That is a section from the Offer Shock newsletter. To read pudgy editions, subscribe.

Bitcoin has extra than one personalities, equal facets cash, freedom, resistance and hope.

MicroStrategy chairman Michael Saylor sits below all of them as bitcoin’s identification — its rawest instincts, personified.

Thursday marked the twenty fifth anniversary of Saylor shedding $6 billion in in the end ($11 billion adjusted for inflation) because the dot-com bubble burst. That match used to be amongst the largest single-day personal losses in human historical past till that time.

That is his comeback story.

Top class domains

Saylor used to be no longer all the time the apex Bitcoin bull. He did, however, model digital scarcity long sooner than the first block used to be ever mined: in domains.

After founding MicroStrategy in 1989 and spending years building it up as an recordsdata mining and commerce intelligence operation, Saylor in the ‘90s had the gleaming thought to start up shopping up “top charge” domains: straightforward, single-observe domains with doubtlessly standard appeal and, preferably, over 500 million hits on Google Search.

Angel.com. Terror.com. Wisdom.com. Emma.com. Speaker.com. Alert.com. Tell.com. Hope.com. Simplest one person could also ever maintain every at a time, and MicroStrategy spent $2 million overall shopping those forms of top charge domains — at a median of around $100,000 every — alongside thousands of less valuable secondary domains.

“I sold all these domains due to I believed, ‘Wouldn’t or no longer it’s astronomical to maintain a segment of the English language?’” Saylor acknowledged on the My First Million podcast. He in my knowing owns Michael.com and one for his nickname, Mike.com.

“I mean, [as to] proudly owning ‘hope’ or proudly owning ‘impart’ — in the raze, there’ll be a Google Tell, or some telecom company can have to launch a service. And what a astronomical enviornment to launch on — a observe be pleased ‘Tell.com.’”

Terror.com and Angel.com had been later commercialized with right corporations, respectively spun up by Saylor and MicroStrategy’s evaluate and trend division.

MicroStrategy in the raze sold Terror.com and its associated commerce for $27.7 million in 2009 to endeavor capital agency ABS Capital Partners. In 2013, instrument company Genesys bought Angel.com with its commerce for $110 million cash, and rapidly rebranded it under its maintain company umbrella.

Saylor, meanwhile, used to be adamant that Tell.com used to be price $1 billion to the staunch purchaser.

It used to be around this time, in December 2013, that Saylor first publicly commented on Bitcoin: “Lacking a legit sponsor, Bitcoin is in coming near hazard of being regulated out of existence,” Saylor tweeted.

He posted again one more week later, after bitcoin had fallen by up to two-thirds from an all-time high of $1,242:

Sunk value

Saylor wouldn’t if truth be told return to Bitcoin till mid-2020, after all publicly, and going by the timeline of events, a top charge enviornment sale to a crypto startup could’ve been his lightbulb 2d, with a capital ₿.

In Might possibly well well well 2019 — 300 and sixty five days sooner than MicroStrategy first showed intent to buy bitcoin — the corporate on the support of upstart blockchain EOS, Block.one, had announced a fresh social media app in the invent of Tell, which promised to pay token payouts to users for posting and sharing stutter.

Block.one used to be beforehand calculated to have raised $4.1 billion in ETH right thru a year-long initial coin offering that began in mid-2017 and ended around a year sooner than Tell used to be revealed.

“They [Block.one] contacted us, one amongst their enviornment brokers, they in most cases asked, ‘Attain you prefer to advertise? We’ll come up with $150,000.’ I acknowledged no. I believed nothing of it, due to I appropriate couldn’t glimpse the purpose,” Saylor recounted.

“They near support and bellow, ‘They doubled it to $300,000.’ I acknowledged, ‘Relate them no.’ So a pair days later they [Saylor’s colleagues] trail, ‘Neatly the dealer’s if truth be told insistent; they went to $600,000.’ I acknowledged no. So that they acknowledged, ‘Neatly, what could also restful we are pronouncing?’ I acknowledged, ‘Don’t mutter them the relaxation. Relate them we’re no longer . It’s bought to be one thing serious.’”

