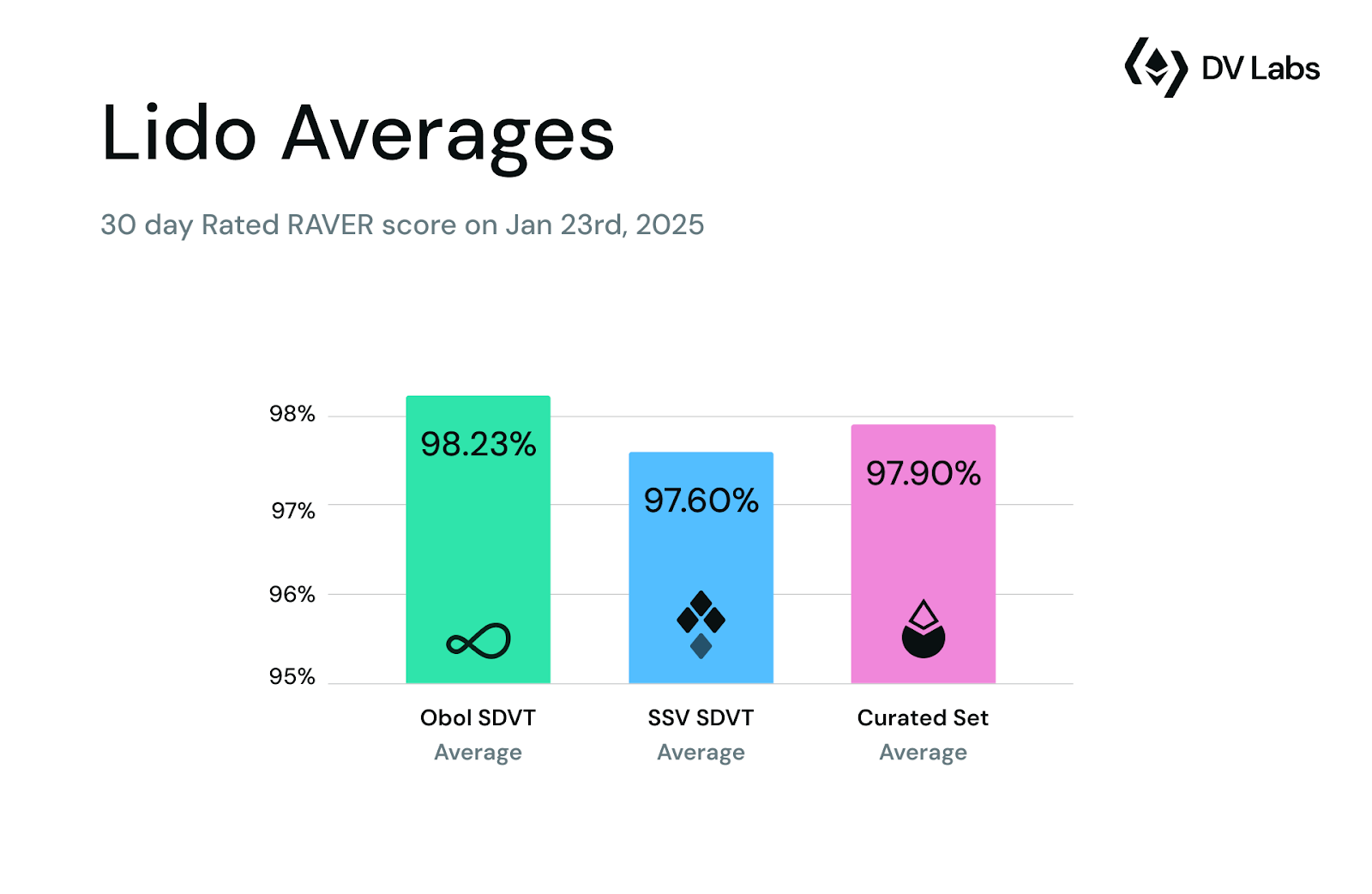

Per DV Labs, the 30-day moderate RAVER compile in January 2025 for Obol DVT modified into once 98.23%, outperforming SSV SDVT and a curated Lido location. The RAVER compile is a metric extinct to measure validator effectiveness across proposal and attestation success in Ethereum staking.

The Pectra network upgrade, which went live the day gone by, included EIP-7251. This elevated the maximum validator stake to 2048 ETH from its outdated cap of 32 ETH. That favors establishments, who can consolidate thousands of validators.

“EIP-7251 represents a prolonged-awaited jump forward in validator effectivity,” Heremans suggested Blockworks.

“By enabling validator consolidations, it addresses one amongst the finest operational burdens confronted by neatly-organized stakers and establishments,” Heremans stated. He forecasts “up to 80% reductions in operational and infrastructure charges.”