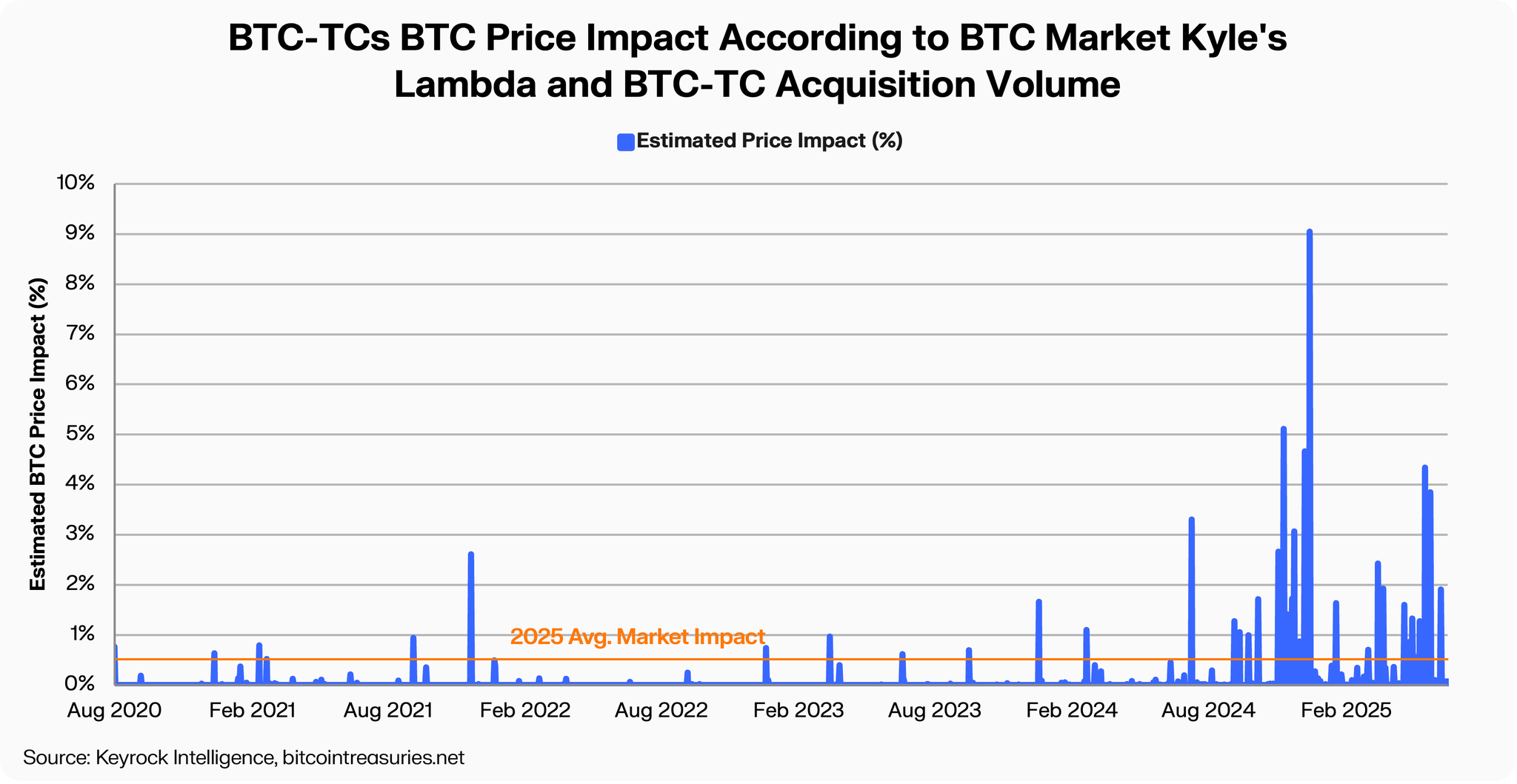

A brand unique study by crypto funding firm, Keyrock, has confirmed that Bitcoin treasury corporations account for honest appropriate 0.59% of day to day BTC label actions. The Brussels-essentially based firm launched the market picture on July 10.

The picture reveals that the Bitcoin Treasuries company has minimal affect on label motion despite preserving a blended 847,000 BTC, approximately 4% of the total Bitcoin offer. Keyrock picture relied on recordsdata from every private and non-private corporations that stammer Bitcoin holdings in monetary stories or regulatory filings.

Per the picture, the largest corporate holder, Draw, by myself controls over 1% of the total BTC offer. Apparently, in the second quarter of 2024, corporate holdings grew by over 159,000 BTC, marking the perfect quarterly amplify thus far.

Nonetheless, the picture reveals this had dinky to no invent on Bitcoin’s non permanent market actions and no tough correlation between treasury shopping for and BTC label trends. It mighty that nearly all corporations behave as prolonged-term holders and accomplish no longer pass coins frequently.

