Within the days leading as a lot as the Bitcoin halving, the cryptocurrency market has skilled a prime downturn, raising concerns about a doable endure market.

Bitcoin seen a distinguished 19% keep drop, whereas altcoins faced even steeper declines, with some plummeting by as great as 70%. This pattern has sparked a debate among investors in regards to the rapid procedure forward for cryptocurrencies because the halving approaches.

Bitcoin and Altcoins Nosedive Sooner than the Halving

Historically, the Bitcoin halving — a scheduled sever value in the reward for mining contemporary blocks — has been a catalyst for bullish market sentiment. The occasion effectively slashes the provision of contemporary BTC, which in concept might perhaps well composed fabricate greater the price if set a query to remains fixed.

Nonetheless, Garry Kabankin, Market Analyst at Santiment, instructed BeInCrypto that the market does no longer operate totally on fundamentals, in particular in sessions surrounding such main events. The latest keep corrections in Bitcoin and altcoins might perhaps well assume a natural market response to speculative anticipation, rather than basic declines in fee.

Certainly, the present market scenario shows a speculative trading atmosphere leading as a lot as the halving.

“The steep drop in altcoins, far more so than Bitcoin, underscores the heightened volatility and speculative trading that can precede such events. It’s a reminder of the market’s sensitivity to offer dynamics adjustments, the set the lowered block reward post-halving can lead to expectations of lowered present rigidity,” Kabankin defined.

Kabankin explains that searching at miner habits, corresponding to adjustments in miners’ balance and total present, can present further insights. A decrease in miners selling their holdings pre-halving might perhaps well point out a bullish outlook, wanting ahead to increased costs post-occasion.

Nonetheless, the staunch impact of the halving will only turn into race in the weeks following. As the market adjusts to the contemporary present fee, its implications for Bitcoin’s scarcity and price can also be understood.

Learn more: Bitcoin Tag Prediction 2024 / 2025 / 2030

The continuing downturn is severely customary of the cyclical nature seen around past halvings. Truly, anticipation outcomes in speculative runs adopted by corrections. Nonetheless, Kabankin facets out that given the present on-chain metrics and social sentiment, a nuanced stare is very indispensable.

“Historically, we’ve considered euphoria around halvings, generally ensuing in a reevaluation of positions post-occasion. It’s a prime to video display social sentiment and whale habits for more rapid indicators of market directio,” Kabankin added.

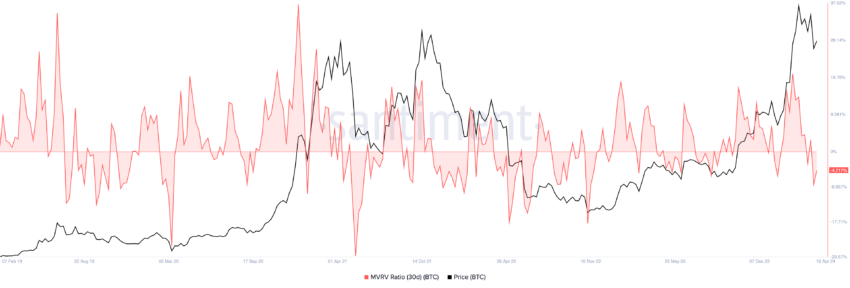

Furthermore, the Market-Value-to-Realized-Value (MVRV) ratio affords a clear stare of market sentiment. It indicates whether the asset is over or undervalued at any given time. In accordance to Kabankin, investors might perhaps well composed also closely video display the mean coin age. Major drops can signal increased circulation and doable selling rigidity, hinting at broader market shifts.

These indicators, mixed with oldschool support stages from technical prognosis, can data investors thru uncertain times.

Kabankin believes that to pickle the skill resumption of a bull flee, investors might perhaps well composed take observe of a blend of social sentiment and on-chain metrics. A decrease in dread, uncertainty, and doubt (FUD) coupled with an fabricate greater in dread of missing out (FOMO), generally precedes market upswings.

Furthermore, a prime uptick in stablecoin present spirited onto exchanges can signal readiness for getting for action, hinting at bullish sentiment. Also, an fabricate greater in trading volume can yell increasing support for the pattern. It will point out a more healthy buildup to a bull flee.

“Wanting at resistance obstacles and on-chain alerts is a prime for recognizing doable turnarounds. One key metric to survey is the Point out Dollar Invested Age, especially when it starts lowering, that will yell that beforehand dormant tokens are spirited, suggesting a doable shift in market sentiment,” Kabankin emphasized.

As the crypto market remains notoriously unstable, these indicators are a must-have for predicting its subsequent strikes. The historical pattern post-Bitcoin halving has generally ignited altcoin seasons. Right here’s an instantaneous outcome of investors procuring for increased returns beyond the initial surge in Bitcoin. With latest dynamics and on-chain actions suggesting a buildup, another cycle might perhaps well neatly be on the horizon.

Learn more: What Took situation on the Final Bitcoin Halving? Predictions for 2024

The buzz around altcoins, as indicated by social metrics and trading volumes, facets to a increasing appetite among investors. Nonetheless, it is a prime to video display these traits closely, as snappy shifts can happen in the cryptocurrency markets.