In a most trendy document printed by QuickNode, the major quarter of 2024 confirmed the dominance of decentralized finance (DeFi) and the necessary enhance of Web3 gaming in the crypto industry, which outperformed the stablecoin sector in key metrics, indicating investor preference and market sentiment all the way thru this era.

Hopes For 2nd ‘DeFi Summer season’

Per the document, DeFi skilled a broad resurgence in Q1’24, fueled by a surge in developer and individual job, particularly on chains admire Solana (SOL) and Noxious.

This resurgence has sparked rising hopes of a second ‘DeFi Summer season,’ as DeFi initiatives contain new ideas much like staking, liquid staking, restaking, and liquid restaking, which own been catalysts for its enhance. Notably, staking now represents a worthy allotment of DeFi’s Total Worth Locked (TVL).

Whereas stablecoins dwell the discontinuance location for handle job, DeFi surpassed stablecoins in a valuable metric: transaction counts.

DeFi emerged as the leader in transactions for Q1’24, averaging almost 7 million on daily foundation transactions. Furthermore, DeFi led in costs spent, gas usage, and the overall number of initiatives despite comprising completely approximately 4% of the complete crypto market cap.

The TVL for yield-generating protocols within DeFi witnessed staunch enhance, hiking from $26.5 billion in Q3’23 to $59.7 billion in Q1’24. In accordance with QuickNode, this rally signifies a return of confidence and liquidity to the DeFi markets as traders perceive opportunities for yield technology.

Avid gamers Grab Adjust With Web3 Gaming

In parallel, Web3-based gaming has emerged as a broad departure from worn gaming platforms. By leveraging cryptocurrencies and non-fungible tokens (NFTs), Web3 gaming provides players new and decentralized gaming.

Avid gamers now own the opportunity to actively participate in video games and compose rewards, animated retain an eye on away from centralized entities within the gaming ecosystem.

The document highlights the enhance of Web3 gaming, surpassing stablecoins in transaction quantity and reaching the last be conscious twelve months-over-twelve months (YoY) energetic handle enhance all the way thru all categories, with a 155% compose bigger in energetic addresses all the way thru Q1 ’24.

This surge in participant engagement and participation is evident thru the exponential enhance of transactions within Web3 gaming, which skilled a staggering 370% YoY compose bigger.

The Allure Of Stablecoins

Though stablecoins proceed to e book in on daily foundation energetic customers, representing over 41% of all Web3 individual job, other categories own shown elevated quarter-over-quarter (QoQ) job enhance, indicating attainable salvage-up.

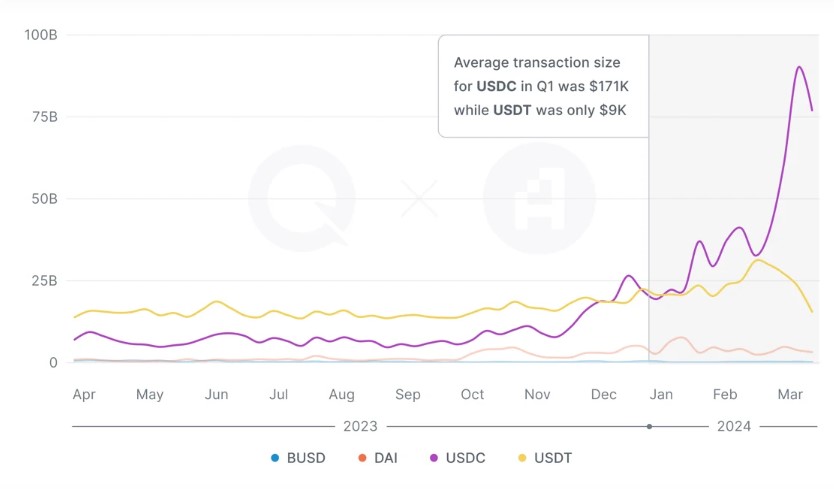

Tether’s USDT stays the dominant stablecoin, controlling approximately 75% of the market cap. Notably, Circle’s USDC has taken the lead in quantity and average transaction size, partly due to Coinbase’s efforts to combine USDC on its platform and promote its spend on its Layer 2 community, Noxious.

Besides, the document notes that stablecoins own confirmed fine to every new and skilled customers, offering balance and payment predictability, particularly all the way thru classes of market uncertainty.

QuickNode attributes the surge in stablecoin individual job in Q1’24 to several components, at the side of the approval and itemizing of location Bitcoin ETFs in the US, the anticipation of Bitcoin’s subsequent Halving occasion, the devaluation of fiat currencies, the repute of low-volatility assets, and the strength of the USD, to which over 90% of stablecoin transactions are anchored.

Featured list from Shutterstock, chart from TradingView.com