Block.one then offered $1.2 million, which Saylor rejected. Then $2.5 million. Then $5 million. Then around $10 million.

“When it bought to $12 million, I acknowledged I’d rep on the mobile phone for half of an hour. That resolution began with anyone pronouncing, ‘Neatly, how about $22 million?’ And I acknowledged, “Let me display masks. That is be pleased my daughter. I’m willing to marry her off, but ideal to a person that values her bigger than I value her.”

MicroStrategy closed the deal in June 2019 for $30 million — 200 times above Block.one’s initial provide. It’s restful the largest identified pure enviornment name sale in historical past, merely about doubling the outdated document of $17 million, which Qihoo paid for 360.com in 2015.

Block.one went on to sink one more $150 million into Tell.com’s trend over the following two years sooner than shutting it down in gradual 2023. Tell mentioned that “the continuing uncertainty in the crypto and NFT market will proceed for added time than we have now.”

Conversely, Saylor and MicroStrategy began shopping bitcoin, positioning themselves to capitalize immensely on an impending bitcoin rally fueled by anticipation of ETFs from BlackRock, Constancy and others.

The map it began

One year after the enviornment sale closed, in July 2020, Saylor acknowledged in a quarterly earnings name that MicroStrategy could also start up shopping bitcoin over the following year as segment of a fresh capital allocation map.

The belief used to be to take a position $250 million over the following 12 months in different resources — “that can even consist of shares, bonds, commodities such as gold, digital resources such as bitcoin, or other asset kinds,” whereas shopping support $250 million in company stock from shareholders.

Excluding it didn’t draw shut a year. MicroStrategy sold 21,454 BTC for $250 million in less than two weeks, and in August 2020 declared bitcoin its major treasury reserve asset.

Bitcoin used to be then shopping and selling for under $12,000, and internal four months had broken its $20,000 label document, which had beforehand held for nearly three years.

Corner the market

By December 2020, MicroStrategy had opened its first debt sale since opting into bitcoin — $400 million with 0.75% hobby — which it pledged to exhaust on shopping extra cash. Then a 2d elevate two months later, and a third four months after the 2d.

So by the time Block.one hurt down Tell in September 2023, MicroStrategy used to be sitting on $4.2 billion in BTC on the very early stages of a monster bull lag.

