Since the initiating of the 300 and sixty five days, decentralized finance (DeFi) insist has diminished greatly one day of a few indicators. Even even though the outlook appeared encouraging early on, shifting macroeconomic pressures and market retracements had been central to the downturn.

DeFi Protocols Stumble in 2025

Newest weeks had been in particular turbulent for crypto markets, following President Donald Trump’s imposition of tariffs that disrupted the actual economic forecast for 2025. The consequence has been a intelligent decline in digital asset valuations, with bitcoin ( BTC) falling to $74,588 on Tuesday. The DeFi sector has no longer been immune to this shift, and the total worth locked (TVL) in DeFi has diminished in measurement noticeably since January.

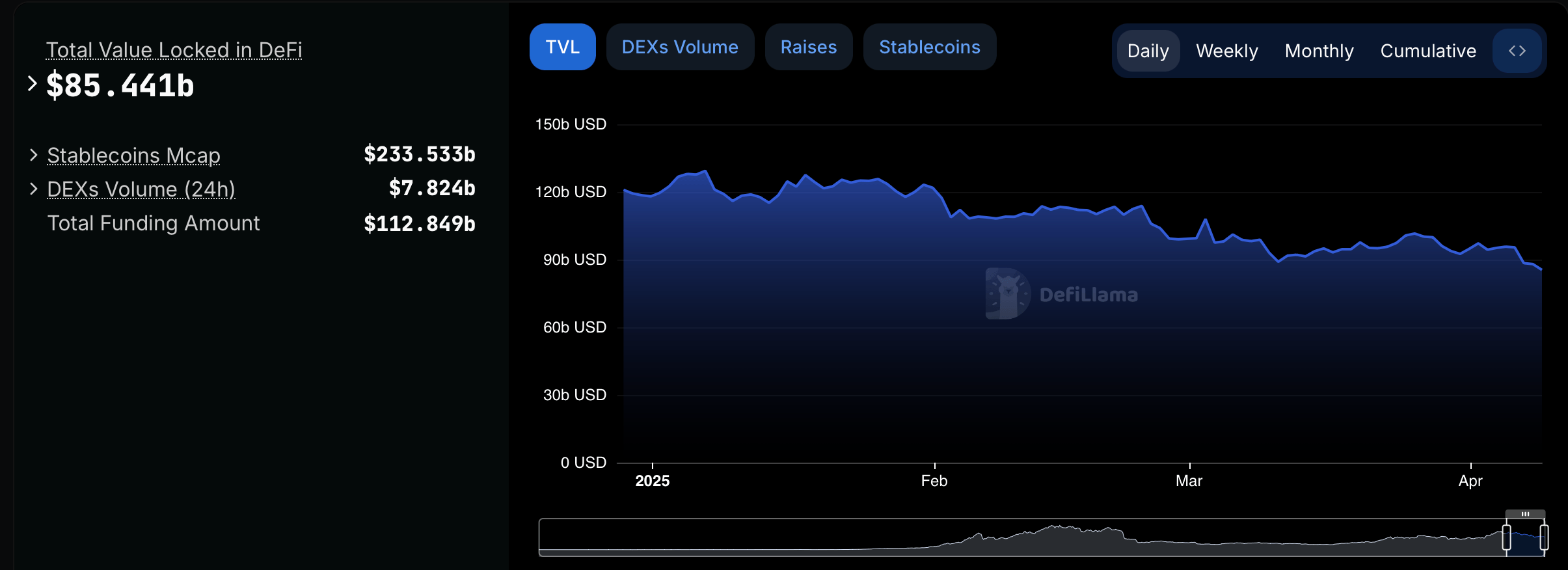

Recordsdata from defillama.com demonstrate that DeFi’s TVL began the 300 and sixty five days at $119.638 billion and now rests at $85.441 billion. That marks a 28.59% decrease from Jan. 1 to April 9, 2025. Aave for the time being holds the end field with $16.287 billion, whereas Lido’s liquid staking platform follows with $13.622 billion. Nonetheless, the decline has no longer been cramped to TVL on my own.

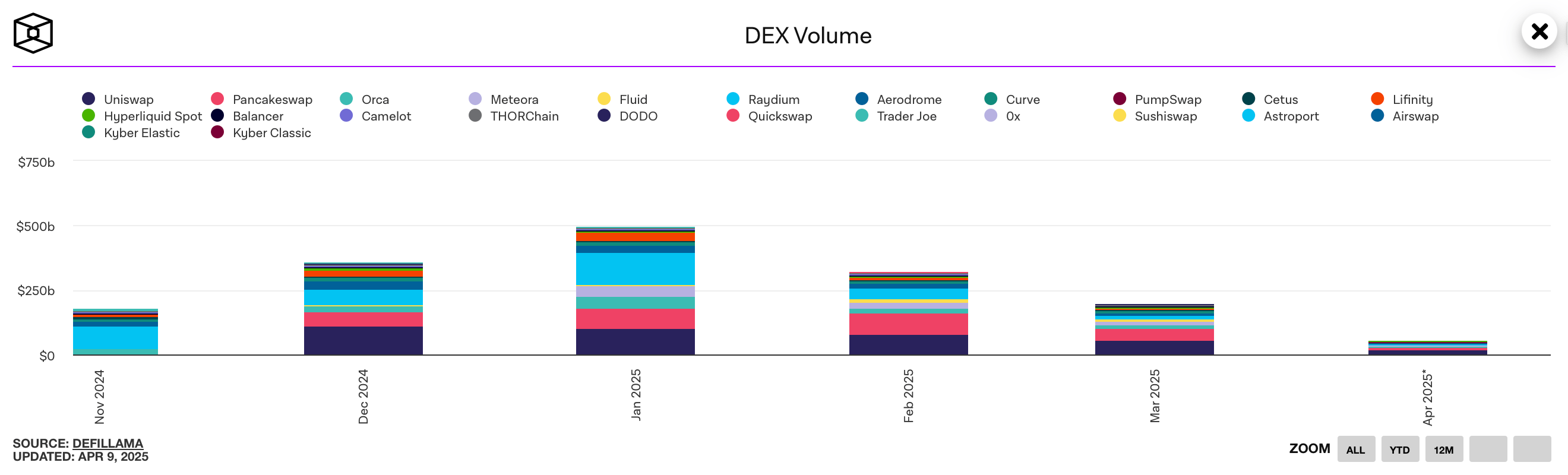

Defillama.com statistics aggregated by theblock.co additionally present that decentralized alternate (DEX) volumes private steadily dwindled every month for the reason that 300 and sixty five days began. Beyond the principle causes, broader shifts in fable private in the end fashioned DeFi participation. Subject issues similar to DeFAI (DeFi + AI), AI agents, and DeSci (Decentralized Science)—which gained traction in boring 2024—private notably misplaced affect in 2025, including to a retreat in crypto-connected funding.

The ideally suited DeFi niche exhibiting signs of vitality is that involving proper-world sources (RWAs), similar to tokenized treasury bonds. Meanwhile, the non-fungible token (NFT) sector has seen a 50% contraction in sales, with figures declining repeatedly month over month since January. Amid the uncertainty stirred by Trump’s tariffs, which private shaken both DeFi and aged finance (TradFi), investors seem like scaling attend their exposure to threat. The steep fall in DeFi insist displays a local climate of caution—how long that hesitation persists stays to be seen.