Tokens powering Decentralized Bodily Infrastructure Networks (DePIN) are emerging as sources to peep within the present market. These cryptocurrencies incentivize the arrival and repairs of bodily infrastructure on decentralized platforms.

Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), and Storj (STORJ) are a pair of of the DePIN coins that promise positive aspects within the arrival month.

Destra Network (DSYNC) Sees Double Digit Surge, Eyes Extra Good points

Destra Network offers a decentralized cloud resolution. The associated payment of its native token, DSYNC, has risen by 33% within the previous seven days. It for the time being ranks among DePin coins with basically the most positive aspects all over that length.

As assessed on an on a typical basis chart, its mark movements inform that the recent rally has been backed by precise quiz for the altcoin. That is evidenced by its rising Relative Energy Index (RSI). As of this writing, the predominant momentum indicator is in an uptrend at 65.14.

RSI measures an asset’s overbought and oversold market prerequisites. At 65.14, DSYNC’s procuring for stress a great deal outweighs selling stress.

If DSYNC continues to bask in quiz for market contributors, its next mark purpose is $0.36, a excessive it final traded at in Could even.

Lumerin (LMR) Trades Above Key Sharp Moderate

Lumeric (LMR) is a foundational layer expertise that makes order of dapper contracts to manipulate how stare-to-stare (P2P) files streams are routed, accessed, and transacted. Its native token, LMR, has loved most necessary consideration within the final week, with its mark rising by 28% over the last seven days.

The uptick within the quiz for the token has pushed its mark above its 20-day exponential transferring common (EMA), which measures its common mark over the last 20 days.

When an asset’s mark rallies previous this key transferring common, it signals a hike in procuring for stress and must probably be a hallmark of a persisted mark rally.

Read more: What Is DePIN (Decentralized Bodily Infrastructure Networks)?

If LMR maintains its uptrend, its mark will climb to $0.033.

AIOZ Network (AIOZ) Traits Within an Ascending Channel

AIOZ Network operates as a decentralized platform that leverages a global network of nodes to bring deliver more inexpensive, faster, and more securely. It is powered by the AIOZ token, the mark of which has risen by 22% within the previous week. As of this writing, the token trades at $0.58.

The asset’s mark has formed an ascending channel on a one-day mark chart. This bullish sample occurs when the mark moves between two upward-sloping parallel lines. The upper line acts as resistance, whereas the lower line serves as make stronger.

At press time, AIOZ’s Aroon Up Line reveals an uptrend, indicating salvage market momentum. The Aroon indicator measures vogue energy and identifies doable reversal parts. When the Up Line is at or in terms of 100, it suggests a salvage uptrend, and the most recent excessive used to be reached just no longer too long ago.

If this DePin token maintains its uptrend within the ascending channel, its mark will rally toward resistance to alternate hands at $0.63.

On the opposite hand, if the present vogue modifications route and AIOZ initiates a downtrend, its mark will plunge to $0.53.

Storj (STORJ) Flashes Buy Signal

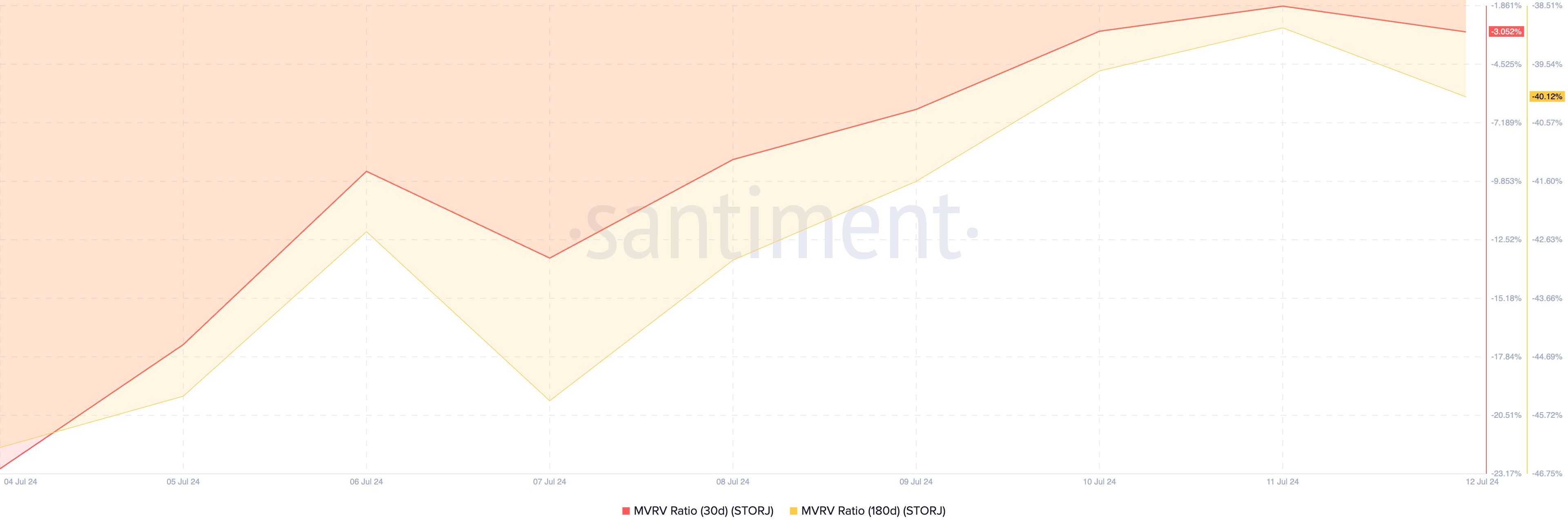

STORJ, the native token of the commence-source cloud storage platform STORJ, has flashed a aquire note. This reading relies totally on the dreadful values of the altcoin’s Market Price to Realised Price (MVRV) ratio when assessed over diversified transferring averages.

An asset’s MVRV measures the ratio between its current mark and the usual mark at which all its coins or tokens had been bought. When it is below zero, the asset’s current market cost is lower than the mark at which most traders save their holdings. The asset is deemed undervalued and offers a staunch procuring for opportunity.

Per Santiment, STORJ’s MVRV ratios for the 30-day and 365-day transferring averages at press time are -3.05% and -40.12%, respectively.

A surge in STORJ’s quiz at its current mark level would per chance presumably additionally kickstart an uptrend. Ought to composed this happen, the token’s next mark purpose is $0.50.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Substitute

For context, the altcoin for the time being trades at $0.43, that implies a doable 16% mark surge is within the books.

StorX Network (SRX) Climbs to a Monthly Excessive, Gears For Extra

StorX Network is additionally a decentralized cloud storage network. Its native token, SRX, has seen its cost climb by 10% within the previous week. It for the time being trades at

Exchanging hands at $0.60 as of this writing, the altcoin trades at a month-to-month excessive. The token enjoys a most necessary bullish bias, evidenced by its obvious Elder-Ray Index. At press time, the indicator’s cost is 0.0081.

This indicator measures the connection between the energy of investors and sellers within the market. When its cost is obvious, it capacity that bull energy is dominant within the market.

Read more: The Economics of Decentralized Storage Protocols

If the bulls dwell dominant, SRX’s next mark purpose is $0.062, a excessive it final traded at in October 2023.