Locked liquidity on decentralized finance (DeFi) applications reached a chronicle $270 billion in July, partly pushed by tokenized shares reveal.

DappRadar’s recordsdata displays the total impress locked (TVL) in DeFi protocols jumped 30% month-over-month, whereas active wallets for tokenized shares soared from roughly 1,600 to bigger than 90,000, pushing their market cap up 220%.

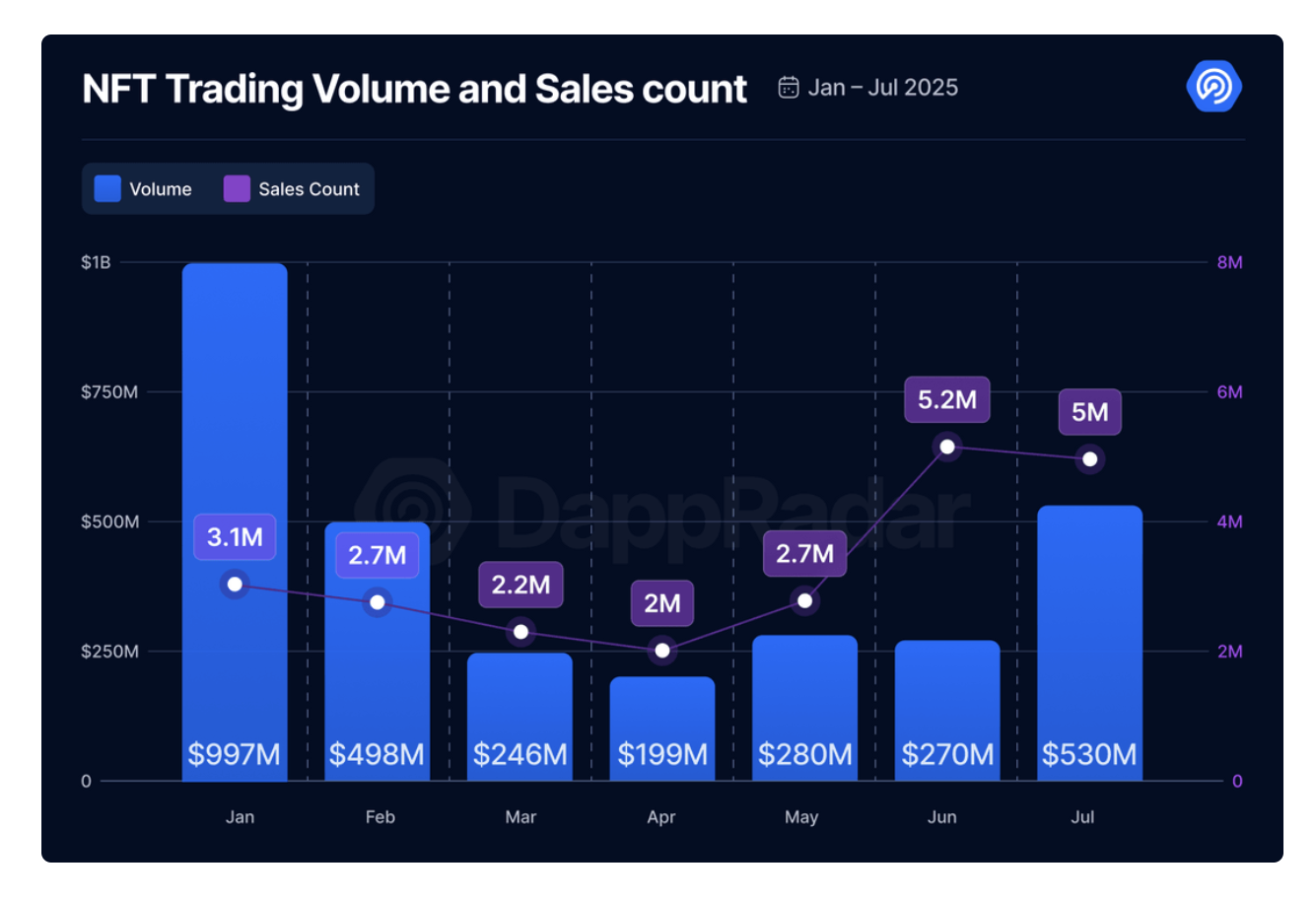

In the period in-between, NFT trading volumes jumped 96% to $530 million at some level of the month. The typical NFT impress moreover doubled to spherical $105 as more customers engaged with the market.

NFT enlighten edges sooner than DeFi

Whereas DeFi liquidity climbed, person attention shifted in other locations. In July, roughly 3.85 million of the 22 million on each day foundation active wallets interacted with NFT DApps — a diminutive bit better than were active in DeFi.

Ethereum-essentially based marketplace Blur drove mighty of the enlighten, capturing up to 80% of on each day foundation NFT volume, whereas OpenSea topped active customers at roughly 27,000 merchants. Zora moreover gained momentum with its creator-first layer 2 and $ZORA token for low-impress minting.

Main manufacturers continued experimenting with NFTs. Nike.SWOOSH partnered with EA Sports for digital sneaker drops, and Louis Vuitton, Rolex and Coca-Cola (China) launched authentication and collectible pilots.

NFT trading volume moreover rose about 36% in July to $530 million, up from $389 million in June, though it’s aloof down from its 2025 excessive of $997 million in January.

As reported by Cointelegraph, there has been a resurgence in hobby in OG NFT collections adore CryptoPunks. Data from NFT Ground Price displays the Ethereum-essentially based series is up over 25% the previous month.

All the contrivance by the previous 24 hours, nine of the tip 10 NFT gross sales were CryptoPunks: The lone non-Punk sale being an NFT from the Web3 artist Beeble.

NFT market is aloof removed from its 2021 reveal

No matter July’s rebound, NFTs are aloof underwhelming when compared with previous peaks. DappRadar’s 2024 industry overview displays that NFT trading volume dropped 19% year‑over‑year, and gross sales counts declined 18%, making 2024 one amongst the weakest years since 2020.

CryptoSlam recordsdata for H1 2025 extra underscores the humdrum recovery: NFT gross sales totaled $2.82 billion, down 4.6% from the 2nd half of of 2024.

Whereas there became as soon as a famous resurgence in July, with trading volume and ground costs rising, the market aloof smartly beneath its 2021 highs, when trading volumes ran into the tens of billions.