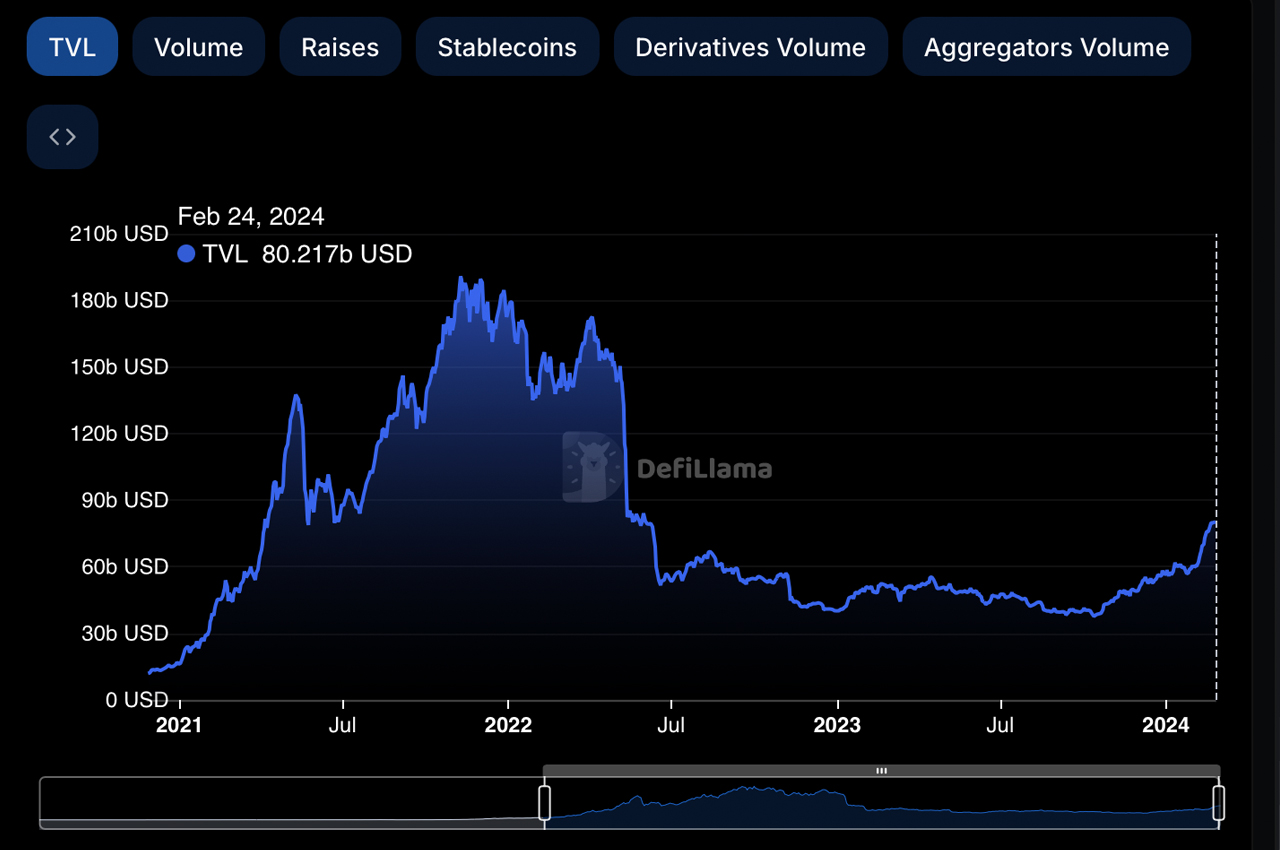

Newest data unearths that the total place locked (TVL) in decentralized finance has jumped previous the $80 billion milestone, reaching heights now no longer seen for the reason that downfall of Terra’s stablecoin in Would possibly perchance well 2022. Main the charge in 2024 by TVL dimension is Lido’s liquid staking platform, with ether-based fully liquid staking derivatives (LSDs) securing a dominant living with $41 billion in TVL.

Designate Locked in Decentralized Finance Vaults Past $80 Billion

A span of 1 year and nine months has elapsed for the reason that UST stablecoin by Terra lost its peg, and Terra’s LUNA plummeted from an $80 valuation per unit to successfully below a cent within the U.S. Days sooner than the atomize, on Would possibly perchance well 1, 2022, archived data from Bitcoin.com Records showed a important $196.6 billion in TVL. At that juncture, Terra accounted for $28.23 billion or 14.36% of the total TVL, with $16.forty eight billion tied up in Anchor, poised to be totally vaporized.

These times contain dilapidated into memory, nonetheless Terra’s downfall now no longer easiest erased important place from the defi sector nonetheless also resulted in the crumple of critical companies and buying and selling entities. With the crypto iciness now within the aid of us, the amount of place secured in defi has experienced a important upswing to $80.21 billion. Lido stands on the forefront of the defi sector as the protocol with the absolute top TVL, boasting a commanding $29.49 billion.

Trailing Lido within the rating are Makerdao with a TVL of $8.66 billion, Aave carefully within the aid of at $8.56 billion, followed by Eigenlayer with $7.95 billion, and Justlend with $6.31 billion, winding up the checklist of the tip 5 defi protocol giants. In relation to the distribution of this wealth, Ethereum reigns supreme within the defi living, claiming over 60% of the TVL part. As of this weekend, a huge sum of $46.967 billion is distributed amongst 979 defi protocols that utilize the Ethereum community.

Tron secures the living as the second-absolute top blockchain by TVL dimension, housing $8.484 billion, which represents 11.01% of the total defi TVL. BNB, Arbitrum, Solana, and Bitcoin spherical out the main six blockchains when it comes to TVL dimension. Over the final 130 days, the cost locked in defi has expanded by bigger than $42 billion. The revitalized momentum all the draw during the defi sector seemingly suggests renewed self belief amongst defi users. Predicting the momentum’s longevity, nonetheless, remains unsure.

What stay you mediate concerning the cost locked in defi rising above the $80 billion fluctuate this week? Let us know what you mediate about this discipline within the feedback part below.