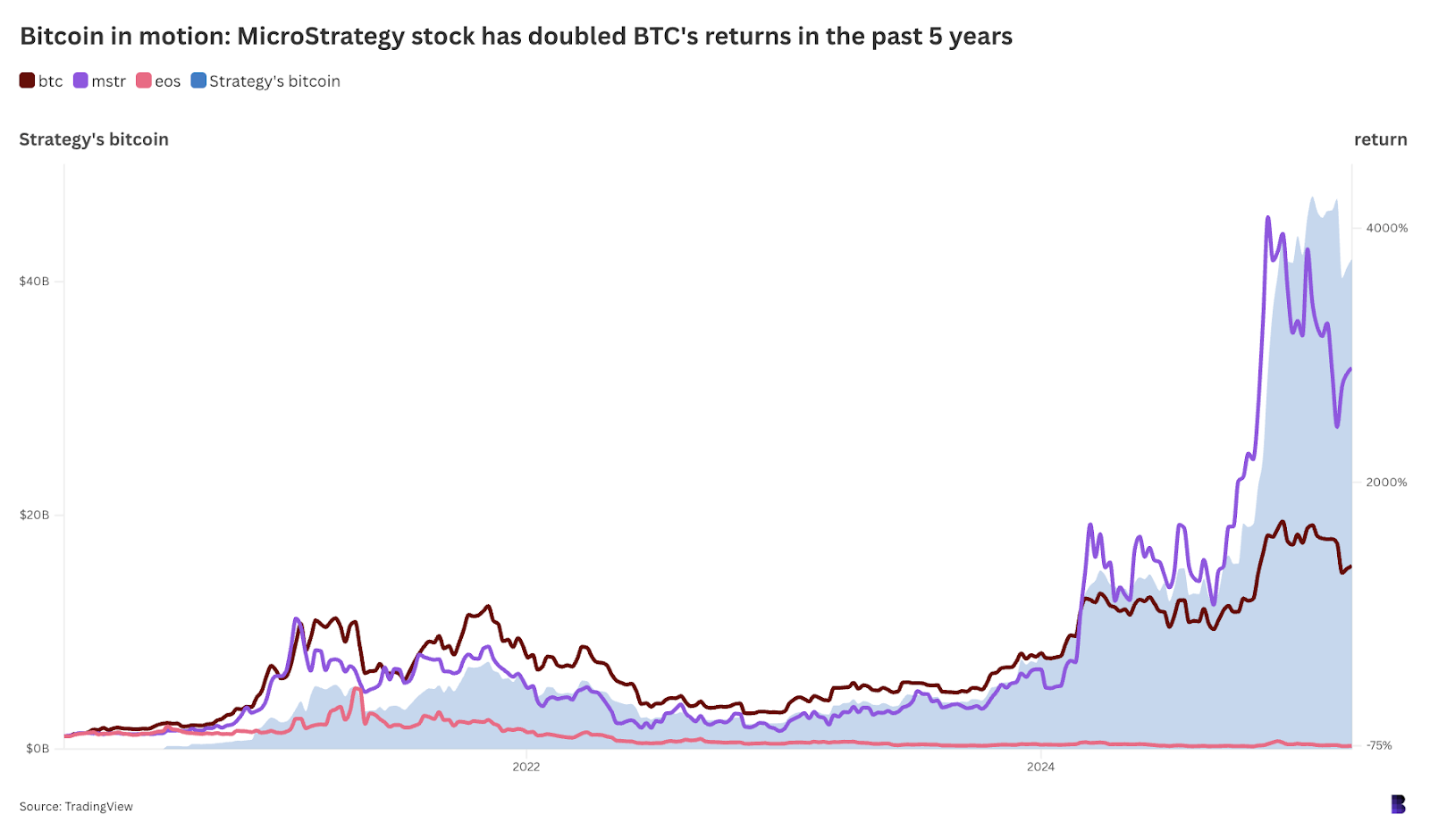

Since then, MicroStrategy has spent nearly $27.8 billion to manufacture an additional 340,860 BTC ($28.7 billion). Bitcoin has bigger than tripled in label in that time, whereas MicroStrategy has dropped the “Micro” from its name and ideal goes by Approach this day.

Approach now holds a complete of 499,096 BTC — 2.5% of the circulating supply — and is valuable ample to be included in the benchmark Nasdaq 100 stock market index. Saylor has relentlessly bull-posted your complete time, picking up where outdated evangelists such as Roger Ver left off.

Clearly, Approach has raised billions of dollars across nine carried out debt gross sales to relieve fund the bitcoin acquisition belief.

The map it’s going

Upright now, the agency has $9.3 billion in convertible debt towards $41.8 billion in BTC, and is this year to blame for 30% of the US convertible market, all “powered by Bitcoin.”

Approach has spent $33.2 billion on bitcoin in complete, and the napkin math puts Approach successfully forward by $700 million at time of writing. Saylor’s personal ranking price is estimated at $6.6 billion, and in January, the agency overtly promised to grab $42 billion over the following three years to buy loads of extra.

Whether it’s conviction that Tell.com is mainly price $1 billion, or that bitcoin is “going up eternally,” Saylor’s occupation has been marked by the same rotten instinct to corner the market on long-lasting digital resources, namely ones that support as foundational constructions for internet economies.

Saylor merely expanded from one extremely-illiquid digital asset class in domains — a explicit section location where he’s also regarded as a yarn — to 1 deeply liquid digital asset in bitcoin.

Amazingly, what followed the Tell.com deal doubles as a shut to-supreme allegory for crypto investing. Block.one sunk nine figures into a token mission that pivoted to NFTs, ideal to head zero sooner than it even began, defeated by a endure market.