Thus, Bitcoin, which is held in corporate treasuries, doesn’t affect shopping and selling behavior or market momentum. Impress motion remains dominated by discipline markets, alternate-traded products, derivatives, and retail train. Treasury assert, whereas symbolic, has no longer translated into volatility or upward label tension.

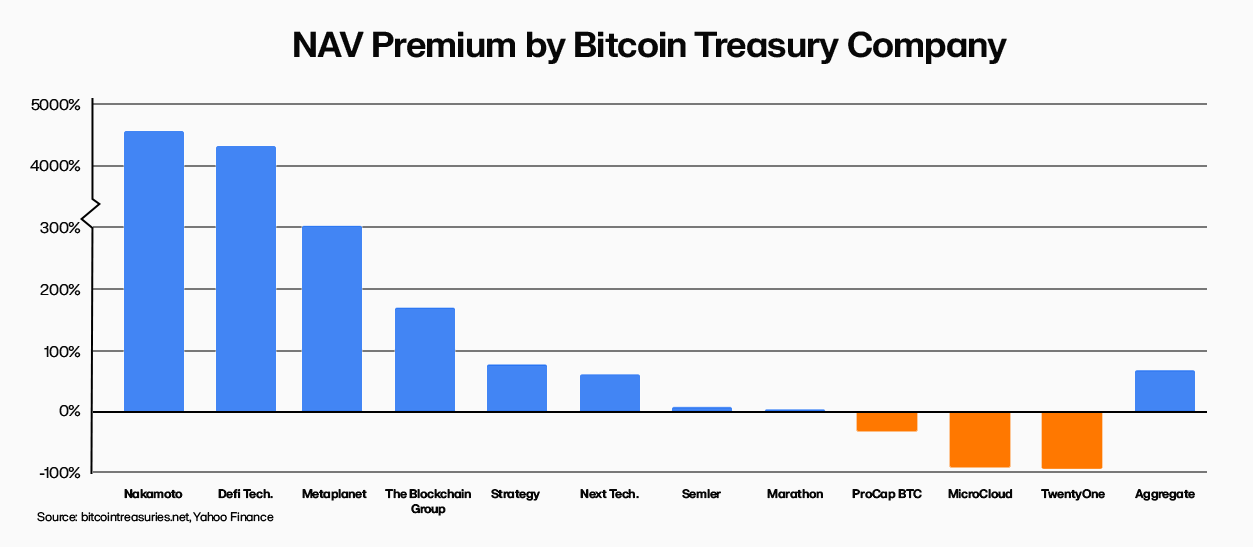

Bitcoin-heavy stocks replace at most important premiums

Meanwhile, the unique picture reveals that public corporations preserving big Bitcoin reserves on the total replace at a top rate to their actual BTC label. MicroStrategy in the interim leads with a 91.3% top rate over the market label of its holdings.. That contrivance merchants pay $191 for every $100 of Bitcoin publicity via its stock.

Other treasury corporations also video display the same premiums, ranging from 20% to 60%, looking on market cycles and investor set a query to. These premiums judge how equities with Bitcoin publicity are priced above the label of the coins they preserve.

The picture tracked multiple corporations with disclosed BTC holdings and realized consistent overvaluation in fragment label when in contrast with underlying property. This style grow to be video display even when Bitcoin grow to be flat or declining.

The firm mighty that these premiums pass independently of Bitcoin’s label. They on the total reply faster to market sentiment, news, or speculation. Premiums narrowed sharply at some level of drawdowns but widened again at some level of label surges.

This hole between fragment label and BTC label highlights a price distinction for merchants the exhaust of public equities to salvage Bitcoin publicity. Whereas treasury holdings appear passive, the pricing of their stocks is never any longer. As of July 2025, MicroStrategy remains essentially the most puffed up relative to its Bitcoin. The picture did no longer name the total corporations reviewed, but confirmed that this pattern is long-established.

Most Treasury Bitcoin can’t be stale as Collateral

Apparently, the picture also highlighted why Bitcoin held by treasury corporations can even no longer agree with a lot impact on the label motion, noting that this is because hundreds of the BTC remains indolent. The picture confirms that nearly all holdings are saved offline and no longer stale as collateral or in monetary products.

Corporations preserving BTC infrequently ever exhaust their reserves for lending, yield expertise programs, or derivatives. Their interior rules and custody constructions limit their operational exhaust of the property, which contrivance that whereas treasury corporations retain big volumes, they don’t seem like stale for leverage or liquidity.

Keyrock notes that nearly all effective a dinky percentage of treasury property are moved or deployed after acquisition. Most remain static, even at some level of market volatility. This contrivance keeps holdings salvage but also limits strategic flexibility. Treasury corporations attain no longer make the most of yield or lending returns, at the same time as assorted platforms generate earnings from packed with life BTC exhaust.

Nonetheless, the picture mighty that unless these corporations adapt, they can even lose ground to institutions with extra dynamic programs, as treasury assert with out exhaust cases is never any longer essentially the most efficient technique to maximise sources.